Ramkrishna Forgings Faces Mixed Technical Trends Amid Strong Historical Performance

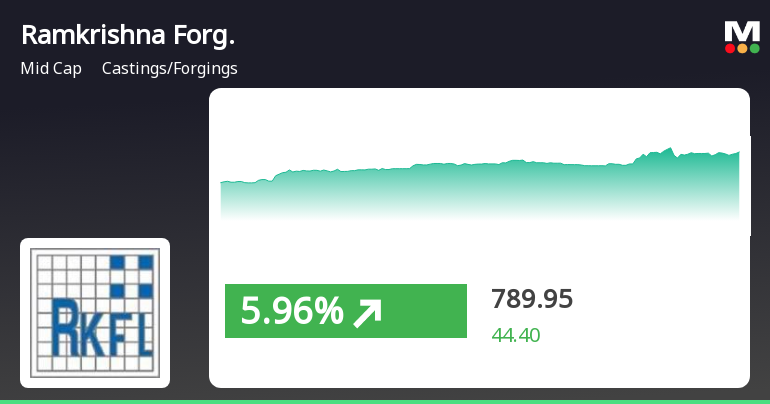

2025-03-24 08:00:20Ramkrishna Forgings, a midcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 840.15, showing a notable increase from the previous close of 745.55. Over the past year, the company has demonstrated a robust performance with a return of 26.12%, significantly outpacing the Sensex's return of 5.87% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Daily moving averages also reflect a mildly bearish stance. The company's performance over various time frames highlights its resilience, particularl...

Read More

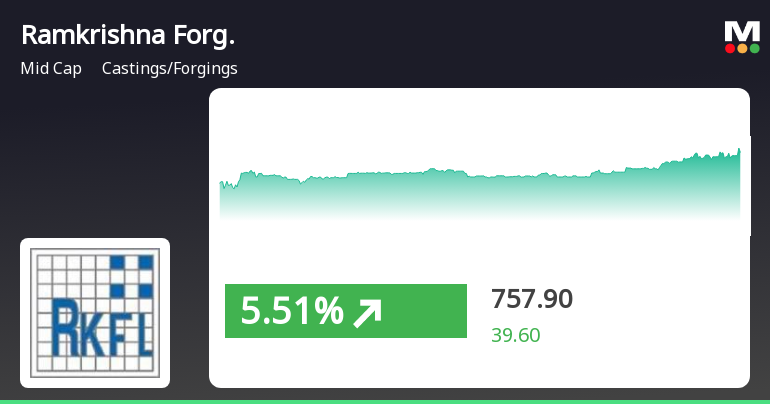

Ramkrishna Forgings Shows Mixed Performance Amid Broader Market Rebound

2025-03-21 11:45:14Ramkrishna Forgings, a midcap player in the castings and forgings sector, experienced notable trading activity, outperforming its sector. The stock is positioned above several short-term moving averages, while the broader market, including the Sensex and BSE Small Cap index, showed positive momentum. Over the past year, the company has outperformed the Sensex.

Read More

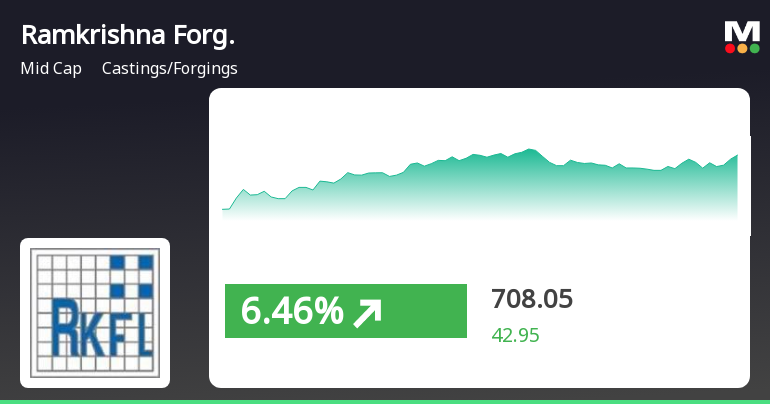

Ramkrishna Forgings Shows Strong Performance Amid Positive Sector Trends and Market Resilience

2025-03-19 15:15:15Ramkrishna Forgings has shown notable performance, gaining 5.1% on March 19, 2025, and outperforming its sector. The stock has achieved a total return of 10.4% over four consecutive days. It remains above its short-term moving averages while the broader market, including the midcap segment, has also seen positive movement.

Read MoreRamkrishna Forgings Adjusts Valuation Amid Competitive Industry Landscape and Premium Metrics

2025-03-06 08:00:10Ramkrishna Forgings, a midcap player in the castings and forgings industry, has recently undergone a valuation adjustment. The company currently holds a PE ratio of 31.20 and a price-to-book value of 4.22, indicating a premium valuation relative to its peers. Its EV to EBITDA stands at 15.60, while the EV to EBIT is recorded at 22.03, reflecting its operational efficiency. In terms of financial performance, Ramkrishna Forgings has a return on capital employed (ROCE) of 14.09% and a return on equity (ROE) of 13.04%. The company's PEG ratio is noted at 1.15, suggesting a moderate growth outlook compared to its earnings. The dividend yield is relatively low at 0.15%. When compared to its peers, Ramkrishna Forgings appears to be positioned at a higher valuation level. For instance, CIE Automotive and Electrost Castings exhibit lower PE ratios and EV to EBITDA metrics, highlighting a significant valuation gap....

Read More

Ramkrishna Forgings Outperforms Market Amid Mixed Long-Term Trends and Small-Cap Gains

2025-03-05 09:45:17Ramkrishna Forgings experienced notable trading activity, outperforming its sector and achieving a significant increase over two days. The stock is currently positioned above its short-term moving averages but below longer-term ones. Meanwhile, the broader market saw gains, particularly in small-cap stocks, despite remaining below key moving averages.

Read More

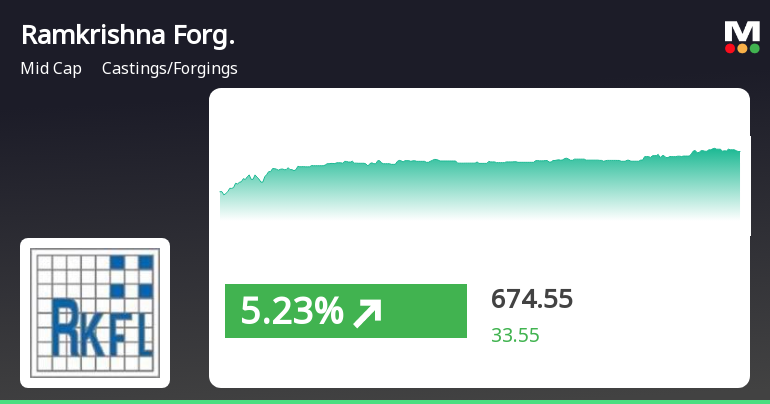

Ramkrishna Forgings Shows Potential Trend Reversal Amid Broader Market Caution

2025-03-04 13:35:14Ramkrishna Forgings has experienced a notable increase in stock price after a series of declines, reaching an intraday high of Rs 677.45. Despite this uptick, the company is trading below key moving averages, indicating ongoing market challenges. Overall market sentiment remains cautious, with the Sensex also showing declines.

Read More

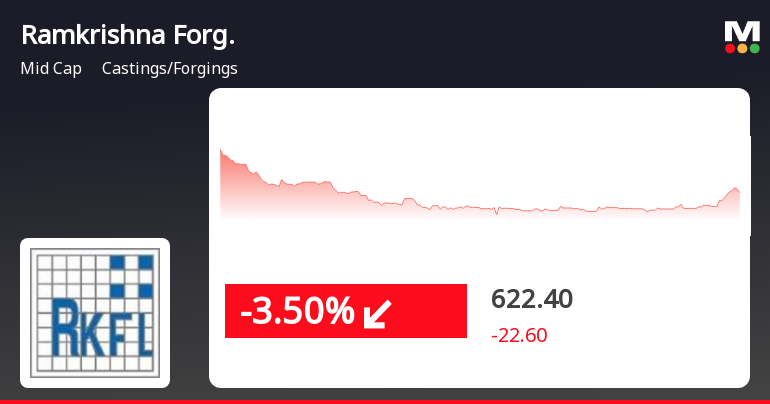

Ramkrishna Forgings Faces Continued Decline Amid Broader Industry Challenges

2025-03-03 10:45:13Ramkrishna Forgings has faced a notable decline, with shares falling for five consecutive days and a total drop of 14.08%. The stock is trading close to its 52-week low and has underperformed its sector, reflecting broader challenges in the market. It has also declined significantly over the past month.

Read MoreRamkrishna Forgings Adjusts Valuation Amidst Competitive Industry Landscape and Stock Decline

2025-02-28 08:00:09Ramkrishna Forgings, a midcap player in the castings and forgings industry, has recently undergone a valuation adjustment. The company's current price stands at 666.00, reflecting a decline from its previous close of 692.70. Over the past year, Ramkrishna Forgings has experienced a stock return of -13.96%, contrasting with a modest gain of 2.08% in the Sensex. Key financial metrics for Ramkrishna Forgings include a PE ratio of 30.36 and an EV to EBITDA ratio of 15.22. The company's return on capital employed (ROCE) is reported at 14.09%, while the return on equity (ROE) stands at 13.04%. These figures indicate a solid operational performance, although they are positioned against peers such as CIE Automotive and Electrostal Casting, which exhibit more favorable valuation metrics. In comparison, CIE Automotive has a PE ratio of 17.94 and an EV to EBITDA of 10.37, while Electrostal Casting shows even lower r...

Read More

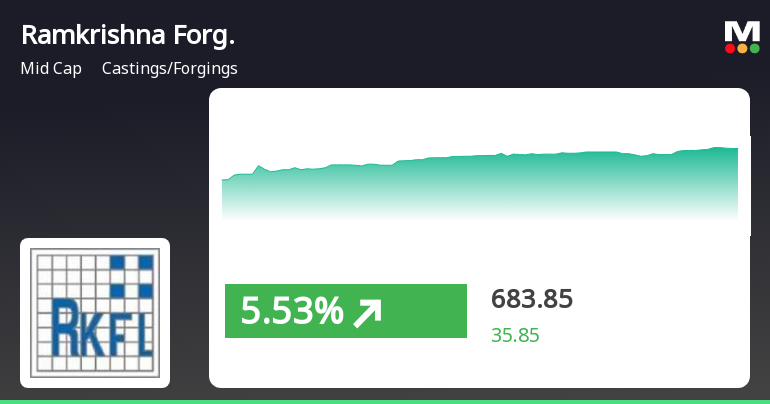

Ramkrishna Forgings Shows Short-Term Gains Amidst Broader Market Volatility

2025-02-19 10:45:14Ramkrishna Forgings, a midcap in the castings and forgings sector, experienced notable trading activity, gaining 5.53% on February 19, 2025. Despite recent volatility and a 30.60% decline over the past month, the stock has shown a positive trend in the last three days, accumulating a total return of 7.15%.

Read MoreClosure of Trading Window

29-Mar-2025 | Source : BSEClosure of Trading Window w.e.f Tuesday 1 April 2025

Honble NCLT Kolkata Bench Order W.R.T Scheme Of Amalgamation - Company And ACIL Limited Wholly Owned Subsidiary

28-Mar-2025 | Source : BSEHonble NCLT Kolkata Bench Order dated Thursday 27 March 2025 w.r.t Scheme of Amalgamation between the Company and ACIL Limited Wholly Owned Subsidiary Company

Capacity Addition By 14250 Metric Tonnes

28-Mar-2025 | Source : BSECapacity Addition by 14250 MTs

Corporate Actions

No Upcoming Board Meetings

Ramkrishna Forgings Ltd has declared 50% dividend, ex-date: 10 May 24

Ramkrishna Forgings Ltd has announced 2:10 stock split, ex-date: 14 Mar 22

No Bonus history available

No Rights history available