Riba Textiles Shows Resilience Amid Broader Market Challenges and Valuation Insights

2025-03-12 18:00:29Riba Textiles, a microcap player in the textile industry, has shown significant activity today, with its stock rising by 3.73%. This uptick comes against a backdrop of broader market performance, as the Sensex experienced a slight decline of 0.10%. Over the past year, Riba Textiles has outperformed the Sensex, achieving a return of 3.02% compared to the index's 0.49%. Despite today's gains, Riba Textiles has faced challenges in the short term, with a 1-week performance of -1.45% and a 1-month decline of -9.63%. Year-to-date, the stock is down 30.47%, while the Sensex has decreased by 5.26%. However, looking at longer-term performance, Riba Textiles has delivered a robust return of 76.41% over the past three years and an impressive 343.67% over the last decade. The company's market capitalization stands at Rs 72.00 crore, with a price-to-earnings ratio of 8.40, significantly lower than the industry average...

Read More

Riba Textiles Faces Growth Challenges Amid Stable Financial Performance and Debt Concerns

2025-03-05 08:07:01Riba Textiles has recently adjusted its evaluation, reflecting its current market position. The company reported stable financial performance for Q3 FY24-25, but faces challenges in long-term growth. Key metrics indicate limited fundamental strength and difficulties in debt servicing, despite an attractive valuation compared to peers.

Read More

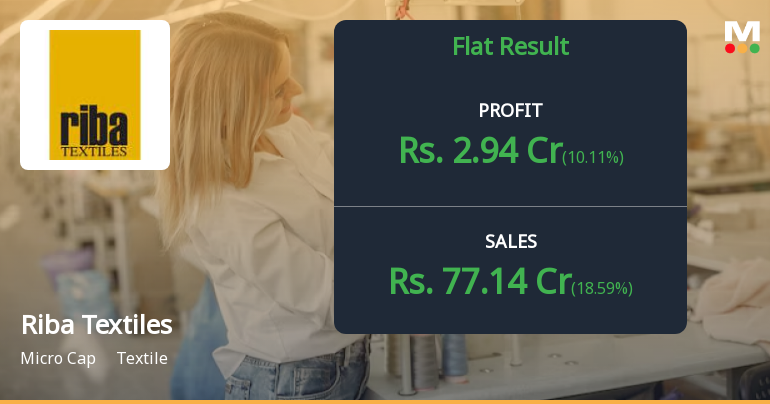

Riba Textiles Faces Challenges Amid Flat Performance and Debt Concerns

2025-03-03 18:45:03Riba Textiles has recently adjusted its evaluation, reflecting its current market position amid flat financial performance for Q3 FY24-25. The company has shown modest growth over five years, but concerns about debt servicing persist. The stock is trading at a discount compared to peers, indicating potential value.

Read More

Riba Textiles Reports Stable Performance Amid Rising Interest Expenses in December 2024 Results

2025-02-13 21:35:12Riba Textiles has reported stable financial results for the quarter ending December 2024, with net sales reaching Rs 75.69 crore, a 34.32% year-on-year increase. The company achieved its highest operating profit in five quarters at Rs 6.83 crore, though interest expenses have also risen significantly, indicating potential financial challenges ahead.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEPlease find attached herewith intimation regarding closure of Trading window.

Disclosure Under Regulation 30 Read With The Clause B Of Part A Of Schedule III Of The SEBI (LODR) Regulations 2015 For Capacity Addition/Expansion

28-Feb-2025 | Source : BSEDetails regarding capacity Addition/ Expansion are enclosed herewith .

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSENewspaper publication of Financial results for the Quarter and nine months ended on 31st December 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available