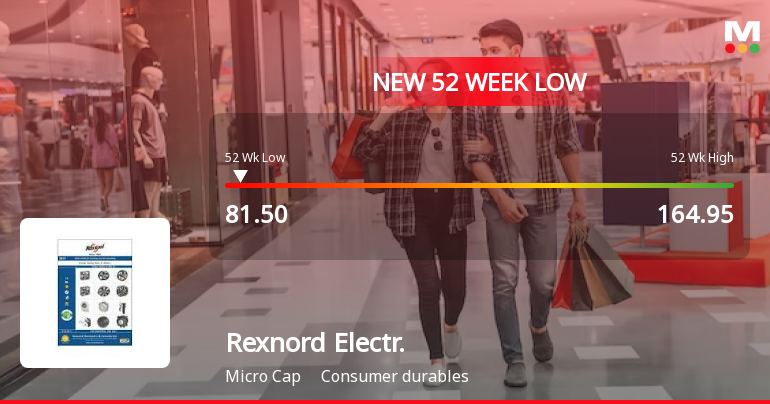

Rexnord Electronics Faces Significant Volatility Amid Declining Stock Performance and Financial Challenges

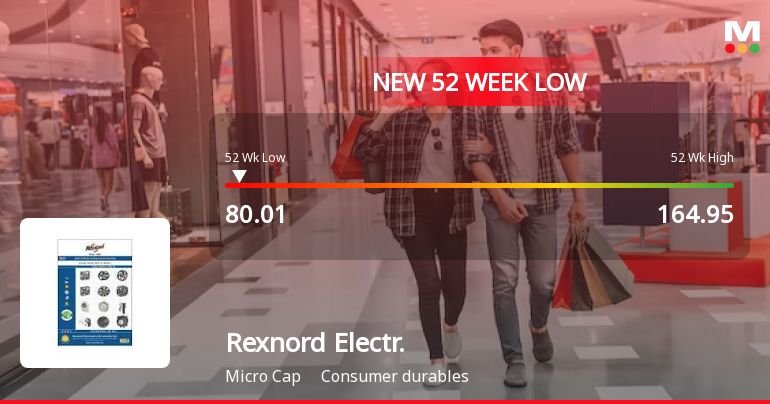

2025-03-28 15:39:13Rexnord Electronics & Controls has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past four days. The stock is trading below key moving averages, with a year-over-year drop contrasting with broader market performance. Financial metrics indicate slow growth and a decrease in profit after tax. Promoter confidence has increased, with a rise in their stake.

Read More

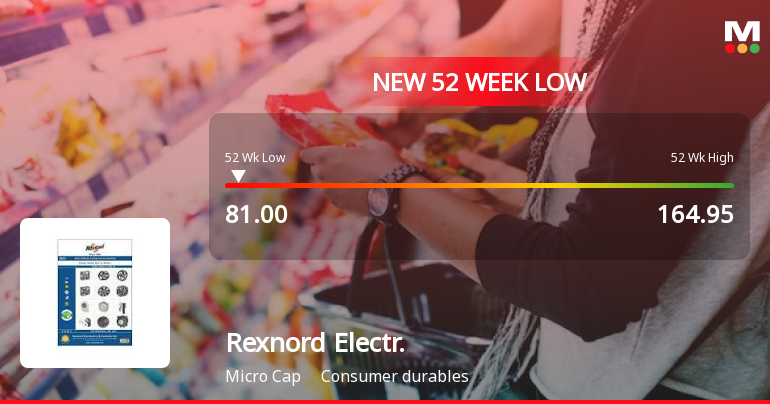

Rexnord Electronics & Controls Faces Mixed Financial Performance Amid Valuation Adjustments

2025-03-27 08:01:42Rexnord Electronics & Controls has recently experienced a score adjustment reflecting changes in its financial metrics and market position. Key indicators show a competitive PE ratio and ROCE, but the company faces challenges with declining net sales growth and profit, alongside a bearish trend in technical indicators.

Read More

Rexnord Electronics & Controls Adjusts Valuation Amid Mixed Financial Signals and Rising Stakeholder Confidence

2025-03-25 08:06:26Rexnord Electronics & Controls has recently experienced a score adjustment reflecting changes in its financial metrics and market position. The company, known for its low debt-to-equity ratio, has faced challenges with declining profits and negative returns, despite notable long-term gains and increasing stakeholder confidence.

Read MoreRexnord Electronics & Controls Experiences Valuation Adjustment Amid Mixed Sector Performance

2025-03-24 08:00:13Rexnord Electronics & Controls has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the consumer durables sector. The company currently exhibits a price-to-earnings (P/E) ratio of 22.71 and an enterprise value to EBITDA ratio of 9.97, indicating its market valuation relative to earnings and cash flow. Additionally, the price-to-book value stands at 1.77, while the return on capital employed (ROCE) is reported at 10.11%, and return on equity (ROE) is at 8.48%. In comparison to its peers, Rexnord's valuation metrics present a mixed picture. For instance, Khadim India and Liberty Shoes are noted for their significantly higher P/E ratios, suggesting a different market perception. Meanwhile, MIRC Electronics is categorized as loss-making, highlighting the varied financial health across the sector. Rexnord's stock performance has shown resilience over longer period...

Read More

Rexnord Electronics Hits 52-Week Low Amid Declining Profit and Bearish Trends

2025-03-04 14:05:48Rexnord Electronics & Controls has reached a new 52-week low, continuing a downward trend over the past two days. Despite a recent increase in promoter stake, the company reported a significant decline in profit after tax for the half-year ending December 2024, contrasting with its sales growth.

Read More

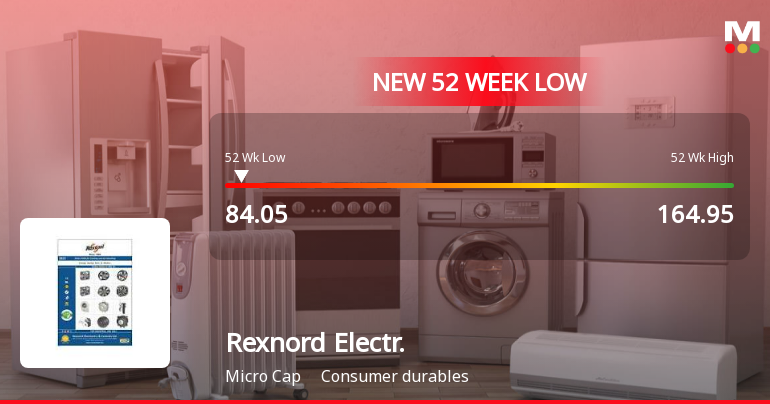

Rexnord Electronics Faces Volatility Amid Declining Stock Performance and Market Challenges

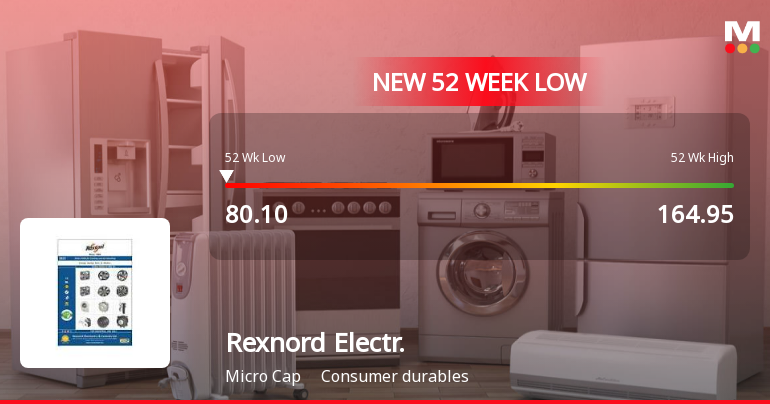

2025-03-03 14:20:37Rexnord Electronics & Controls experienced notable trading activity, reaching a new 52-week low. Despite an initial gain, the stock underperformed its sector and is trading below key moving averages. Over the past year, the company's performance has declined significantly, reflecting ongoing challenges in the consumer durables market.

Read More

Rexnord Electronics Faces Significant Volatility Amid Broader Consumer Durables Decline

2025-02-28 12:05:17Rexnord Electronics & Controls has faced notable volatility, reaching a new 52-week low amid a five-day losing streak, resulting in a 12.43% decline. Despite outperforming its sector, the stock is trading below key moving averages and has declined 31.56% over the past year, contrasting with the Sensex's gains.

Read More

Rexnord Electronics Faces Continued Volatility Amidst Persistent Market Challenges

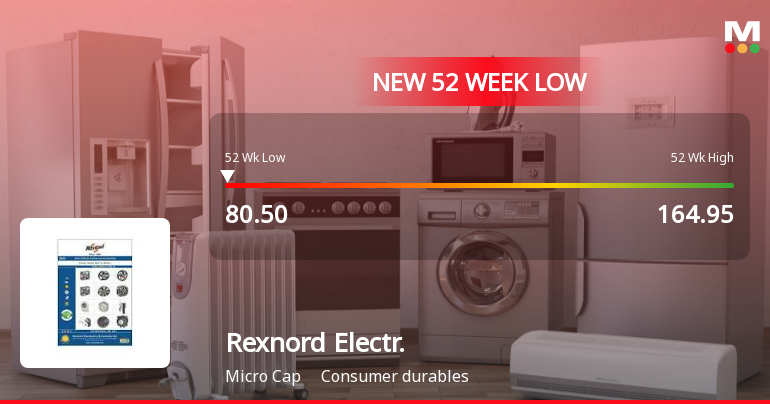

2025-02-27 10:05:29Rexnord Electronics & Controls, a microcap in the consumer durables sector, has hit a new 52-week low amid ongoing volatility, reflecting a 12.33% drop over four days. The stock has underperformed its sector significantly and is trading below all major moving averages, indicating a sustained bearish trend.

Read More

Rexnord Electronics Hits 52-Week Low Amid Sustained Market Underperformance

2025-02-25 15:35:17Rexnord Electronics & Controls has hit a new 52-week low, reflecting significant volatility and a cumulative loss over the past three days. The stock is trading below all major moving averages and has declined by over 31% in the past year, contrasting with the overall market's modest gains.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSERexnord Electronics and Controls Limited has informed about the closure of trading window.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSERexnord Electronics and Controls Limited has submitted the clippings of Newspaper Publications of the unaudited financial results for the quarter ended December 31 2024.

Board Meeting Outcome for Outcome Of The Board Meeting Held On February 14 2025.

14-Feb-2025 | Source : BSEPursuant to Regulation 30 & Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 the Board of Directors of the Company at their meeting held today i.e. (Friday February 14 2025) interalia considered and approved the Un-audited Financial Results (Standalone and Consolidated) for the quarter ended December 31 2024 as recommended by the Audit Committee along with Limited Review Report from the Statutory Auditors of the Company.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available