Rashi Peripherals Shows Resilience Amidst Broader Market Volatility and Technical Caution

2025-04-02 08:10:43Rashi Peripherals, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 304.50, showing a notable increase from the previous close of 281.45. Over the past week, Rashi Peripherals has demonstrated a stock return of 3.31%, contrasting with a decline of 2.55% in the Sensex, highlighting its relative strength in the short term. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages indicate a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish sentiment, suggesting some caution among traders. Notably, the stock's 52-week high stands at 474.80, with a low of 245.10, indicating significant volatility over the past year. When examining the company's performance over various time frames, it has experienced a year-to-date decline of 23.08%, while t...

Read More

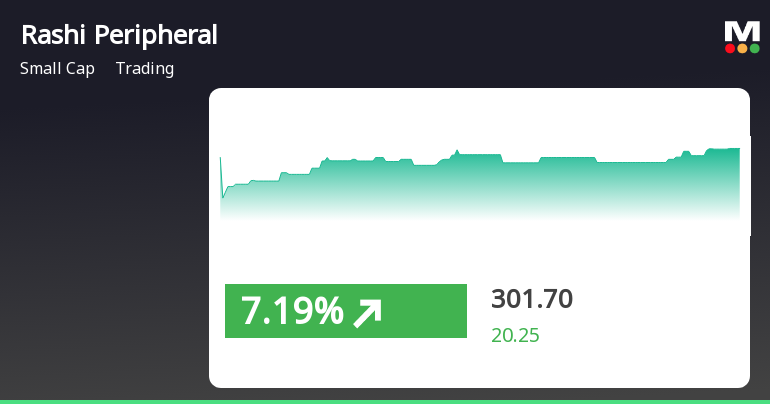

Rashi Peripherals Shows Resilience Amid Broader Market Challenges and Mixed Momentum

2025-04-01 12:35:30Rashi Peripherals experienced notable trading activity on April 1, 2025, with a significant intraday high and outperforming its sector. While the stock shows mixed momentum in relation to various moving averages, it has demonstrated resilience against broader market challenges, particularly over the past month.

Read More

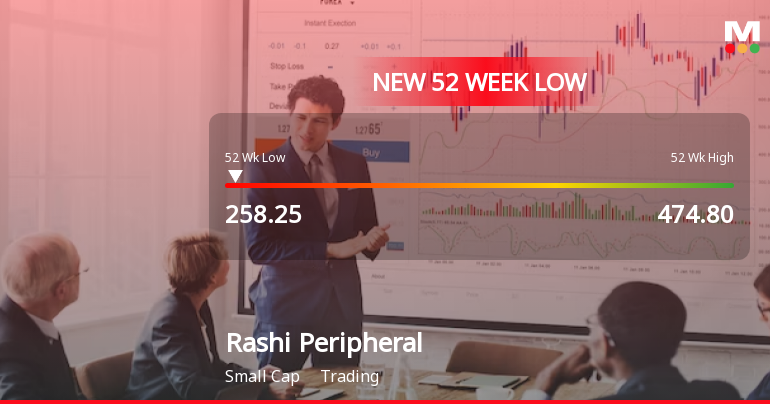

Rashi Peripherals Hits 52-Week Low Amid Ongoing Market Challenges and Volatility

2025-03-03 10:36:58Rashi Peripherals has faced significant volatility, hitting a new 52-week low of Rs. 246.9 amid ongoing market challenges. The stock has underperformed its sector and recorded a 29.33% decline over the year, contrasting sharply with the Sensex's modest drop, indicating persistent weakness in its performance.

Read More

Rashi Peripherals Faces Significant Volatility Amid Sustained Downward Trend in Trading Performance

2025-02-28 09:39:34Rashi Peripherals has faced notable volatility, hitting a new 52-week low of Rs. 260.25 and experiencing a 10.48% decline over the past four days. The stock has underperformed its sector and is trading below all key moving averages, reflecting ongoing challenges in its performance over the past year.

Read More

Rashi Peripherals Hits 52-Week Low Amid Sustained Underperformance and Market Scrutiny

2025-02-27 10:05:57Rashi Peripherals has reached a new 52-week low, continuing a downward trend over the past three days with a cumulative decline. Despite this, the stock has outperformed its sector today. Over the past year, it has faced significant challenges, contrasting with the overall market performance.

Read More

Rashi Peripherals Hits 52-Week Low Amid Sustained Underperformance in Trading Sector

2025-02-17 09:41:47Rashi Peripherals has reached a new 52-week low, continuing a downward trend over the past three days with an 11.01% cumulative decline. The stock is trading below all key moving averages and has decreased by 17.43% over the past year, contrasting with the Sensex's gains.

Read More

Rashi Peripherals Faces Financial Challenges Amidst Long-Term Growth Potential

2025-02-14 18:39:24Rashi Peripherals has recently experienced a change in evaluation, reflecting a shift in its financial outlook. The company reported flat performance for the quarter ending December 2024, with declines in key metrics such as profit after tax and net sales, despite demonstrating long-term growth and increased institutional investor interest.

Read More

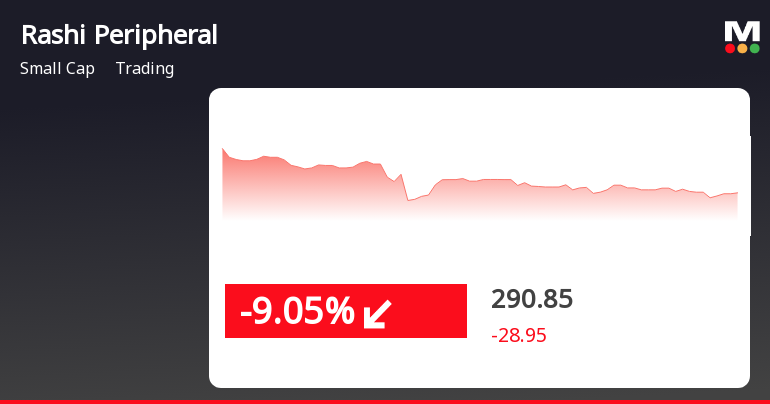

Rashi Peripherals Faces Significant Volatility Amidst Broader Market Challenges in October 2023

2025-02-14 14:35:41Rashi Peripherals has faced significant volatility, hitting a new 52-week low and experiencing a 10.18% decline over the past two days. The stock is trading below multiple moving averages and has underperformed its sector and the Sensex over the past year, reflecting ongoing challenges in the market.

Read More

Rashi Peripherals Faces Significant Volatility Amid Sustained Downward Trend in February 2025

2025-02-13 09:50:32Rashi Peripherals has faced significant volatility, experiencing a notable decline and reaching a new 52-week low. The stock has underperformed its sector and has seen a substantial drop over the past month, contrasting with the modest performance of the Sensex. It is trading below multiple moving averages.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPlease find enclosed herewith certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Suresh Mahavirprasad Pansari

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Kapal Pansari Family Trust

Corporate Actions

No Upcoming Board Meetings

Rashi Peripherals Ltd has declared 20% dividend, ex-date: 23 Aug 24

No Splits history available

No Bonus history available

No Rights history available