Ramky Infrastructure's Valuation Shift Highlights Financial Strengths Amid Debt Concerns

2025-03-26 08:04:37Ramky Infrastructure has recently experienced a change in its valuation grade, reflecting its financial metrics, including a PE ratio of 12.49 and a ROCE of 15.64%. However, the company faces challenges such as a high debt-to-equity ratio and modest sales growth, alongside a significant portion of pledged promoter shares.

Read MoreRamky Infrastructure Adjusts Valuation Grade Amid Strong Financial Performance Metrics

2025-03-26 08:00:25Ramky Infrastructure, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics. The company boasts a price-to-earnings (PE) ratio of 12.49 and an EV to EBITDA ratio of 8.68, indicating a favorable valuation relative to its earnings potential. Additionally, its return on capital employed (ROCE) stands at 15.64%, while return on equity (ROE) is reported at 12.92%, showcasing effective management of resources. In comparison to its peers, Ramky Infrastructure demonstrates a competitive edge with a lower PE ratio than several companies in the sector, such as Hindustan Construction, which is currently loss-making, and Bharat Bijlee, which has a significantly higher PE ratio of 24.93. Furthermore, Ramky's EV to sales ratio of 1.75 positions it favorably against peers like Quality Power and Indo Tech, which are categorized as very expens...

Read More

Ramky Infrastructure Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-07 11:15:51Ramky Infrastructure has experienced notable gains, outperforming its sector and showing a strong upward trend over the past three days. While the stock is currently above its short-term moving averages, it remains below longer-term averages. Despite recent declines, it has achieved significant growth over the past three to five years.

Read More

Ramky Infrastructure Faces Financial Challenges Amidst Modest Growth and High Debt Levels

2025-03-07 08:02:38Ramky Infrastructure has recently experienced a change in evaluation, reflecting its current market dynamics and financial metrics. Despite positive financial results in Q3 FY24-25, the company faces challenges from high debt levels and modest sales growth, contributing to underperformance compared to the broader market.

Read More

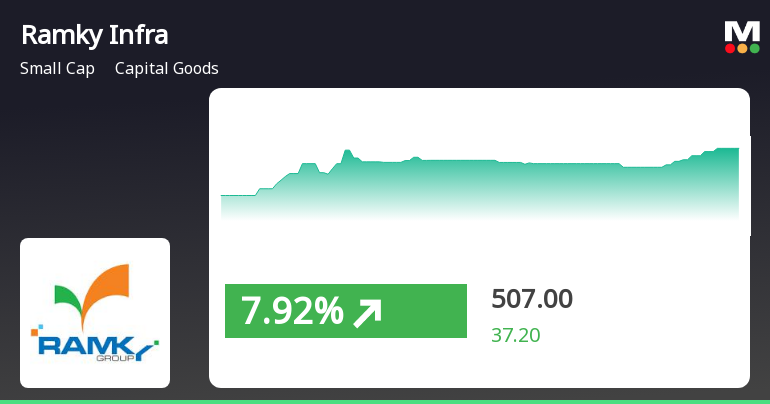

Ramky Infrastructure's Recent Gains Highlight Mixed Momentum Amid Broader Market Trends

2025-03-06 10:45:19Ramky Infrastructure has experienced notable gains, outperforming its sector and achieving a total return of 12.86% over two days. The stock is currently above its 5-day moving average but below longer-term averages. Despite recent performance, it remains down over the past month and year.

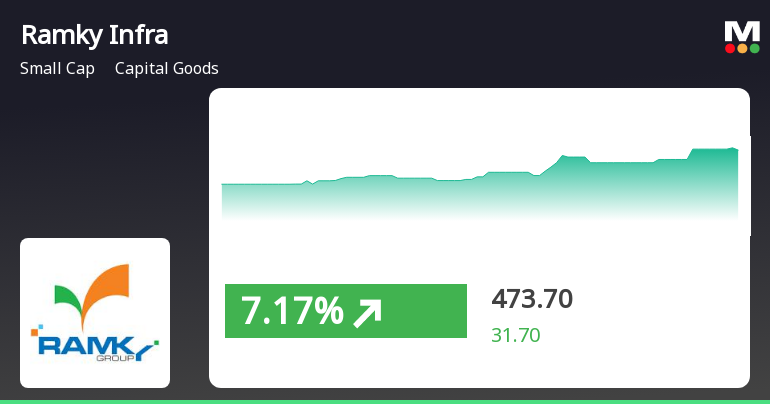

Read MoreRamky Infrastructure Shows Signs of Recovery Amid Ongoing Market Volatility

2025-03-05 09:35:08Ramky Infrastructure, a small-cap player in the capital goods sector, has shown significant activity today, opening with a gain of 6.28%. This marks a notable trend reversal for the stock, which had experienced four consecutive days of decline prior to today’s performance. The stock reached an intraday high of Rs 440, outperforming its sector by 3.19%. In terms of performance metrics, Ramky Infrastructure's one-day gain of 5.31% stands in stark contrast to the Sensex, which only increased by 0.63%. However, the stock's one-month performance reveals a decline of 19.58%, compared to the Sensex's drop of 6.16%, indicating a challenging month for the company. Despite today's positive movement, Ramky Infrastructure is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting ongoing volatility in its market position. Investors and market watchers will be keen to observ...

Read More

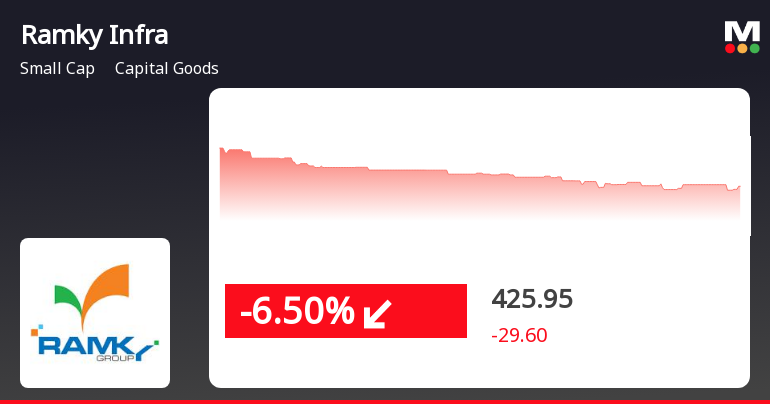

Ramky Infrastructure Faces Continued Decline Amid Broader Small-Cap Sector Challenges

2025-03-03 10:06:38Ramky Infrastructure, a small-cap company in the capital goods sector, has hit a new 52-week low, continuing a downward trend with a 9.41% drop over three days. The stock has underperformed significantly compared to the Sensex, reflecting broader challenges in the small-cap market.

Read MoreRamky Infrastructure Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-03-03 08:00:08Ramky Infrastructure, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company currently boasts a price-to-earnings (P/E) ratio of 11.36 and an enterprise value to EBITDA ratio of 8.00, indicating a competitive valuation relative to its peers. Additionally, Ramky's return on capital employed (ROCE) stands at 15.64%, while its return on equity (ROE) is recorded at 12.92%. In comparison to its industry counterparts, Ramky Infrastructure presents a more favorable valuation profile. For instance, TD Power Systems shows a significantly higher P/E ratio of 32.15, while Hindustan Construction Company is currently loss-making, making direct comparisons challenging. Other peers like Ahluwalia Contracts and Patel Engineering also exhibit higher valuation metrics, reinforcing Ramky's competitive stance in the marke...

Read More

Ramky Infrastructure Faces Significant Volatility Amid Broader Industry Challenges

2025-02-28 14:50:17Ramky Infrastructure, a small-cap company in the capital goods sector, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges. Over the past month, it has recorded substantial losses compared to broader market indices.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading window of the Company from 01.04.2025 till 48 hours after the declaration of Audited financial results for the Quarter and Financial Year ended 31st March 2025

Announcement under Regulation 30 (LODR)-Investor Presentation

18-Mar-2025 | Source : BSEThe company has attended the Sunidhi Securities Emerging Stars Conference today.

Corporate Actions

No Upcoming Board Meetings

Ramky Infrastructure Ltd has declared 45% dividend, ex-date: 04 Aug 11

No Splits history available

No Bonus history available

No Rights history available