Rathi Steel & Power Adjusts Valuation Amid Elevated Industry Comparisons

2025-03-25 08:00:48Rathi Steel & Power has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the steel industry. The company’s price-to-earnings (PE) ratio stands at 51.15, indicating a significant valuation relative to its earnings. Additionally, the price-to-book value is recorded at 2.41, while the enterprise value to EBITDA ratio is 16.07, suggesting a notable market valuation compared to its earnings before interest, taxes, depreciation, and amortization. In terms of performance indicators, Rathi Steel has a return on capital employed (ROCE) of 17.50% and a return on equity (ROE) of 4.72%. These figures provide insight into the company's efficiency in generating profits from its capital and equity. When compared to its peers, Rathi Steel's valuation metrics appear elevated. For instance, Beekay Steel Industries and Vraj Iron exhibit more attractive valuation ...

Read MoreRathi Steel & Power Adjusts Valuation Amidst Competitive Steel Industry Landscape

2025-03-18 08:00:49Rathi Steel & Power has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the steel industry. The company's price-to-earnings (PE) ratio stands at 40.77, indicating a significant valuation relative to its earnings. Additionally, the price-to-book value is recorded at 1.92, while the enterprise value to EBITDA ratio is 12.74, suggesting a complex financial landscape. Rathi Steel's return on capital employed (ROCE) is reported at 17.50%, and its return on equity (ROE) is at 4.72%. These figures provide insight into the company's efficiency in generating profits from its capital and equity. However, the company has faced challenges, as evidenced by its stock performance, which has seen a decline of 32.51% year-to-date and 45.54% over the past year, contrasting with a modest gain in the Sensex. In comparison to its peers, Rathi Steel's valuation met...

Read MoreRathi Steel & Power Adjusts Valuation Amid Competitive Industry Landscape

2025-03-06 08:01:01Rathi Steel & Power has recently undergone a valuation adjustment, reflecting its current standing in the steel industry. The company's price-to-earnings ratio stands at 43.64, while its price-to-book value is recorded at 2.06. Other key metrics include an EV to EBIT ratio of 28.16 and an EV to EBITDA ratio of 13.66, indicating its operational performance relative to its enterprise value. In terms of return on capital employed (ROCE), Rathi Steel reported a rate of 17.50%, alongside a return on equity (ROE) of 4.72%. These figures provide insight into the company's efficiency in generating profits from its capital and equity. When compared to its peers, Rathi Steel's valuation metrics present a mixed picture. For instance, Beekay Steel Industries and Ratnaveer Precision exhibit more favorable valuation indicators, while other competitors like Gandhi Special Tube and Espire Hospitality show higher valuatio...

Read More

Rathi Steel & Power Faces Ongoing Market Challenges Amid Significant Stock Volatility

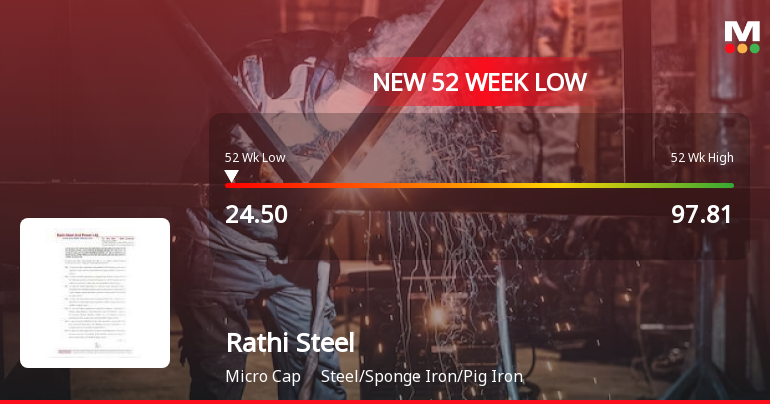

2025-03-03 10:36:36Rathi Steel & Power has faced significant volatility, hitting a new 52-week low and experiencing a cumulative drop of 12.5% over three days. The company has struggled over the past year, with a decline of 57.86%, and is trading below multiple moving averages, indicating ongoing challenges.

Read More

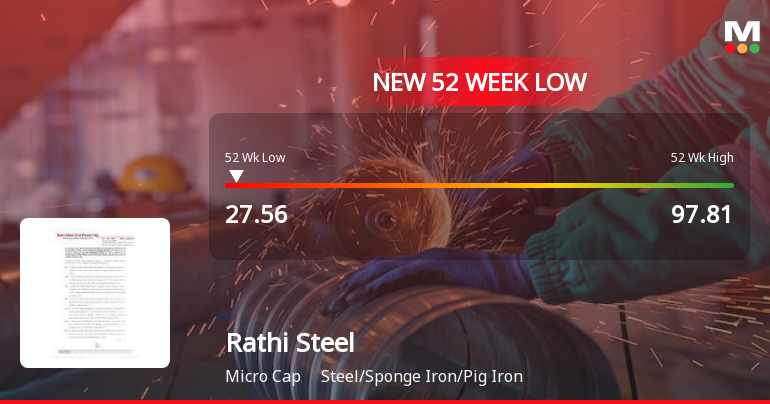

Rathi Steel & Power Faces Persistent Downward Trend Amid Significant Volatility

2025-02-28 10:35:39Rathi Steel & Power has faced significant volatility, hitting a new 52-week low of Rs. 27.5 and underperforming its sector. The stock has declined 4.46% over two days and 53.66% over the past year, trading below all major moving averages, indicating ongoing challenges for the company.

Read More

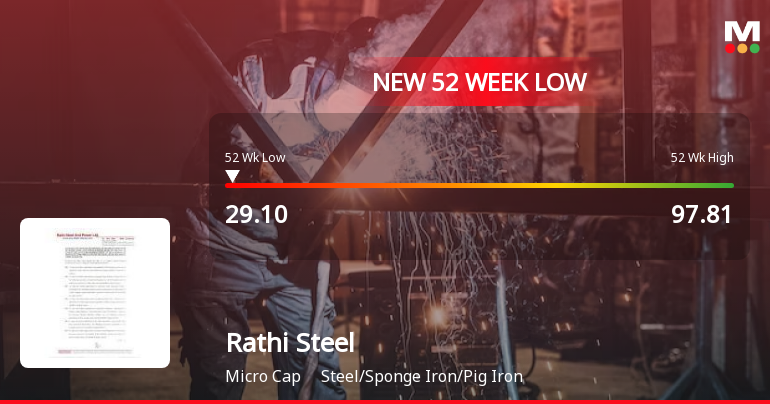

Rathi Steel & Power Faces Significant Volatility Amidst Ongoing Market Challenges

2025-02-18 12:05:31Rathi Steel & Power has faced significant volatility, hitting a new 52-week low and experiencing an 18.03% decline over three days. The microcap company has consistently underperformed its sector and has seen a 47.74% drop over the past year, contrasting with the Sensex's positive performance.

Read More

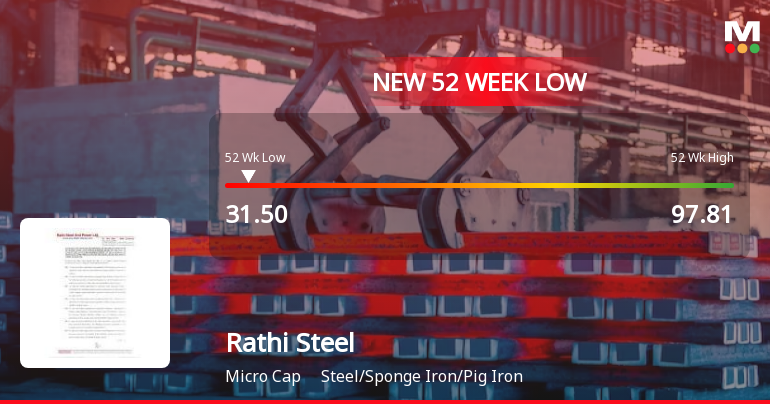

Rathi Steel & Power Faces Significant Stock Volatility Amid Industry Challenges

2025-02-17 10:10:17Rathi Steel & Power, a microcap in the steel industry, has faced significant stock volatility, reaching a new 52-week low. The stock has declined 11% over two days and is trading below multiple moving averages, reflecting ongoing challenges and a 41.30% drop in one-year performance compared to the Sensex.

Read More

Rathi Steel & Power Reports Flat Financial Results Amid Industry Challenges in February 2025

2025-02-15 10:49:18Rathi Steel & Power has announced its financial results for the quarter ending December 2024, revealing a stable performance amid challenges. The recent evaluation adjustments reflect the complexities faced by the company within the steel industry, providing insights into its position in the microcap market segment.

Read More

Rathi Steel & Power Hits 52-Week Low Amid Ongoing Market Struggles

2025-02-12 09:37:40Rathi Steel & Power, a microcap in the steel industry, has reached a new 52-week low, continuing a downward trend with a significant decline over the past two days. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in a competitive market.

Read MoreDisclosure Pursuant To Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 (Listing Regulations)- Re-Commencement Of Commercial Operations Of TMT Rolling Mill Division Of Rathi Steel And Power Limited (Company)

05-Apr-2025 | Source : BSERe-commencement of commercial operations of TMT Rolling Mill Division of Rathi Steel and Power Limited

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 (Listing Regulations) Read With Sub Para 20 Of Para A Of Part A Of Schedule III Thereto With Respect To Tax Assessment And Demand Order.

01-Apr-2025 | Source : BSEDisclosure under Regulation 30 of Listing regulations with respect to Tax Assessment and Demand Order

Announcement under Regulation 30 (LODR)-Resignation of Director

29-Mar-2025 | Source : BSEDisclosure of Resignation of Ms. Sangeeta Pandey as Independent Director of the Company effective from March 29 2025.

Corporate Actions

No Upcoming Board Meetings

Rathi Steel & Power Ltd has declared 3% dividend, ex-date: 22 Sep 11

No Splits history available

No Bonus history available

No Rights history available