Relicab Cable Manufacturing Ltd Sees Strong Buying Activity Amid Market Volatility

2025-04-03 10:45:10Relicab Cable Manufacturing Ltd is currently witnessing significant buying activity, with the stock gaining 4.98% today, in stark contrast to the Sensex, which has declined by 0.29%. Over the past week, Relicab has shown a robust performance, rising 12.98%, while the Sensex has dropped 1.56%. This marks three consecutive days of gains for the stock, indicating a potential shift in market sentiment. Despite a challenging month, where Relicab's performance fell by 32.78% compared to a 4.53% increase in the Sensex, the recent uptick may be attributed to various factors, including market positioning and investor confidence. The stock opened with a gap up of 4.98% and reached an intraday high of Rs 53.1, reflecting strong buyer interest. While the stock has underperformed over longer periods, including a 41.65% decline over the past year, its recent performance has outpaced the sector by 5.21%. The stock is c...

Read MoreRelicab Cable Manufacturing Ltd Sees Notable Buying Activity Amid Price Gains

2025-04-02 09:40:12Relicab Cable Manufacturing Ltd is currently witnessing significant buying activity, with the stock rising by 4.72% today, notably outperforming the Sensex, which gained only 0.47%. This marks the second consecutive day of gains for Relicab, accumulating a total return of 3.19% over this period. Despite this recent uptick, the stock has faced challenges over the longer term, with a decline of 36.38% over the past month and 44.39% year-to-date. In contrast, the Sensex has shown resilience, increasing by 4.35% over the month and 3.36% over the year. Today's trading session opened with a gap up, indicating strong initial buyer interest, and the intraday high reflects positive momentum. However, Relicab Cable continues to trade below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting that while there is current buying pressure, the stock's overall trend remains under scrutiny. Fact...

Read More

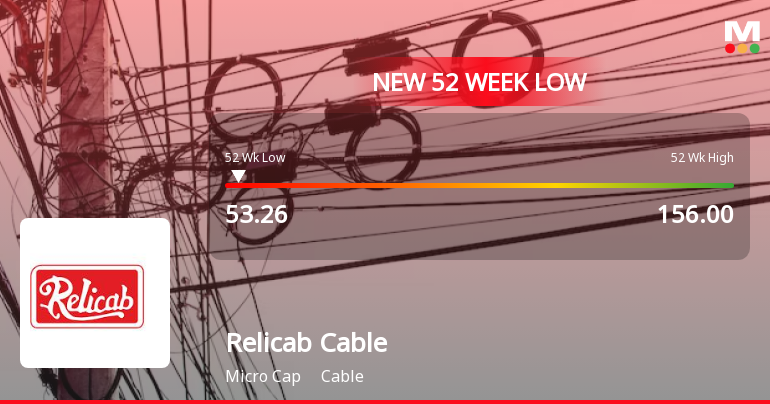

Relicab Cable Manufacturing Faces Severe Financial Challenges Amid Market Volatility

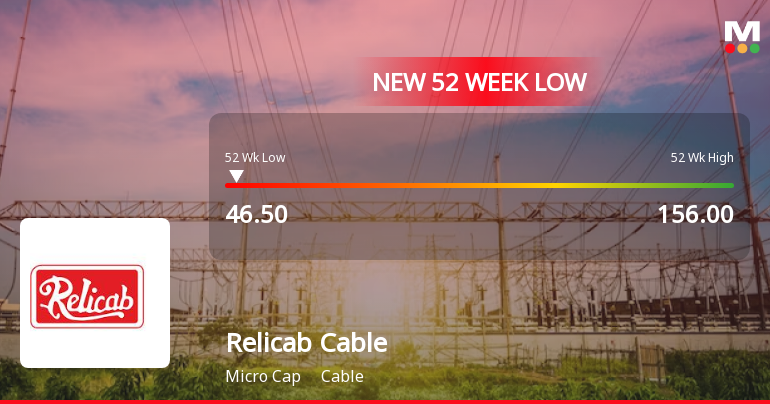

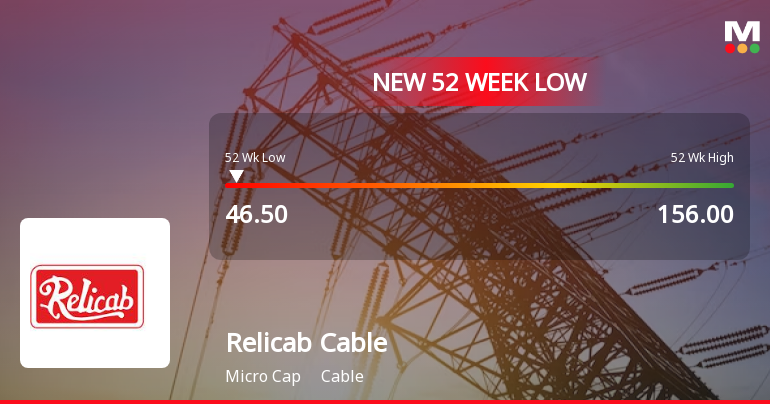

2025-03-28 14:07:23Relicab Cable Manufacturing has faced notable volatility, reaching a new 52-week low and showing a significant decline over the past four days. The company’s one-year performance is sharply negative, with concerning financial metrics, including a decline in net sales and a high percentage of pledged promoter shares, indicating ongoing challenges.

Read More

Relicab Cable Manufacturing Faces Financial Struggles Amid Significant Stock Volatility

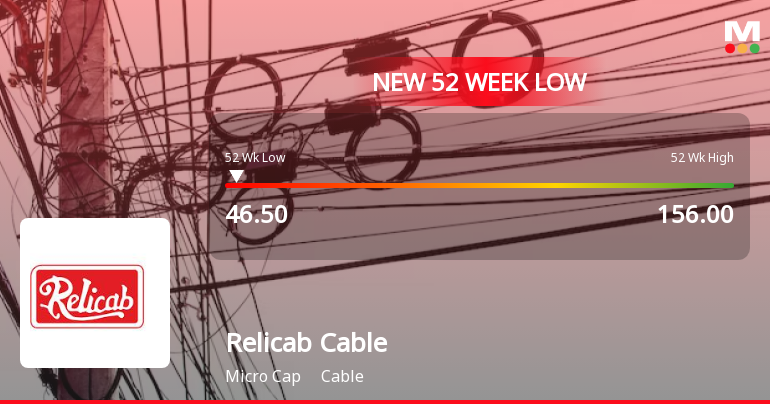

2025-03-27 10:05:32Relicab Cable Manufacturing has faced notable volatility, hitting a 52-week low and underperforming its sector. The stock has declined over three consecutive days and shows weak financial health, with a low EBIT to Interest ratio and significant promoter share pledges, indicating a challenging environment for the company.

Read More

Relicab Cable Manufacturing Faces Financial Struggles Amid Significant Stock Volatility

2025-03-27 10:05:28Relicab Cable Manufacturing has faced notable volatility, reaching a new 52-week low amid a three-day decline. The company's one-year performance shows a significant drop, contrasting with broader market gains. Financial metrics indicate challenges, including a weak EBIT to Interest ratio and declining net sales, alongside a high percentage of pledged promoter shares.

Read More

Relicab Cable Faces Severe Volatility Amid Weak Financial Performance and High Pledged Shares

2025-03-27 10:05:22Relicab Cable Manufacturing has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company reported a significant decline in net sales and has a low EBIT to Interest ratio, indicating financial challenges. Additionally, a high percentage of pledged promoter shares raises concerns about its stability.

Read MoreRelicab Cable Faces Intense Selling Pressure Amid Significant Price Declines

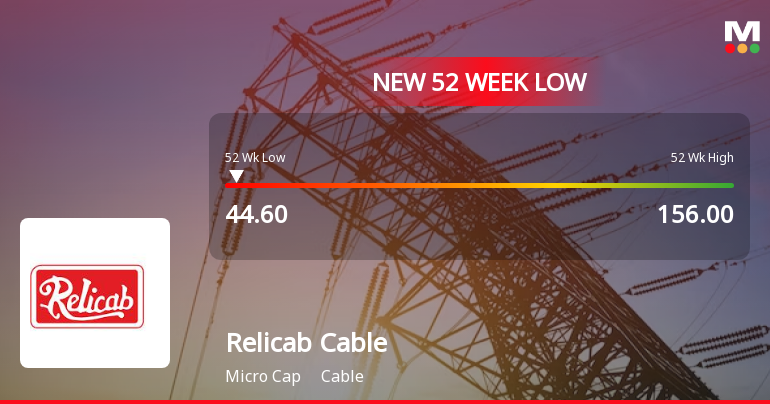

2025-03-19 15:15:11Relicab Cable Manufacturing Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The stock has experienced a dramatic decline of 19.54% in a single day, contrasting sharply with the Sensex, which has gained 0.21%. Over the past week, Relicab has lost 33.00%, while the Sensex has risen by 1.93%. The downward trend is evident over a longer period as well, with the stock down 40.86% in the last month and 52.31% over the past three months, compared to the Sensex's respective declines of only 0.63% and 4.74%. Today, Relicab Cable hit a new 52-week low of Rs. 47.31, reflecting a significant underperformance against its sector, which has gained 2.65%. The stock has been on a consecutive losing streak for the last 10 days, accumulating a total loss of 41.52% during this period. Intraday volatility has been high, with a range of 12.52%. Additionally, Relicab is trading be...

Read More

Relicab Cable Manufacturing Faces Significant Financial Challenges Amidst Market Volatility

2025-03-19 11:35:44Relicab Cable Manufacturing has faced notable volatility, reaching a new 52-week low and showing a significant decline over the past ten days. The company's financial performance is weak, with declining net sales and a high percentage of pledged promoter shares, contributing to a bearish market outlook.

Read MoreRelicab Cable Manufacturing Adjusts Valuation Amid Competitive Industry Landscape

2025-03-19 08:00:54Relicab Cable Manufacturing has recently undergone a valuation adjustment, reflecting its current standing in the cable industry. The company's price-to-earnings ratio stands at 25.92, while its price-to-book value is recorded at 4.99. Other key financial metrics include an EV to EBIT ratio of 12.75 and an EV to EBITDA ratio of 12.40, indicating its operational efficiency relative to its enterprise value. Despite facing challenges, Relicab's return on capital employed (ROCE) is at 9.16%, and its return on equity (ROE) is 19.25%, showcasing its ability to generate profits from its equity base. However, the company's stock performance has been under pressure, with a year-to-date return of -35.91%, contrasting with a slight decline in the Sensex of -3.63% over the same period. In comparison to its peers, Relicab's valuation metrics present a mixed picture. For instance, Delton Cables and Birla Cable exhibit ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulation 2018 is attached herewith.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Feb-2025 | Source : BSENewspaper cuttings of the Unaudited Financial Results of the company for the quarter and nine months ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Relicab Cable Manufacturing Ltd has announced 74:100 bonus issue, ex-date: 22 Jul 22

No Rights history available