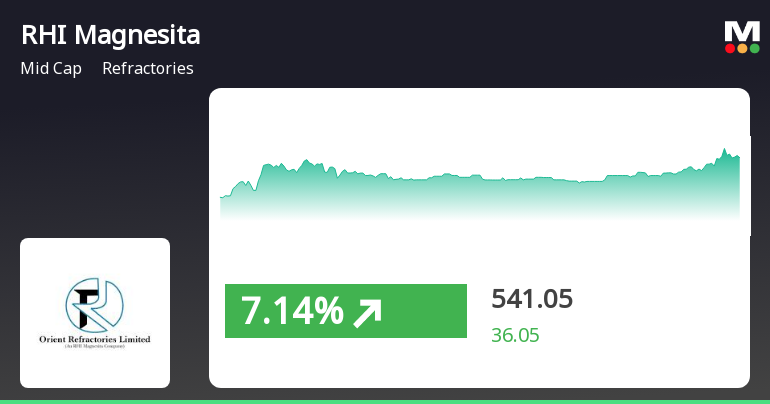

RHI Magnesita India Shows Resilience Amid Broader Market Decline and Volatility

2025-04-01 12:15:22RHI Magnesita India, a midcap refractories company, experienced notable gains today, contrasting with a broader market decline. The stock has shown strong weekly and monthly performance, although it remains down year-over-year. Its moving averages reflect a mixed trend, indicating volatility in its market position.

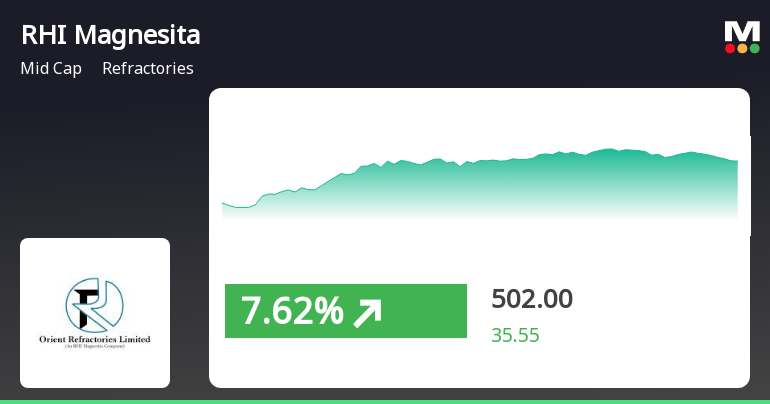

Read MoreRHI Magnesita India Sees Surge in Trading Activity and Market Presence

2025-03-28 10:00:05RHI Magnesita India Ltd, a prominent player in the refractories industry, has emerged as one of the most active equities today, with a total traded volume of 2,824,082 shares and a total traded value of approximately Rs 149.30 crores. The stock opened at Rs 508.30 and reached a day high of Rs 547.85, reflecting a notable intraday increase of 6.44%. Conversely, it also experienced a low of Rs 504.35, marking a decrease of 2.01% from its previous close of Rs 514.70. In terms of performance, RHI Magnesita India has outperformed its sector by 0.36% and has shown a consecutive gain over the last two days, with returns of 13.04% during this period. The stock's weighted average price indicates that more volume was traded closer to its low price, suggesting active trading behavior. Additionally, the stock's liquidity remains robust, with a delivery volume of 526,000 shares on March 27, reflecting a significant in...

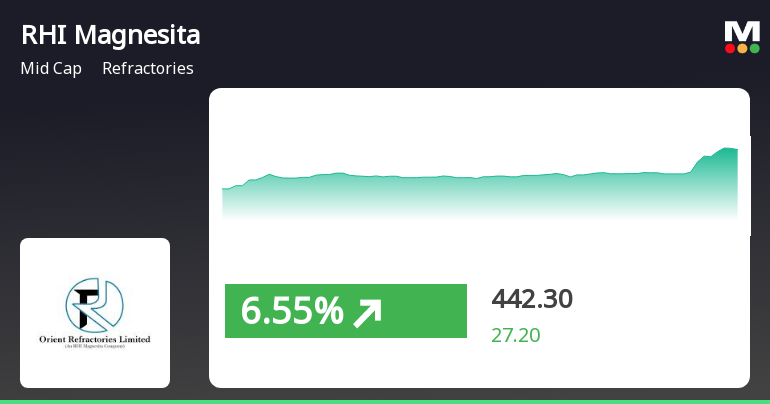

Read MoreRHI Magnesita India Ltd Sees Significant Trading Activity Amid Sector Volatility

2025-03-27 11:00:04RHI Magnesita India Ltd, a prominent player in the refractories industry, has emerged as one of the most active equities today, with a total traded volume of 6,325,140 shares and a total traded value of approximately Rs 31,795.85 lakhs. The stock opened at Rs 462.80 and reached a day high of Rs 514.00, reflecting a significant intraday gain of 10.5%. The stock's last traded price stands at Rs 503.45, marking an impressive 8.14% return for the day. After experiencing three consecutive days of decline, RHI Magnesita has shown a trend reversal, outperforming its sector by 4.61%. The stock has traded within a wide range of Rs 52 today, indicating notable volatility. Despite this activity, investor participation has seen a decline, with delivery volume dropping by 58.24% compared to the five-day average. In terms of moving averages, the stock is currently above the 5-day, 20-day, 50-day, and 100-day moving ave...

Read More

RHI Magnesita India Shows Strong Stock Performance Amid Broader Market Trends

2025-03-27 09:45:18RHI Magnesita India experienced notable stock activity, rising significantly and outperforming the refractories sector. The stock reached an intraday high and demonstrated high volatility. While it has shown positive short-term trends, its one-year performance remains down compared to the broader market's gains.

Read MoreRHI Magnesita India Shows Mixed Technical Signals Amid Strong Recent Performance

2025-03-21 08:01:07RHI Magnesita India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 460.90, showing a notable increase from the previous close of 415.10. Over the past week, RHI Magnesita has demonstrated a strong performance, with a return of 17.88%, significantly outpacing the Sensex's return of 3.41% during the same period. In terms of technical indicators, the weekly MACD and KST remain bearish, while the moving averages indicate a mildly bearish sentiment. The Bollinger Bands also reflect a mildly bearish trend on a weekly basis. However, the Dow Theory suggests a mildly bullish outlook in the weekly timeframe, indicating some mixed signals in the technical landscape. Looking at the company's performance over various timeframes, RHI Magnesita has faced challenges, with a year-to-date return of -8.48%...

Read MoreRHI Magnesita India Adjusts Valuation Amidst Competitive Refractory Market Challenges

2025-03-21 08:00:15RHI Magnesita India, a midcap player in the refractories industry, has recently undergone a valuation adjustment. The company's current price stands at 460.90, reflecting a notable increase from the previous close of 415.10. Over the past year, RHI Magnesita has experienced a decline of 15.70%, contrasting with a 5.89% gain in the Sensex, highlighting a challenging market environment for the company. Key financial metrics reveal a PE ratio of 40.64 and an EV to EBITDA ratio of 18.39, indicating a premium valuation relative to its peers. For instance, Vesuvius India, another player in the refractories sector, has a lower PE ratio of 34.74 and a significantly higher EV to EBITDA ratio of 25.15. This comparison underscores the competitive landscape in which RHI Magnesita operates. Despite a dividend yield of 0.54% and a return on capital employed (ROCE) of 7.93%, the company's performance indicators suggest ...

Read More

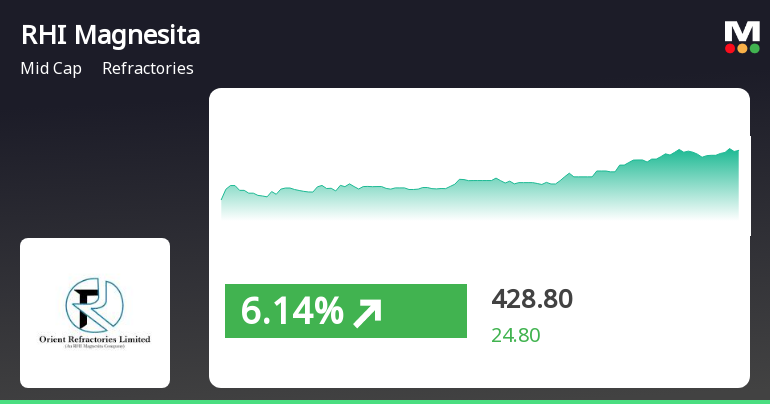

RHI Magnesita India's Recent Gains Suggest Potential Shift in Market Momentum

2025-03-20 10:30:20RHI Magnesita India has experienced notable trading activity, with a recent gain reflecting a positive short-term trend. The stock has outperformed the broader market and reached an intraday high, although it shows mixed signals in its longer-term moving averages. The Sensex also opened higher today.

Read More

RHI Magnesita India Experiences Notable Gains Amid Broader Market Fluctuations

2025-03-06 11:05:21RHI Magnesita India has experienced notable gains, marking its third consecutive day of increases and a total return of 10.31% during this period. Despite recent performance, the stock remains below several long-term moving averages and has faced declines over the past month and year-to-date. The broader market shows mixed trends.

Read More

RHI Magnesita India Faces Significant Stock Volatility Amid Broader Market Stability

2025-02-18 14:20:18RHI Magnesita India, a midcap refractories company, faced notable stock volatility today, hitting a new 52-week low after eight consecutive days of losses. The stock underperformed its sector and the broader market, with significant declines over the past month and trading below key moving averages, indicating market challenges.

Read MoreIntimation Of Receipt Of Cautionary Letters From NSE & BSE Under SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

29-Mar-2025 | Source : BSEThe Company was in receipt of Cautionary letters through e-mail from NSE and BSE pertaining to the announcement submitted by the Company on 19 June 2024 regarding the schedule of investor/Analysts meet/call to be held on 21 June 2024 (Intimation is enclosed)

Closure of Trading Window

26-Mar-2025 | Source : BSENotice of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

25-Mar-2025 | Source : BSEIntimation is enclosed

Corporate Actions

No Upcoming Board Meetings

RHI Magnesita India Ltd has declared 250% dividend, ex-date: 05 Sep 24

No Splits history available

No Bonus history available

No Rights history available