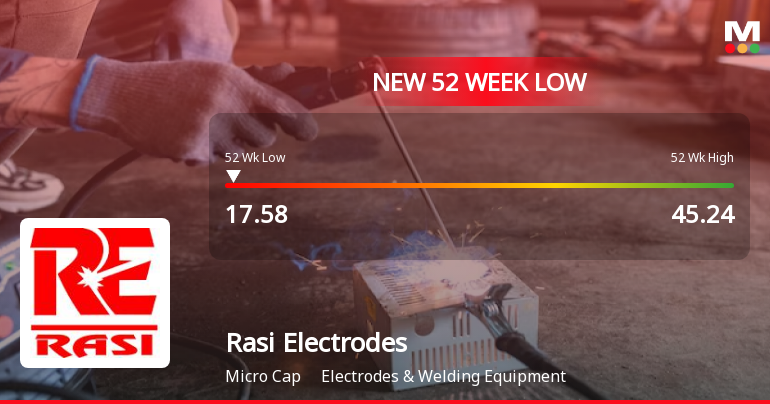

Rasi Electrodes Faces Significant Volatility Amid Broader Market Downturn and Weak Fundamentals

2025-03-28 09:55:59Rasi Electrodes, a microcap in the Electrodes & Welding Equipment sector, has reached a new 52-week low amid significant volatility. The company has underperformed over the past year, with weak financial metrics and disappointing quarterly results, contributing to a bearish trend in its stock performance.

Read More

Rasi Electrodes Faces Continued Volatility Amid Broader Market Fluctuations

2025-03-28 09:55:52Rasi Electrodes, a microcap in the electrodes and welding sector, has hit a new 52-week low amid ongoing volatility, reflecting a significant decline over recent days. The company's long-term fundamentals appear weak, with poor financial metrics and disappointing quarterly results, contrasting with broader market trends.

Read More

Rasi Electrodes Faces Continued Financial Struggles Amid Market Volatility and Weak Fundamentals

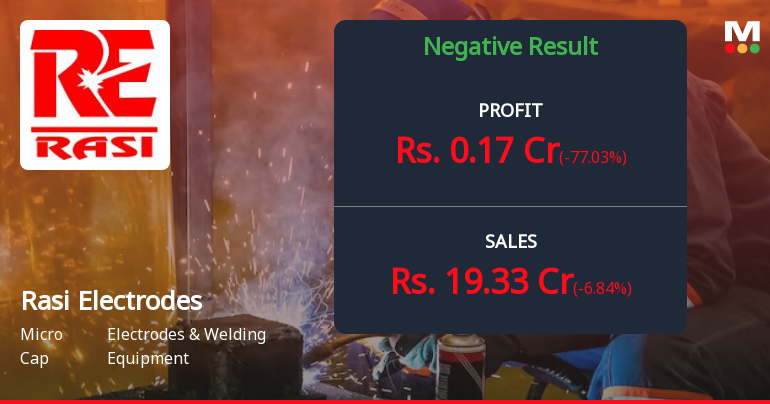

2025-03-28 09:55:45Rasi Electrodes, a microcap in the Electrodes & Welding Equipment sector, has hit a new 52-week low amid ongoing losses. The company reported disappointing net sales and a low operating profit margin, raising concerns about its profitability and long-term fundamentals, as it struggles with weak growth metrics.

Read More

Rasi Electrodes Hits New Low Amid Broader Market Decline and Weak Fundamentals

2025-03-26 15:40:35Rasi Electrodes, a microcap in the Electrodes & Welding Equipment sector, has reached a new 52-week low, continuing a downward trend. Over the past year, the company has significantly underperformed compared to the Sensex, with weak long-term fundamentals and modest growth metrics, amid broader market declines.

Read More

Rasi Electrodes Faces Continued Decline Amid Weak Fundamentals and Market Performance

2025-03-26 15:40:26Rasi Electrodes, a microcap in the Electrodes & Welding Equipment sector, has hit a new 52-week low, continuing a downward trend. The company has underperformed its sector and reported a significant decline in net sales and operating profit margin, reflecting weak long-term fundamentals and bearish market indicators.

Read More

Rasi Electrodes Hits 52-Week Low Amid Broader Market Gains and Weak Fundamentals

2025-03-25 10:07:07Rasi Electrodes, a microcap in the Electrodes & Welding Equipment sector, reached a new 52-week low today amid a broader market rise. The company has faced a 17.91% decline over the past year, with weak financial metrics and recent quarterly results showing significant drops in net sales and profit margins.

Read More

Rasi Electrodes Hits 52-Week Low Amid Broader Market Gains and Weak Fundamentals

2025-03-19 13:35:52Rasi Electrodes, a microcap in the electrodes and welding equipment sector, reached a new 52-week low today despite a positive market backdrop. The company has shown consecutive gains recently, but its long-term fundamentals are weak, with disappointing sales and underperformance compared to the broader market.

Read MoreRasi Electrodes Adjusts Valuation Amidst Competitive Industry Landscape and Declining Stock Performance

2025-03-05 08:00:50Rasi Electrodes, a microcap player in the Electrodes & Welding Equipment industry, has recently undergone a valuation adjustment. The company's current price stands at 19.37, reflecting a notable decline from its previous close of 20.72. Over the past year, Rasi Electrodes has experienced a stock return of -22.43%, contrasting with a modest -1.19% return from the Sensex during the same period. Key financial metrics for Rasi Electrodes include a PE ratio of 19.90 and an EV to EBITDA ratio of 13.79, indicating a competitive position within its sector. The company's return on capital employed (ROCE) is reported at 12.55%, while its return on equity (ROE) stands at 8.78%. In comparison to its peers, Rasi Electrodes presents a more favorable valuation profile. For instance, DE Nora India is categorized as risky with a significantly higher PE ratio of 90.99, while GEE, also attractive, has a PE of 45.13. Panas...

Read More

Rasi Electrodes Reports December 2024 Results, Signals Need for Strategic Adjustments

2025-02-17 13:48:09Rasi Electrodes has announced its financial results for the quarter ending December 2024, revealing a significant shift in its financial landscape. The company's score has seen a downward adjustment over the past three months, indicating challenges in its financial metrics that may impact future operational strategies.

Read MoreSEBI SAST DISCLOSURES Received From Promoters And Promoters Grp Under Reg 30 And 31 AS ON 31.3.2025

07-Apr-2025 | Source : BSESEBI SAST DISCLOSURES RECEIVED FROM PROMOTERS AND PROMOTERS GRP FYE 31.3.2025 UNDER REG 30 AND 31

Closure of Trading Window

21-Mar-2025 | Source : BSETRading Window to be closed from 1.4.2025 to 1.6.2025 for the purpose of approval of Audited Financial Results FYE 31.3.2025 at a Board meeting to be held on or before 30.05.2025

Announcement under Regulation 30 (LODR)-Credit Rating

14-Mar-2025 | Source : BSEICRA RE-AFFIRMED RATING FOR COMPANYS LONGTERM BORROWINGS AND SHORTERM BORROWINGS VIDE THEIR LETTER ATTACHED

Corporate Actions

No Upcoming Board Meetings

Rasi Electrodes Ltd has declared 5% dividend, ex-date: 11 Sep 15

Rasi Electrodes Ltd has announced 2:10 stock split, ex-date: 11 May 15

Rasi Electrodes Ltd has announced 2:5 bonus issue, ex-date: 19 Dec 07

No Rights history available