Redington Adjusts Evaluation Amid Strong Financial Performance and Institutional Support

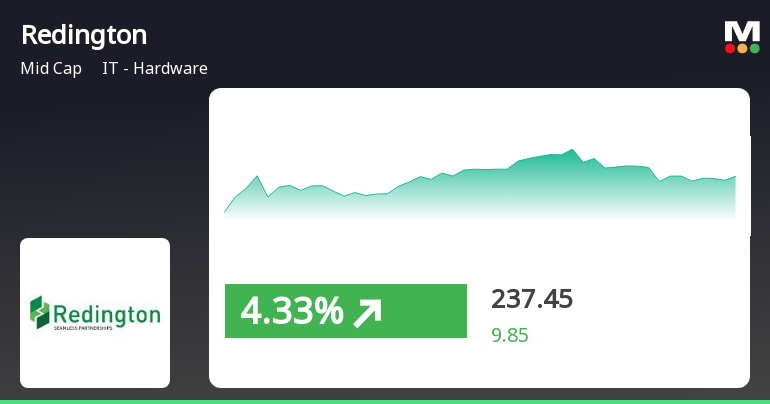

2025-04-02 08:06:55Redington, a key player in the IT Hardware sector, has recently adjusted its evaluation, reflecting changes in the stock's technical landscape. The company maintains strong financial metrics, including an 18.03% return on equity and a low debt-to-equity ratio, alongside healthy long-term growth and significant institutional support.

Read MoreRedington's Technical Indicators Show Mixed Signals Amid Market Volatility

2025-04-02 08:00:34Redington, a midcap player in the IT hardware industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 229.65, down from a previous close of 243.15, with a 52-week high of 263.80 and a low of 159.10. Today's trading saw a high of 242.65 and a low of 227.45, indicating some volatility. In terms of technical indicators, the weekly MACD remains bullish, while the monthly MACD shows a different trend. The Bollinger Bands indicate a mildly bullish sentiment on both weekly and monthly charts. Moving averages also reflect a mildly bullish stance on a daily basis. However, the KST presents a mixed picture, being bullish weekly but mildly bearish monthly. The Dow Theory suggests a mildly bullish trend on a weekly basis, while the monthly analysis shows no clear trend. When comparing Redington's performance to the Sensex, the stock has shown no...

Read More

Redington Faces Short-Term Decline Amid Strong Long-Term Performance Trends

2025-04-01 12:00:18Redington, an IT hardware midcap, has faced a decline today, marking its second consecutive day of losses. Despite this short-term downturn, the stock has shown strong long-term performance, with significant gains over the past month, three months, and five years, outperforming the Sensex in these periods.

Read MoreRedington Adjusts Valuation Grade Amid Competitive IT Hardware Market Dynamics

2025-03-24 08:00:05Redington, a midcap player in the IT hardware sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 15.46 and a price-to-book value of 2.57. Its enterprise value to EBITDA stands at 10.34, while the enterprise value to EBIT is recorded at 11.61. Additionally, Redington shows a PEG ratio of 3.02 and a dividend yield of 2.48%. The return on capital employed (ROCE) is reported at 21.15%, and the return on equity (ROE) is at 15.85%. In terms of market performance, Redington's stock price has seen fluctuations, with a current price of 250.05, compared to a previous close of 227.60. Over the past year, the stock has returned 23.63%, significantly outperforming the Sensex, which returned 5.87% in the same period. When compared to peers, Redington's valuation metrics indicate a competitive position within the industry. For instance, Tejas Networks...

Read MoreRedington Ltd Sees High Trading Volume Amidst Sector Resilience and Positive Trends

2025-03-21 14:00:05Redington Ltd, a prominent player in the IT Hardware sector, has emerged as one of the most active equities today, with a total traded volume of 26,472,154 shares and a total traded value of approximately Rs 65.97 crores. The stock opened at Rs 229.87 and reached an intraday high of Rs 257.5, reflecting a notable increase of 13.21% during the trading session. Currently, the last traded price stands at Rs 246.97. Despite this activity, Redington's performance has underperformed the sector by 0.91%. However, the stock has shown resilience, gaining 7.98% over the last two days. It has consistently traded above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a positive trend in its short to long-term performance. The IT Hardware sector overall has gained 8.47%, while Redington's liquidity remains robust, with a delivery volume of 1.447 million shares on March 20, reflecting a 12.5%...

Read MoreRedington Ltd Sees Surge in Trading Activity Amidst Sector Volatility

2025-03-21 14:00:05Redington Ltd, a prominent player in the IT Hardware sector, has emerged as one of the most active equities today, with a total traded volume of 26,986,423 shares and a total traded value of approximately Rs 67.24 crores. The stock opened at Rs 229.87 and reached an intraday high of Rs 257.5, reflecting a notable increase of 13.21% during the trading session. Currently, the last traded price stands at Rs 244.43. Despite this activity, Redington's performance has slightly underperformed its sector, which has gained 8.47% today. Over the past two days, Redington has shown a positive trend, with a cumulative return of 7.98%. The stock has traded within a wide range of Rs 28.44, indicating significant volatility. Additionally, Redington is trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a strong short-term performance. The delivery volume on March 20 was recorded at 1...

Read More

Redington's Strong Performance Highlights Resilience in IT-Hardware Sector Amid Market Recovery

2025-03-21 09:45:15Redington, a midcap IT-Hardware company, has experienced notable gains, outperforming its sector and showing a consistent upward trend over the past two days. The stock is above several key moving averages and has achieved significant year-to-date and five-year increases, contrasting with the broader market's performance.

Read MoreRedington Adjusts Valuation Grade Amid Strong Financial Performance and Competitive Metrics

2025-03-10 08:00:05Redington, a midcap player in the IT hardware sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 250.85, slightly above the previous close of 247.90, with a 52-week high of 263.80 and a low of 159.10. Key financial metrics reveal a PE ratio of 15.50 and an EV to EBITDA of 10.38, indicating a competitive position within its industry. The company also boasts a robust return on capital employed (ROCE) of 21.15% and a return on equity (ROE) of 15.85%. Additionally, Redington offers a dividend yield of 2.47%, which may appeal to income-focused investors. In comparison to its peers, Redington's valuation metrics show it is positioned favorably against Tejas Networks, which has a higher PE ratio of 19.5 and a similar EV to EBITDA. Over various time frames, Redington has outperformed the Sensex, with a year-to-date return of ...

Read MoreRedington Ltd Sees High Trading Volume Amidst Notable Market Activity

2025-03-05 14:00:04Redington Ltd, a prominent player in the IT Hardware sector, has emerged as one of the most active equities today, with a total traded volume of 15,871,680 shares and a total traded value of approximately Rs 3,911.26 million. The stock opened at Rs 229.75 and reached an intraday high of Rs 252.24, reflecting a notable increase of 10.37% during the trading session. The stock's performance today has outpaced its sector by 2.92%, with the IT Hardware industry itself gaining 4.43%. Redington's last traded price (LTP) stands at Rs 244.61, marking a 7.06% return for the day. The stock has demonstrated a wide trading range of Rs 23.23, indicating significant volatility. Additionally, it is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a strong upward trend in its recent performance. However, it is worth noting that investor participation has declined, with de...

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSETrading Window Closure

Income Tax Assessment Order

25-Mar-2025 | Source : BSEIncome Tax Assessment Order

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Mar-2025 | Source : BSENewspaper publication

Corporate Actions

No Upcoming Board Meetings

Redington Ltd has declared 310% dividend, ex-date: 05 Jul 24

Redington Ltd has announced 2:10 stock split, ex-date: 20 Aug 10

Redington Ltd has announced 1:1 bonus issue, ex-date: 18 Aug 21

No Rights history available