Rishiroop Ltd Experiences Strong Buying Momentum Amid Broader Market Decline

2025-04-03 15:10:10Rishiroop Ltd, a microcap player in the rubber products industry, is witnessing significant buying activity, marking a notable performance against the broader market. Today, the stock surged by 4.83%, while the Sensex declined by 0.40%. Over the past week, Rishiroop has recorded a total gain of 4.93%, contrasting with a 1.67% drop in the Sensex. The stock has shown consecutive gains over the last three days, accumulating a total return of 9.46%. It opened with a gap up of 2.02% today and reached an intraday high of Rs 111.7, reflecting the strong buying momentum. Despite this recent uptick, Rishiroop's performance over longer periods remains mixed, with a year-to-date decline of 50.39% compared to the Sensex's 2.34% drop. Factors contributing to the current buying pressure may include recent market sentiment shifts, potential operational developments, or sector-specific trends. Notably, Rishiroop's perfor...

Read More

Rishiroop Faces Significant Volatility Amidst Ongoing Bearish Market Sentiment

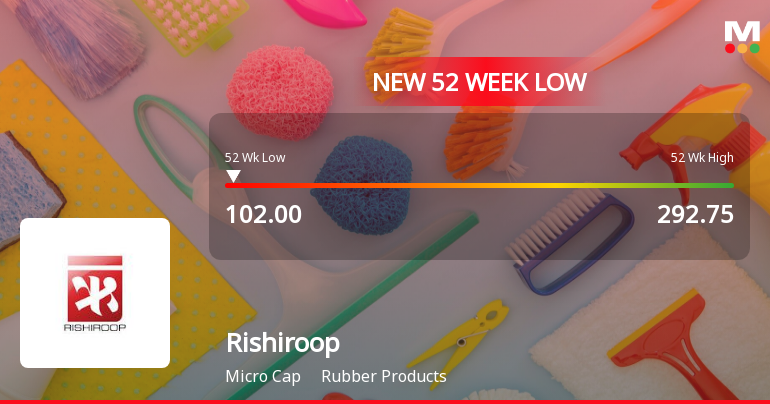

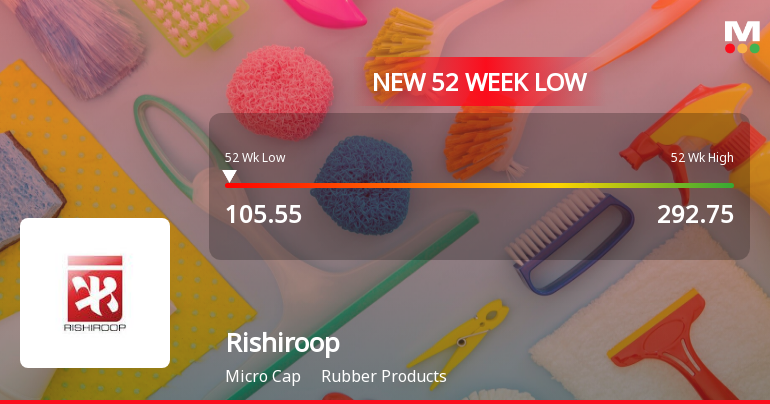

2025-03-28 11:06:29Rishiroop, a microcap rubber products company, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and experienced a decline over the past week. Its one-year return is significantly negative, with disappointing quarterly results and technical indicators suggesting a bearish trend.

Read More

Rishiroop Faces Continued Decline Amid Weak Financial Performance and Market Volatility

2025-03-27 12:38:06Rishiroop, a microcap in the rubber products sector, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and recorded a significant decline over the past year. Financial metrics indicate concerning performance, with negative profit and stagnant sales growth, raising uncertainty about future prospects.

Read More

Rishiroop Faces Continued Decline Amidst Weak Financial Performance and Market Volatility

2025-03-26 13:37:46Rishiroop, a microcap rubber products company, has faced notable volatility, reaching a new 52-week low and declining for five consecutive days. Its one-year performance shows a significant drop, contrasting with the Sensex's gains. Recent quarterly results revealed disappointing earnings and minimal sales growth, indicating ongoing challenges for the company.

Read More

Rishiroop Faces Significant Challenges Amid Broader Market Resilience and Declining Performance

2025-03-17 11:07:49Rishiroop, a microcap in the rubber products sector, has hit a new 52-week low amid significant volatility, underperforming its sector. The company reported a decline in net sales and a negative profit after tax, raising concerns about its long-term growth potential despite a low debt-to-equity ratio.

Read More

Rishiroop Faces Market Challenges Amid Significant Stock Volatility and Underperformance

2025-03-03 10:07:40Rishiroop, a microcap in the rubber products sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its industry. The stock has declined over the past two days and is trading below its moving averages, indicating a challenging market environment.

Read More

Rishiroop Hits 52-Week Low Amidst Broader Market Gains and Sector Resilience

2025-02-28 09:38:26Rishiroop, a microcap in the rubber products sector, has hit a new 52-week low, reflecting a year-to-date decline of 31.20%. Despite this, the stock outperformed its sector today. However, it continues to trade below its moving averages, indicating ongoing challenges in achieving upward momentum.

Read More

Rishiroop Faces Significant Stock Volatility Amidst Ongoing Market Challenges

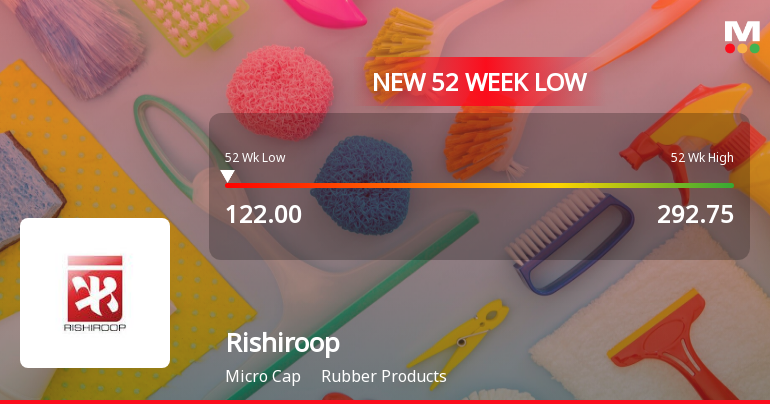

2025-02-25 15:35:27Rishiroop, a microcap in the rubber products sector, has faced significant volatility, hitting a new 52-week low of Rs. 122. The stock has declined 39.38% over the past year, underperforming against the Sensex, and is trading below its moving averages across multiple time frames.

Read MoreRishiroop Ltd Faces Stock Volatility Amidst Broader Market Stability Concerns

2025-02-24 10:44:33Rishiroop Ltd, a microcap player in the rubber products industry, has experienced significant volatility in its stock performance. Currently, the company holds a market capitalization of Rs 116.00 crore and a price-to-earnings (P/E) ratio of 6.42, notably lower than the industry average of 30.92. Over the past year, Rishiroop's stock has declined by 37.19%, contrasting sharply with the Sensex, which has gained 1.92% during the same period. The stock's performance has been consistently negative, with a 1.25% drop observed today, alongside a 1.63% decrease over the past week. In the month leading up to today, Rishiroop's shares have fallen by 36.88%, while the Sensex has only dipped by 2.16%. Longer-term trends show a mixed picture; while Rishiroop has seen a 296.86% increase over the past five years, its year-to-date performance stands at a decline of 43.86%. Technical indicators suggest a bearish sentimen...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Rishiroop Ltd |

| 2 | CIN NO. | L25200MH1984PLC034093 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | 0 |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: afernandes@rishiroop.com

Designation: Chief Financial Officer

EmailId: msavla@rishiroop.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

31-Mar-2025 | Source : BSEPostal Ballot - Scrutinizers Report

Corporate Actions

No Upcoming Board Meetings

Rishiroop Ltd has declared 18% dividend, ex-date: 05 Aug 24

No Splits history available

No Bonus history available

No Rights history available