Raymond's Resilient Performance Highlights Midcap Strength Amid Market Volatility

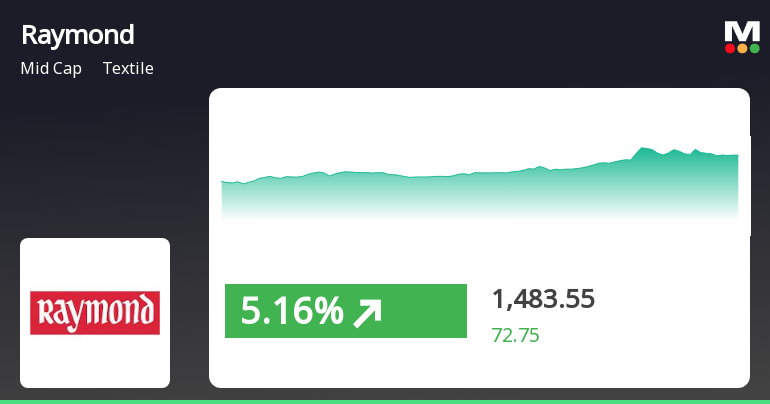

2025-04-03 10:45:15Raymond, a midcap textile company, experienced notable stock activity on April 3, 2025, rebounding from an early loss to reach an intraday high. The stock has shown resilience, trading above several moving averages and delivering strong returns over the past month, despite a decline over the past year.

Read More

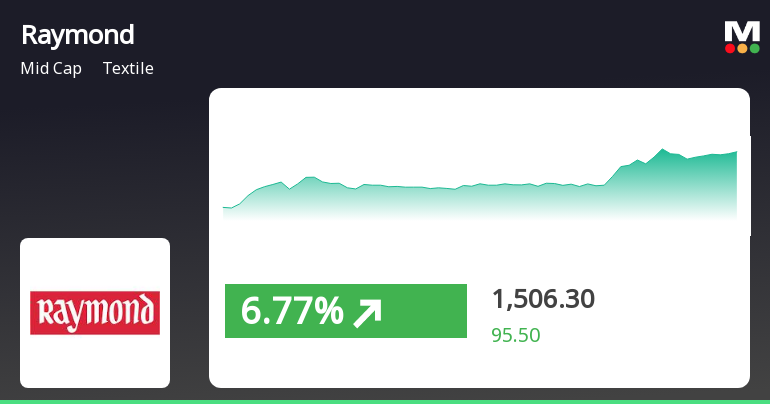

Raymond's Technical Outlook Shifts Amid Mixed Performance Indicators and Debt Concerns

2025-04-03 08:01:25Raymond, a midcap textile company, has recently adjusted its evaluation amid mixed performance indicators. While it has shown strong management efficiency with a 26.34% return on equity and a significant profit increase, concerns remain regarding its debt servicing capabilities and stock performance relative to the broader market.

Read MoreRaymond's Stock Shows Mixed Technical Trends Amid Market Fluctuations

2025-04-03 08:01:12Raymond, a prominent player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1410.80, showing a notable increase from the previous close of 1373.65. Over the past year, Raymond has experienced significant fluctuations, with a 52-week high of 3,493.00 and a low of 1,215.60. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans towards a mildly bearish stance. The Bollinger Bands and KST metrics also indicate a bearish trend on both weekly and monthly bases. The stock's performance has been mixed, with the On-Balance Volume (OBV) showing bullish signals weekly, yet no clear trend on a monthly basis. When comparing Raymond's stock return to the Sensex, the company has faced challenges, particularly in the year-to-date performance, where it has declin...

Read MoreRaymond's Technical Indicators Signal Bearish Sentiment Amid Market Volatility

2025-04-01 08:00:40Raymond, a prominent player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, currently priced at 1403.50, has seen fluctuations with a 52-week high of 3,493.00 and a low of 1,215.60. Recent trading activity shows a daily high of 1468.75 and a low of 1390.00, indicating volatility in its performance. The technical summary reveals a bearish sentiment in various indicators, including MACD and Bollinger Bands on a weekly basis, while the monthly indicators show a mildly bearish trend. The moving averages also reflect a bearish stance, suggesting a cautious outlook. Despite these trends, the On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, indicating some underlying strength in trading volume. In terms of returns, Raymond's performance has been mixed compared to the Sensex. Over the past week, the stock has decli...

Read More

Raymond's Evaluation Score Adjustment Highlights Market Sentiment and Financial Challenges

2025-03-24 08:00:40Raymond, a midcap textile company, has recently adjusted its evaluation score, reflecting changes in technical indicators and market performance. While facing challenges such as declining net sales and debt servicing issues, the company maintains strong management efficiency and an attractive valuation, highlighting its complex market position.

Read MoreRaymond's Stock Performance Highlights Technical Trends Amid Market Dynamics

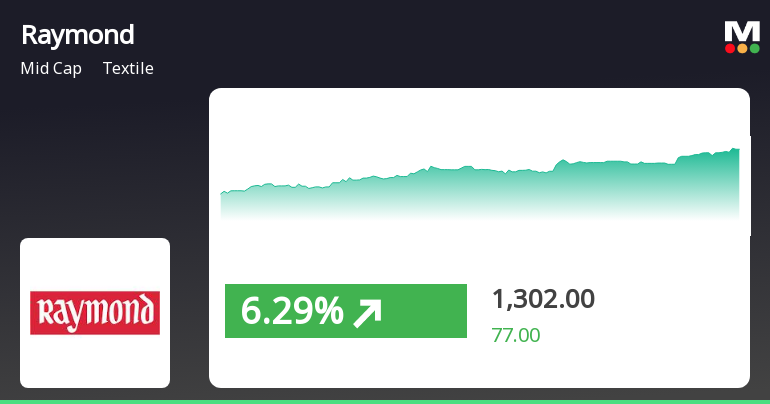

2025-03-24 08:00:24Raymond, a prominent player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,481.00, showing a notable increase from the previous close of 1,410.80. Over the past week, Raymond has demonstrated a strong performance with a return of 20.98%, significantly outpacing the Sensex, which returned 4.17% in the same period. In terms of technical indicators, the weekly MACD and KST are positioned in a bearish trend, while the monthly indicators show a mildly bearish stance. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands and moving averages also reflect a mildly bearish outlook, suggesting a cautious market sentiment. Despite the recent challenges, Raymond has shown resilience over longer periods, with a remarkable 438.94% return over the past fi...

Read More

Raymond's Stock Shows Signs of Reversal Amidst Mixed Long-Term Performance

2025-03-21 10:15:16Raymond, a midcap textile company, experienced notable activity with a 6.32% increase on March 21, 2025, following two days of decline. The stock outperformed its sector and has surged 22.74% over the past week, despite longer-term declines. Its moving averages indicate volatility within the market context.

Read More

Raymond's Stock Performance Highlights Mixed Trends Amid Broader Market Gains

2025-03-18 11:45:15Raymond, a midcap textile company, experienced a notable increase in stock performance, outperforming its sector. Despite recent gains, the stock's price remains mixed against various moving averages. In the broader market, the Sensex rose, with small-cap stocks leading the gains, while Raymond shows a complex performance over different time frames.

Read More

Raymond Ltd Hits 52-Week Low Amidst Ongoing Financial Challenges and Market Trends

2025-03-17 09:42:36Raymond Ltd, a midcap textile company, reached a new 52-week low amid a challenging year, with a 29.68% stock price decline. Despite outperforming its sector today, the stock remains below key moving averages. Financial metrics indicate concerns over profitability and debt servicing, while long-term growth prospects appear limited.

Read MoreAnnouncement under Regulation 30 (LODR)-Scheme of Arrangement

08-Apr-2025 | Source : BSEPlease find attached intimation under Regulation 30 of Listing Regulations.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEPlease find attached Press Release intimation under regulation 30 of Listing Regulations.

Announcement under Regulation 30 (LODR)-Change in Management

29-Mar-2025 | Source : BSEPlease find enclosed intimation under Regulation 30 of SEBI Listing Regulations

Corporate Actions

No Upcoming Board Meetings

Raymond Ltd has declared 100% dividend, ex-date: 13 Jun 24

No Splits history available

No Bonus history available

No Rights history available