Redtape Faces Valuation Challenges Despite Strong Profit Growth and Operational Strengths

2025-04-03 08:14:15Redtape, a midcap consumer durables company, has recently adjusted its evaluation metrics, reflecting a premium valuation despite a 25% profit increase over the past year. The stock has faced challenges, with a notable decline in performance compared to the broader market, while operational strengths are evident in its sales and profit figures.

Read MoreRedtape Adjusts Valuation Grade Amidst Competitive Consumer Durables Landscape

2025-04-01 08:00:53Redtape, a midcap player in the consumer durables sector, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings (P/E) ratio stands at 47.16, while its price-to-book value is noted at 11.38. Other key metrics include an EV to EBIT ratio of 33.16 and an EV to EBITDA ratio of 25.57, indicating a robust operational performance relative to its valuation. In terms of return metrics, Redtape has faced challenges, with a year-to-date return of -33.71%, contrasting with a slight decline of -0.93% in the Sensex over the same period. Over the past year, the stock has also underperformed, showing a return of -11.9% compared to the Sensex's gain of 5.11%. When compared to its peers, Redtape's valuation metrics reveal a competitive landscape. For instance, Bata India and Sheela Foam are positioned favorably with lower P/E ratios, while Relaxo Footwear ex...

Read More

Redtape Reports Strong Profit Growth Amid Market Evaluation Adjustments

2025-03-18 08:24:48Redtape, a midcap consumer durables company, recently adjusted its evaluation following a strong third-quarter performance for FY24-25. The company reported a 25% profit increase, record net sales of Rs 664.57 crore, and a high return on capital employed, indicating effective management and operational efficiency.

Read MoreRedtape Adjusts Valuation Grade Amidst Competitive Consumer Durables Landscape

2025-03-13 08:00:56Redtape, a midcap player in the consumer durables sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 49.76, while its price-to-book value is noted at 12.01. Additionally, Redtape's enterprise value to EBITDA ratio is 26.88, indicating a robust valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance indicators, Redtape boasts a return on capital employed (ROCE) of 18.04% and a return on equity (ROE) of 22.39%, showcasing its efficiency in generating profits from its capital and equity. However, the company has experienced a decline of 30.05% year-to-date, contrasting with a modest gain of 0.49% over the past year. When compared to its peers, Redtape's valuation metrics appear elevated, particularly against companies like Bata India and ...

Read MoreRedtape Adjusts Valuation Grade Amidst Competitive Consumer Durables Landscape

2025-03-13 08:00:56Redtape, a midcap player in the consumer durables sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 49.76, while its price-to-book value is noted at 12.01. Additionally, Redtape's enterprise value to EBITDA ratio is 26.88, indicating a robust valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance indicators, Redtape boasts a return on capital employed (ROCE) of 18.04% and a return on equity (ROE) of 22.39%, showcasing its efficiency in generating profits from its capital and equity. However, the company has experienced a decline of 30.05% year-to-date, contrasting with a modest gain of 0.49% over the past year. When compared to its peers, Redtape's valuation metrics appear elevated, particularly against companies like Bata India and ...

Read More

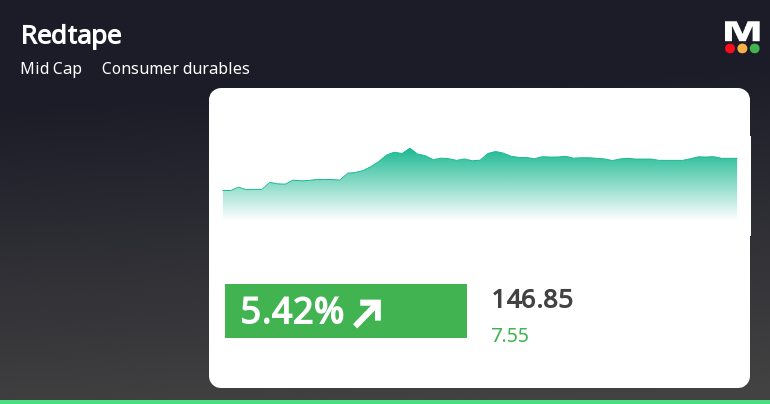

Redtape's Notable Gains Highlight Resilience Amidst Broader Market Volatility

2025-03-12 09:50:25Redtape, a midcap consumer durables company, has shown notable activity, gaining 5.46% today and outperforming its sector. The stock reached an intraday high of Rs 149.6, with significant volatility. Despite recent gains, its performance over the past month and year-to-date remains negative.

Read More

Redtape Reports Strong Growth Amid Market Challenges and Technical Indicators

2025-03-11 08:22:14Redtape, a midcap consumer durables company, recently adjusted its evaluation amid strong Q3 FY24-25 results, reporting net sales of Rs 664.57 crore and an operating profit of Rs 128.75 crore. The company demonstrates effective capital utilization with a ROCE of 18.04%, despite facing a mildly bearish stock position.

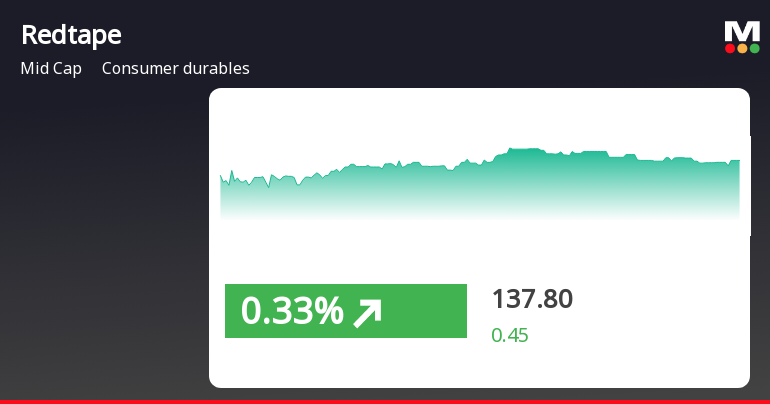

Read MoreRedtape Faces Technical Trend Adjustments Amidst Market Volatility and Challenges

2025-03-11 08:05:46Redtape, a midcap player in the consumer durables sector, has recently undergone a technical trend adjustment. The company's current price stands at 137.35, reflecting a decline from the previous close of 144.65. Over the past year, Redtape has faced challenges, with a stock return of -7.87%, while the Sensex remained relatively stable with a return of -0.01%. In terms of technical indicators, the weekly MACD and Bollinger Bands signal bearish trends, while the monthly Bollinger Bands show a sideways movement. The daily moving averages also indicate a bearish stance. Notably, the On-Balance Volume (OBV) shows a bullish trend on a monthly basis, suggesting some underlying strength despite the overall bearish sentiment. The company's performance over various periods highlights significant volatility, particularly in the one-month timeframe, where Redtape's return of -16.5% starkly contrasts with the Sensex...

Read More

Redtape Faces Market Sentiment Shift Amid Broader Decline in Consumer Durables Sector

2025-03-10 15:45:31Redtape, a midcap consumer durables company, saw a notable decline on March 10, 2025, reversing three days of gains. The stock is trading near its 52-week low and has underperformed its sector. Meanwhile, the broader market also experienced a downturn, with the Sensex dropping significantly.

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

28-Mar-2025 | Source : BSEDisclosure of Resignation of Senior Management under regulation 30

Announcement under Regulation 30 (LODR)-Cessation

28-Mar-2025 | Source : BSEDisclosure of cessation under regulation 30

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation for closure of trading window for the 4th Quarter and Financial Year ending on March 31st 2025. Refer attach copy for reference.

Corporate Actions

No Upcoming Board Meetings

Redtape Ltd has declared 100% dividend, ex-date: 03 Jan 25

No Splits history available

Redtape Ltd has announced 3:1 bonus issue, ex-date: 04 Feb 25

No Rights history available