REC Ltd's Technical Indicators Reflect Mixed Sentiment Amid Market Volatility

2025-04-03 08:02:04REC Ltd, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 425.00, showing a slight increase from the previous close of 416.85. Over the past year, REC has experienced a high of 653.90 and a low of 357.45, indicating notable volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands and KST indicators are indicating bearish trends, particularly on the monthly scale. The Dow Theory presents a mildly bullish trend on a weekly basis, while the On-Balance Volume (OBV) reflects a mildly bearish stance. When comparing REC's performance to the Sensex, the company has shown...

Read More

REC Ltd Faces Market Sentiment Shift Amid Strong Valuation Metrics and Underperformance

2025-04-02 08:06:09REC Ltd, a key player in the Finance/NBFC sector, has recently experienced an evaluation adjustment reflecting changes in its financial metrics and market position. While the company shows attractive valuation metrics, it has struggled with performance relative to broader market trends over the past year.

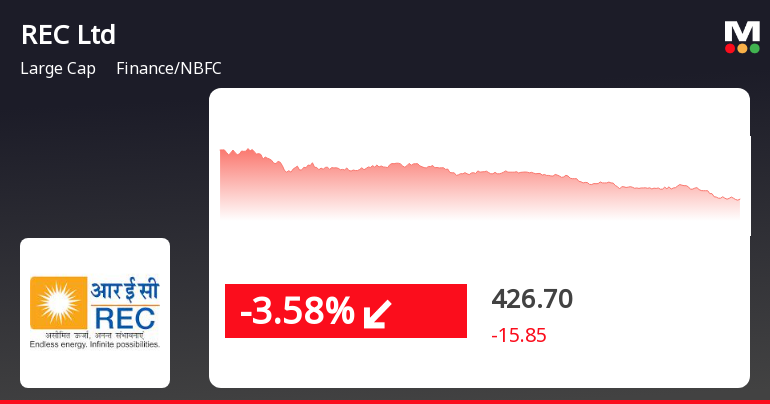

Read MoreREC Ltd Faces Mixed Technical Signals Amid Market Volatility and Performance Fluctuations

2025-04-02 08:03:25REC Ltd, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 416.85, has experienced fluctuations, with a 52-week high of 653.90 and a low of 357.45. Today's trading saw a high of 432.70 and a low of 415.15, indicating a volatile market environment. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish stance. Bollinger Bands and moving averages indicate bearish trends, suggesting caution in the short term. The KST also reflects a bearish outlook on a weekly basis, with no definitive trend observed in the Dow Theory. In terms of performance, REC Ltd's stock return over the past week has been notably negative at -5.81%, compared to a -2.55% return for the Sensex. Howe...

Read MoreREC Ltd Adjusts Valuation Grade, Highlighting Strong Financial Metrics and Market Position

2025-03-28 08:00:16REC Ltd, a prominent player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company's price-to-earnings ratio stands at 7.25, indicating a competitive valuation compared to its peers. Additionally, REC's price-to-book value is recorded at 1.54, while its enterprise value to EBITDA ratio is 11.15, showcasing its operational efficiency. The company also boasts a robust dividend yield of 5.78% and a return on equity (ROE) of 20.25%, highlighting its ability to generate profits from shareholders' equity. In terms of performance, REC has shown significant returns over the long term, with a remarkable 577.27% increase over the past five years, outpacing the broader market. When compared to its peers, REC's valuation metrics are notably more favorable. For instance, Bajaj Finance and Bajaj Finserv exhibit much higher pric...

Read More

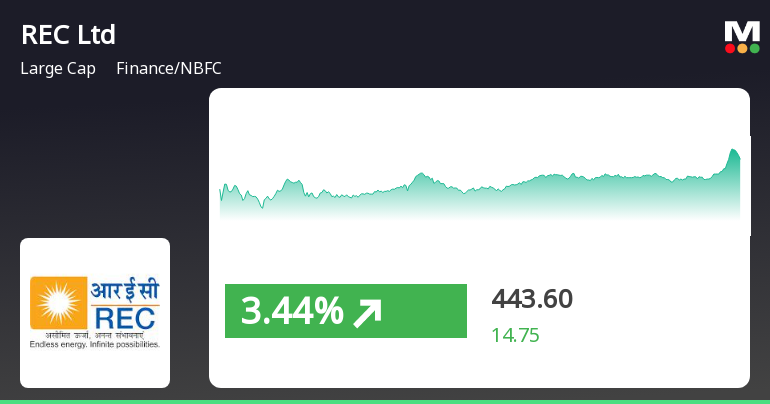

REC Shows Signs of Recovery Amid Broader Market Rebound and Sector Outperformance

2025-03-27 10:35:15REC, a key player in the finance and NBFC sector, has experienced a notable uptick today, reversing a two-day decline. The stock has outperformed its sector and offers a high dividend yield. Meanwhile, the broader market, represented by the Sensex, has rebounded significantly after a negative start.

Read More

REC Faces Consecutive Losses Amid Broader Market Decline and Strong Long-Term Growth

2025-03-26 13:15:17REC, a key player in the finance and NBFC sector, faced a decline on March 26, 2025, marking its second consecutive day of losses. Despite recent struggles, the company has demonstrated significant long-term growth, with substantial increases over the past three and five years. It also offers a high dividend yield.

Read More

REC Ltd Shows Strong Short-Term Gains Amid Mixed Long-Term Performance Trends

2025-03-24 14:30:17REC Ltd has experienced notable trading activity, outperforming the broader market. The stock is currently above several short-term moving averages and offers a high dividend yield. While recent performance shows fluctuations, the company has achieved substantial long-term growth over the past three and five years.

Read More

REC Ltd Adjusts Valuation Amid Mildly Bearish Technical Indicators and Strong Financial Metrics

2025-03-20 08:01:54REC Ltd, a key player in the Finance/NBFC sector, has recently experienced an evaluation adjustment reflecting changes in its metrics. The company's financial ratios indicate a strong position, with a notable dividend yield and robust Return on Equity, despite a flat performance in the recent quarter.

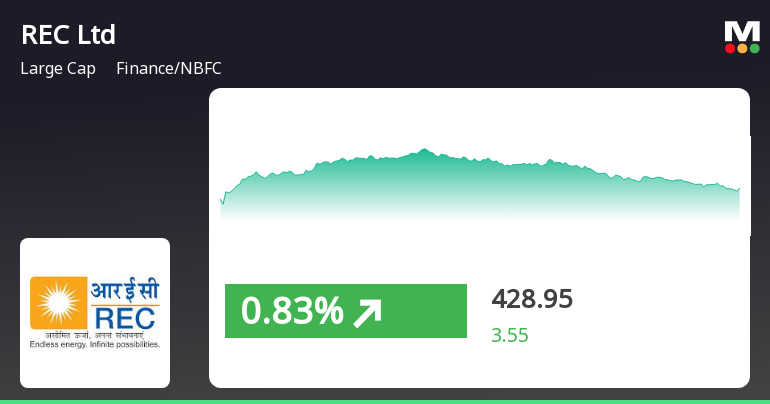

Read MoreREC Ltd Shows Mixed Technical Trends Amidst Market Volatility and Outperformance

2025-03-20 08:01:13REC Ltd, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 428.55, showing a slight increase from the previous close of 421.40. Over the past year, REC has experienced a 52-week high of 653.90 and a low of 357.45, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands and Moving Averages also reflect a mildly bearish trend on a daily basis. However, the Dow Theory indicates a mildly bullish stance on a weekly basis, with no discernible trend on a monthly scale. When comparing REC's performance to the Sensex, the company has shown notable returns over various periods. In the last week, REC outperf...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018.

Intimation Of Incorporation Of Subsidiary Company.

31-Mar-2025 | Source : BSEIntimation of incorporation of subsidiary company.

Intimation Of Incorporation Of Subsidiary Company.

28-Mar-2025 | Source : BSEIntimation of incorporation of subsidiary company.

Corporate Actions

No Upcoming Board Meetings

REC Ltd has declared 36% dividend, ex-date: 26 Mar 25

No Splits history available

REC Ltd has announced 1:3 bonus issue, ex-date: 17 Aug 22

No Rights history available