Rishabh Instruments Faces Technical Challenges Amidst Market Outperformance Dynamics

2025-04-02 08:10:24Rishabh Instruments, a microcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 239.00, showing a notable increase from the previous close of 212.50. Over the past week, Rishabh Instruments has experienced a stock return of 2.38%, contrasting with a decline of 2.55% in the Sensex, indicating a relative outperformance in the short term. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages on a daily basis also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, with no significant signals from the RSI or KST metrics. The Dow Theory and On-Balance Volume show no discernible trends in both weekly and monthly evaluations. Looking at the company's performance over various time frames, Rishabh Instruments has faced chal...

Read More

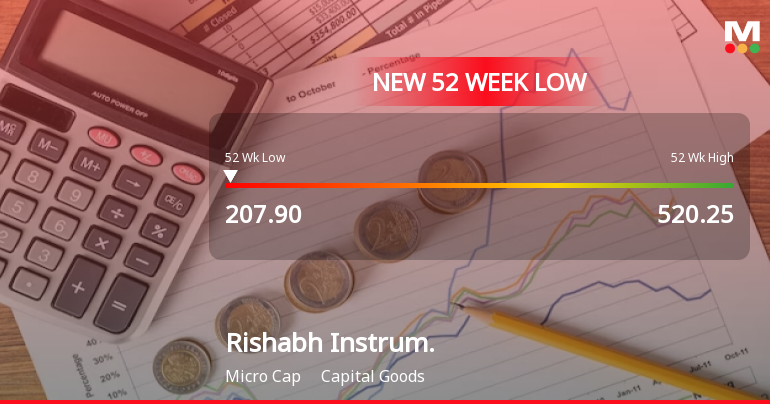

Rishabh Instruments Faces Significant Stock Volatility Amidst Ongoing Market Challenges

2025-03-03 09:37:59Rishabh Instruments, a microcap in the capital goods sector, has hit a new 52-week low of Rs. 200.55 amid significant volatility. The stock has declined 8.25% over the past five days and is trading below all major moving averages, highlighting its struggles compared to the broader market.

Read More

Rishabh Instruments Hits 52-Week Low Amid Sustained Downward Trend in Capital Goods Sector

2025-02-28 09:39:33Rishabh Instruments, a microcap in the capital goods sector, has hit a new 52-week low, reflecting significant volatility. The stock has declined consecutively over four days, with a year-to-date drop of 57.87%, contrasting with the Sensex's modest gains, indicating ongoing challenges for the company.

Read More

Rishabh Instruments Faces Sustained Downward Trend Amid Capital Goods Sector Challenges

2025-02-27 11:05:32Rishabh Instruments, a microcap in the capital goods sector, has faced significant volatility, hitting a new 52-week low. The stock has declined over the past three days and is trading below key moving averages, reflecting ongoing challenges in its market performance amid a tough industry landscape.

Read More

Rishabh Instruments Shows Signs of Recovery Amidst Ongoing Market Challenges

2025-02-19 11:05:41Rishabh Instruments, a microcap in the capital goods sector, has shown signs of recovery after a prolonged decline, gaining 2.54% at the open. Despite today's uptick, the stock remains below key moving averages and has declined 56.34% over the past year, contrasting with the Sensex's gains.

Read More

Rishabh Instruments Faces Continued Stock Volatility Amid Sustained Downward Trend

2025-02-18 11:57:24Rishabh Instruments, a microcap in the capital goods sector, has faced notable stock volatility, hitting a 52-week low and experiencing a 24.38% decline over the past week. The stock has struggled significantly over the past year, trading below key moving averages and underperforming its sector.

Read More

Rishabh Instruments Faces Persistent Selling Pressure Amid Significant Market Challenges

2025-02-17 09:41:45Rishabh Instruments, a microcap in the capital goods sector, has hit a new 52-week low amid significant volatility, experiencing a 20.26% decline over the past six days. The stock is trading below all major moving averages and has dropped 53.64% over the past year, contrasting with the Sensex's gains.

Read More

Rishabh Instruments Faces Significant Stock Volatility Amidst Broader Market Gains

2025-02-12 09:38:28Rishabh Instruments, a small-cap company in the capital goods sector, has faced notable stock volatility, nearing its 52-week low. Over the past year, the stock has declined significantly, underperforming against the Sensex, and is currently trading below its moving averages across multiple time frames.

Read More

Rishabh Instruments Hits 52-Week Low Amid Broader Capital Goods Sector Decline

2025-02-11 13:35:59Rishabh Instruments, a small-cap company in the capital goods sector, has hit a new 52-week low amid significant volatility, reflecting a 54.29% decline over the past year. The stock is currently trading below multiple moving averages, indicating a bearish trend, while the broader sector has also faced challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under regulation 74(5) of SEBI (DP) Regulation 2018

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

29-Mar-2025 | Source : BSEAs per the attachment.

Closure of Trading Window

27-Mar-2025 | Source : BSEAs per the attachment.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available