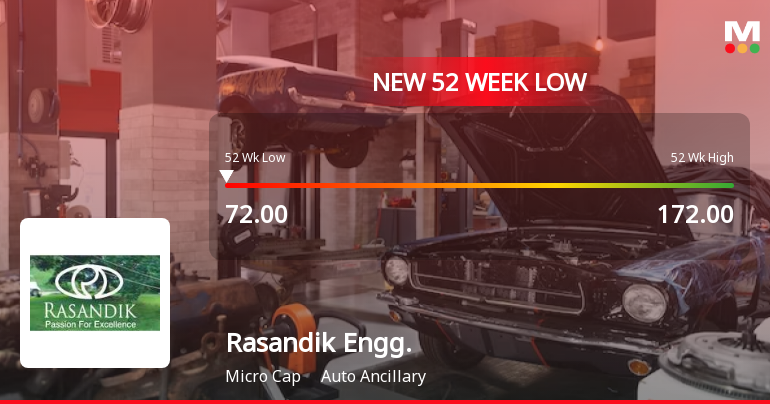

Rasandik Engineering Faces Significant Volatility Amid Weak Fundamentals and Market Underperformance

2025-03-28 15:06:06Rasandik Engineering Industries India, a microcap in the auto ancillary sector, has hit a new 52-week low and has underperformed its sector significantly. The stock has shown a bearish trend, with declining moving averages and weak long-term fundamentals, including a high debt-to-EBITDA ratio and negative operating profit growth.

Read More

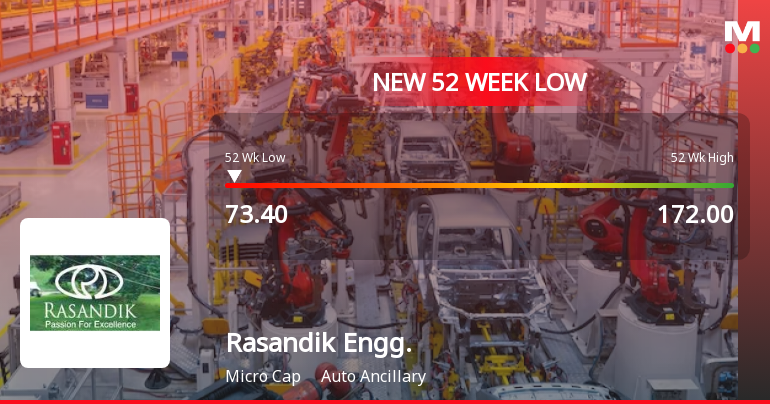

Rasandik Engineering Faces Financial Struggles Amidst Significant Stock Volatility

2025-03-26 10:10:15Rasandik Engineering Industries India, a microcap in the auto ancillary sector, has hit a new 52-week low amid significant volatility. The company faces challenges with a one-year return of -15.60% and weak long-term fundamentals, including a high debt-to-EBITDA ratio and low return on equity.

Read More

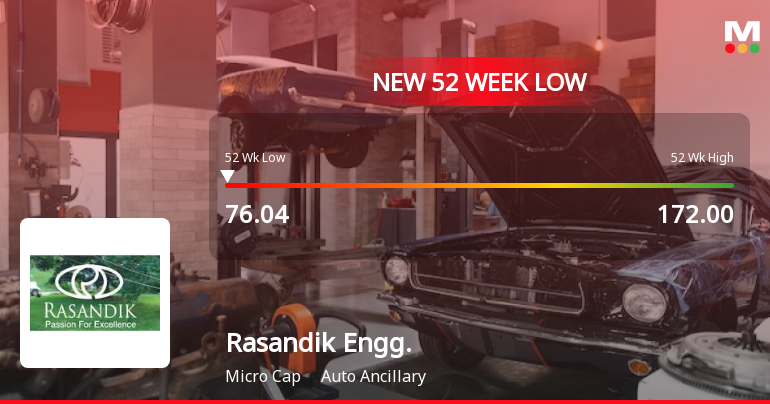

Rasandik Engineering Faces Continued Volatility Amid Weak Long-Term Fundamentals

2025-03-25 15:35:50Rasandik Engineering Industries India, a microcap in the auto ancillary sector, has hit a new 52-week low amid ongoing volatility. The stock has underperformed its sector significantly, with weak long-term fundamentals and a high debt-to-EBITDA ratio, despite a recent surge in quarterly profit after tax.

Read MoreRasandik Engineering Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-02-25 10:27:05Rasandik Engineering Industries India, a microcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish trends on a weekly basis and mildly bearish on a monthly basis. The Bollinger Bands also indicate a mildly bearish stance weekly, while the moving averages signal bearish conditions daily. In terms of performance, Rasandik's stock price currently stands at 104.80, unchanged from the previous close. Over the past year, the stock has experienced a high of 172.00 and a low of 72.10. Recent returns indicate a decline of 2.87% over the past week and 11.19% over the past month, contrasting with a modest gain of 4.38% over the last year. Notably, the company has outperformed the Sensex over a five-year period, with a return of 122.74% compared to the Sens...

Read More

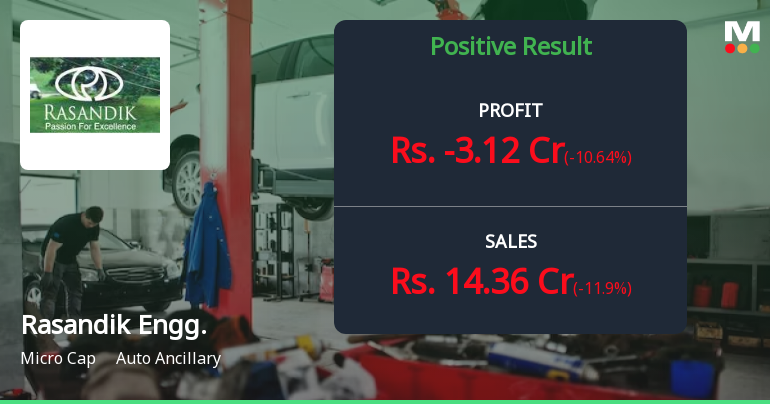

Rasandik Engineering Reports Strong Profit Growth Amid Declining Net Sales in Q4 2024

2025-02-11 19:31:25Rasandik Engineering Industries India has announced its financial results for the quarter ending December 2024, highlighting a significant increase in Profit After Tax to Rs 6.14 crore and improved Operating Profit Margin at 7.66%. However, Net Sales declined to Rs 14.36 crore, indicating challenges in sales performance.

Read MoreDisclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

07-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Ajay Kumar Kayan & Others

Closure of Trading Window

31-Mar-2025 | Source : BSEClosure of Trading Window

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

27-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Ajay Kumar Kayan & PACs

Corporate Actions

No Upcoming Board Meetings

Rasandik Engineering Industries India Ltd has declared 15% dividend, ex-date: 04 Sep 08

No Splits history available

No Bonus history available

No Rights history available