Rolex Rings Adjusts Valuation Amid Competitive Industry Landscape and Stock Performance Challenges

2025-04-03 08:00:52Rolex Rings, a small-cap player in the castings and forgings industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company’s price-to-earnings ratio stands at 19.70, while its price-to-book value is recorded at 3.58. Other key metrics include an EV to EBIT of 15.26 and an EV to EBITDA of 12.85, indicating its operational efficiency. The return on capital employed (ROCE) is notably high at 28.94%, alongside a return on equity (ROE) of 18.16%. In comparison to its peers, Rolex Rings presents a relatively favorable valuation, particularly when juxtaposed with Sundaram Clayton and Steelcast, which are positioned at significantly higher valuation metrics. MM Forgings, on the other hand, shows a more attractive valuation profile, with a lower PE ratio and EV to EBITDA. Despite the recent valuation adjustment, Rolex Rings has faced challenges in stock performanc...

Read MoreRolex Rings Adjusts Valuation Amidst Competitive Industry Landscape and Declining Stock Performance

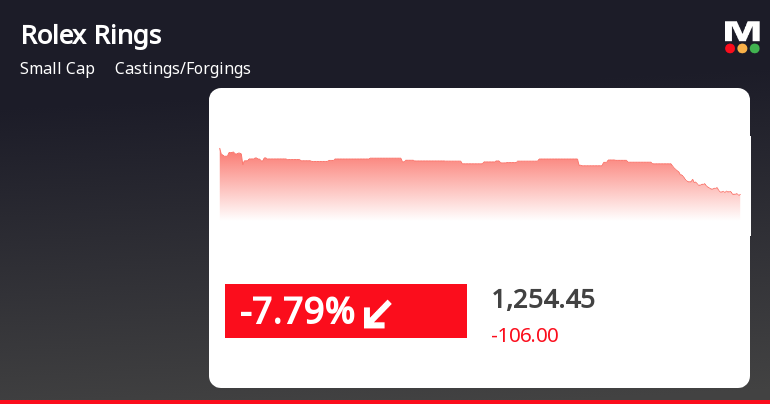

2025-03-28 08:00:52Rolex Rings, a small-cap player in the castings and forgings industry, has recently undergone a valuation adjustment. The company's current price stands at 1,299.00, reflecting a decline from its previous close of 1,360.45. Over the past year, Rolex Rings has experienced a stock return of -26.52%, contrasting sharply with a 6.32% return from the Sensex. Key financial metrics for Rolex Rings include a price-to-earnings (PE) ratio of 19.53 and an EV to EBITDA ratio of 12.73. The company's return on capital employed (ROCE) is notably high at 28.94%, while its return on equity (ROE) is recorded at 18.16%. These figures suggest a solid operational performance relative to its market position. In comparison to its peers, Rolex Rings presents a more favorable valuation profile. For instance, Sundaram Clayton and Steelcast are positioned at significantly higher valuation levels, with PE ratios of 74.83 and 30.92, ...

Read More

Rolex Rings Faces Continued Decline Amid Broader Market Recovery Trends

2025-03-27 14:50:30Rolex Rings, a small-cap company in the castings and forgings sector, has faced notable volatility, with its stock hitting a new 52-week low. The company has underperformed its sector and is currently trading below key moving averages, reflecting a challenging trend over various time frames.

Read More

Rolex Rings Faces Significant Volatility Amid Broader Market Resilience

2025-03-27 14:37:21Rolex Rings, a small-cap company in the castings and forgings sector, has hit a new 52-week low amid significant volatility. The stock has underperformed its sector and experienced a notable decline in profit and sales over the past five years, raising concerns about its valuation and market position.

Read More

Rolex Rings Hits 52-Week Low Amid Broader Small-Cap Market Gains

2025-03-18 10:00:48Rolex Rings, a small-cap company in the castings and forgings sector, has reached a new 52-week low amid underperformance relative to its industry. Despite a recent uptick, the stock remains below key moving averages. Over the past year, it has declined significantly, contrasting with broader market trends.

Read More

Rolex Rings Hits 52-Week Low Amid Broader Market Trends and Declining Sales

2025-03-18 10:00:46Rolex Rings, a small-cap company in the castings and forgings sector, has reached a new 52-week low amid broader market trends. The stock has underperformed significantly over the past year, with a notable decline in profit and net sales. However, it maintains strong management efficiency and institutional investor confidence.

Read MoreRolex Rings Experiences Valuation Grade Change Amidst Competitive Industry Landscape

2025-03-18 08:01:08Rolex Rings, a small-cap player in the castings and forgings industry, has recently undergone a valuation adjustment, reflecting a shift in its financial assessment. The company's current price stands at 1,304.00, down from a previous close of 1,339.05. Over the past year, Rolex Rings has experienced a stock return of -30.63%, contrasting with a modest 2.10% gain in the Sensex. Key financial metrics for Rolex Rings include a PE ratio of 19.60 and an EV to EBITDA ratio of 12.78, indicating its market positioning within the industry. The company's return on capital employed (ROCE) is reported at 28.94%, while its return on equity (ROE) stands at 18.16%. These figures suggest a solid operational performance relative to its peers. In comparison, other companies in the sector, such as Sundaram Clayton and Steelcast, are positioned at significantly higher valuation levels, with PE ratios of 71.1 and 32.39, resp...

Read More

Rolex Rings Hits 52-Week Low Amid Broader Market Gains and Profit Decline

2025-03-17 09:57:09Rolex Rings, a small-cap company in the castings and forgings sector, has hit a new 52-week low amid a rising broader market. The firm has seen a significant decline in profitability and faces challenges with low long-term growth metrics, despite some positive management efficiency indicators.

Read More

Rolex Rings Hits 52-Week Low Amid Broader Market Gains and Declining Performance Metrics

2025-03-17 09:57:08Rolex Rings, a small-cap company in the castings and forgings sector, has reached a new 52-week low amid mixed market sentiment. The firm has struggled with declining sales growth and profits, while trading below key moving averages. Its low debt and high institutional holdings contrast with its underperformance relative to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (DP) Regulations 2018

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation for Closure of Trading Window for 31st March 2025

Update For In Person Meeting With Various AMCs

21-Mar-2025 | Source : BSEUpdate of the In-Person Meeting by the Company

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available