Roopa Industries Faces Volatility Amidst Positive Sales Growth and Weak Fundamentals

2025-04-01 12:35:33Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, hit a new 52-week low amid significant volatility. Despite reporting positive sales growth and profit for three consecutive quarters, the company's long-term fundamentals appear weak, with a low return on capital and high debt levels.

Read More

Roopa Industries Faces Volatility Amid Strong Sales Growth and Valuation Opportunities

2025-03-28 10:38:16Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, has faced significant volatility, reaching a 52-week low. The company has underperformed the broader market over the past year, but reported strong quarterly results with a notable increase in net sales and profits, indicating potential despite ongoing challenges.

Read More

Roopa Industries Reports Sales Growth Amid Financial Health Concerns and Market Sentiment Shift

2025-03-12 08:03:58Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, recently adjusted its evaluation amid mixed performance indicators. In Q3 FY24-25, the company reported a significant rise in net sales and achieved its highest profit after tax. However, challenges include a low return on capital employed and a high debt to EBITDA ratio.

Read More

Roopa Industries Reports Strong Sales Growth Amid Long-Term Financial Concerns

2025-03-07 08:04:05Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, recently adjusted its evaluation following strong third-quarter FY24-25 results, including a 21.2% rise in net sales and record profit after tax. However, challenges remain regarding long-term financial strength and debt servicing capabilities.

Read More

Roopa Industries Reports Strong Sales Growth Amid Long-Term Financial Concerns

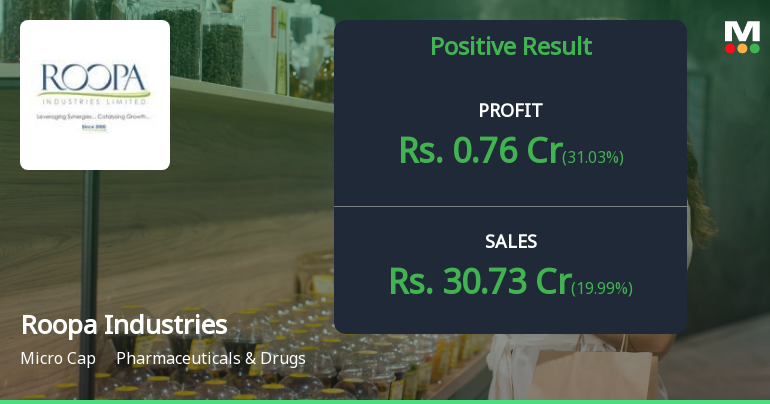

2025-02-28 18:27:28Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, recently reported strong third-quarter FY24-25 results, with net sales of Rs 30.73 crore and a profit after tax of Rs 0.76 crore. However, challenges remain, including low capital efficiency and high debt levels, indicating mixed long-term fundamentals.

Read MoreRoopa Industries Faces Stock Volatility Amid Strong Long-Term Growth Trends

2025-02-24 10:44:26Roopa Industries, a microcap player in the Pharmaceuticals & Drugs sector, has experienced notable fluctuations in its stock performance today. The company's market capitalization stands at Rs 51.91 crore, with a price-to-earnings (P/E) ratio of 26.21, which is below the industry average of 35.70. Over the past year, Roopa Industries has shown a performance increase of 8.66%, significantly outperforming the Sensex, which rose by only 1.92%. However, the stock has faced challenges recently, with a decline of 4.33% today, compared to a 1.02% drop in the Sensex. In the short term, the stock's performance over the past month has decreased by 8.27%, while the Sensex fell by 2.16%. Long-term performance metrics reveal a robust growth trajectory for Roopa Industries, with a remarkable 224.32% increase over three years and an impressive 695.18% rise over five years. Despite recent volatility, the company has main...

Read More

Roopa Industries Reports Strong Sales Growth Amid Long-Term Financial Challenges

2025-02-18 18:01:13Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, has recently adjusted its evaluation following a strong third-quarter performance, with net sales reaching Rs 30.73 crore. However, challenges persist, including a low Return on Capital Employed and difficulties in debt servicing, indicating a complex financial landscape.

Read More

Roopa Industries Reports Strong Sales Growth and Highest Profit in Five Quarters

2025-02-17 13:47:52Roopa Industries has announced its financial results for the quarter ending December 2024, revealing net sales of Rs 30.73 crore, a 21.2% increase from the previous year. The company also reported a profit after tax of Rs 0.76 crore and earnings per share of Rs 0.97, both at five-quarter highs.

Read More

Roopa Industries Reports Growth Amid Financial Challenges in Recent Evaluation Adjustment

2025-02-03 18:31:16Roopa Industries, a microcap in the Pharmaceuticals & Drugs sector, has recently adjusted its evaluation amid positive financial results for the quarter ending September 2024. The company reported significant net sales growth and a profit after tax, although it faces challenges related to long-term financial metrics and high debt levels.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

03-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Roopa Industries Ltd |

| 2 | CIN NO. | L10100AP1985PLC005582 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 31.61 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: cs@roopaindustries.com

Designation: Chief Financial Officer

EmailId: cfo@roopaindustries.com

Date: 03/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSEPublication of Unaudited Financial Results for the Third Quarter and Nine months ended 31st December 2024 as per SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available