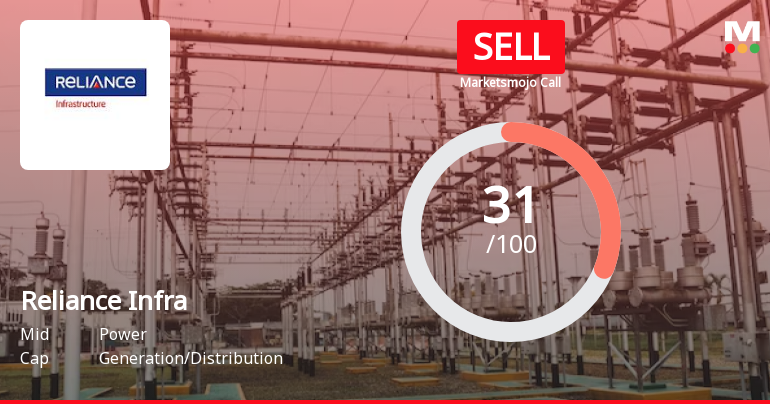

Reliance Infrastructure Faces Financial Challenges Amid Increased Institutional Investor Interest

2025-04-02 08:10:50Reliance Infrastructure has experienced a recent adjustment in its evaluation, indicating a shift in its technical trend. The company reported net sales of Rs 5,032.55 crore and a profit after tax of Rs -227.48 crore, alongside a low return on capital employed of 3.82%. Institutional investor participation has increased.

Read MoreReliance Infrastructure Faces Mixed Technical Trends Amid Market Volatility

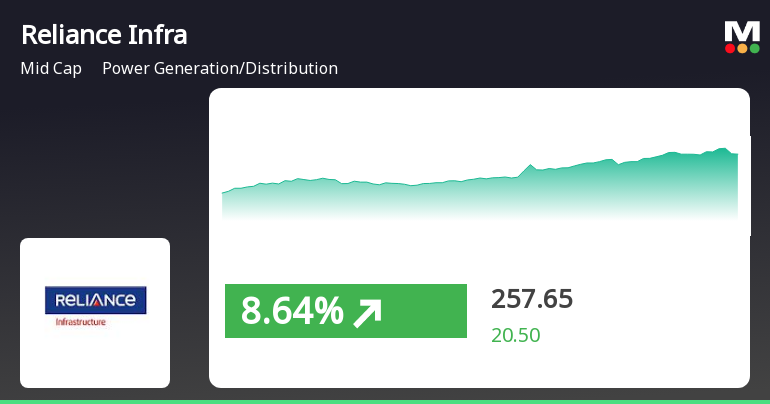

2025-03-27 08:01:03Reliance Infrastructure, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 253.75, showing a notable increase from the previous close of 237.15. Over the past week, the stock has experienced a high of 262.20 and a low of 237.75, indicating some volatility in its trading range. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages also reflect a mildly bearish sentiment on a daily basis. When comparing the stock's performance to the Sensex, Reliance Infrastructure has shown varied return...

Read More

Reliance Infrastructure Demonstrates Resilience Amid Mixed Market Trends and Sector Performance

2025-03-26 10:15:16Reliance Infrastructure has demonstrated notable performance, gaining 6.83% on March 26, 2025, and surpassing its sector. The stock reached an intraday high of Rs 246.65, while its moving averages indicate a mixed trend. Despite a slight decline in the broader market, mid-cap stocks are performing well.

Read More

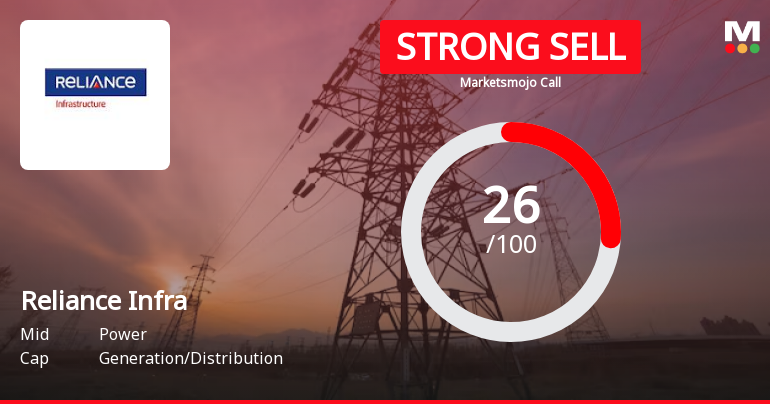

Reliance Infrastructure Faces Financial Challenges Amid Shift in Technical Trends

2025-03-25 08:08:26Reliance Infrastructure has recently experienced a change in its evaluation, reflecting a shift in its technical trend. The company has faced challenges with declining net sales and profit, low return on capital employed, and high leverage. However, increased institutional investor participation may help mitigate market volatility.

Read MoreReliance Infrastructure Faces Mixed Technical Trends Amidst Market Challenges

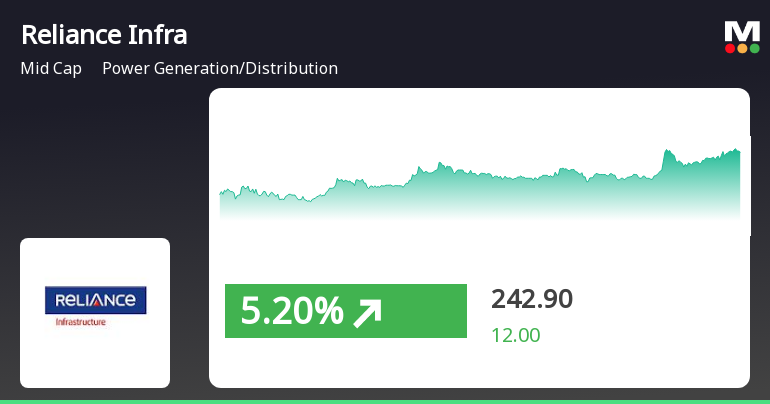

2025-03-25 08:01:47Reliance Infrastructure, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 243.45, showing a slight increase from the previous close of 239.50. Over the past year, the stock has experienced a decline of 12.16%, contrasting with a 7.07% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and KST are both indicating bearish trends, while the monthly metrics show a mildly bearish stance. The Bollinger Bands present a mixed picture, with weekly readings leaning mildly bearish and monthly readings suggesting bullish conditions. The daily moving averages also reflect a bearish sentiment, indicating a cautious outlook. Despite these technical challenges, Reliance Infrastructure has shown notab...

Read MoreReliance Infrastructure Navigates Market Fluctuations Amidst Mixed Performance Trends

2025-03-24 18:00:18Reliance Infrastructure, a mid-cap player in the power generation and distribution sector, has shown notable activity today, with its stock rising by 1.65%. This uptick comes against the backdrop of a challenging year, where the stock has declined by 12.16%, contrasting sharply with the Sensex's gain of 7.07% over the same period. In the short term, Reliance Infrastructure has outperformed the Sensex, with a weekly increase of 11.52% compared to the index's 5.14%. However, the stock's performance over the last three months remains concerning, down 19.52%, while the Sensex has only dipped by 0.62%. The company's market capitalization stands at Rs 9,689.00 crore, and it currently has a price-to-earnings (P/E) ratio of -20.29, which is below the industry average of 22.38. Over the longer term, Reliance Infrastructure has demonstrated significant growth, with a remarkable 2462.63% increase over the past fiv...

Read MoreReliance Infrastructure Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-20 08:01:11Reliance Infrastructure, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 242.25, showing a notable increase from the previous close of 230.90. Over the past year, the stock has experienced a high of 350.90 and a low of 143.70, indicating significant volatility. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages suggest a mildly bullish trend on a daily basis, while the KST and Dow Theory both reflect a mildly bearish stance. When comparing the stock's performance to the Sensex, Reliance Infrastructu...

Read More

Reliance Infrastructure Shows Resilience Amid Mixed Market Trends and Sector Gains

2025-03-19 14:45:19Reliance Infrastructure has demonstrated notable performance, gaining 5.37% on March 19, 2025, and achieving a total return of 10.9% over two days. While the stock is above its short-term moving averages, it remains below longer-term averages, reflecting mixed performance amid broader market trends.

Read MoreReliance Infrastructure Shows Mixed Technical Trends Amid Market Dynamics

2025-03-19 08:01:39Reliance Infrastructure, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 230.90, showing a notable increase from the previous close of 218.30. Over the past year, the stock has experienced fluctuations, with a 52-week high of 350.90 and a low of 143.70. In terms of technical indicators, the weekly MACD and KST suggest bearish trends, while the monthly Bollinger Bands indicate a bullish stance. The daily moving averages lean towards a mildly bullish outlook, highlighting mixed signals across different time frames. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. When comparing the stock's performance to the Sensex, Reliance Infrastructure has demonstrated varied returns. Over the past week, it outperformed the Sensex w...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Directorate

03-Apr-2025 | Source : BSEDisclosure under Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements ) Regulations 2015 - Appointment of Shri Rajesh Kumar Dhingra (DIN: 03612092) as an Additional Director in the capacity of Non-Executive Non Independent Director.

Authorization To Determine Materiality Of Information And Disclosures To The Stock Exchanges

03-Apr-2025 | Source : BSEAuthorization to Determine Materiality of Information and Disclosures to the Stock Exchanges

Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulation 2015

02-Apr-2025 | Source : BSEDisclosure under Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulation 2015 - Update

Corporate Actions

No Upcoming Board Meetings

Reliance Infrastructure Ltd has declared 95% dividend, ex-date: 12 Sep 18

No Splits history available

No Bonus history available

No Rights history available