Rossari Biotech Faces Mixed Technical Trends Amid Ongoing Market Challenges

2025-03-07 08:03:58Rossari Biotech, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 670.00, showing a slight increase from the previous close of 650.35. Over the past year, Rossari Biotech has faced challenges, with a return of -7.57%, contrasting with a modest gain of 0.34% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a definitive signal on a monthly scale. Bollinger Bands and moving averages also reflect bearish tendencies, particularly on daily metrics. In terms of returns, Rossari Biotech has experienced a notable decline of -14.94% year-to-date, while the Sen...

Read MoreRossari Biotech Faces Mixed Technical Trends Amidst Market Challenges

2025-03-05 08:03:28Rossari Biotech, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 619.85, showing a slight increase from the previous close of 598.00. Over the past year, Rossari Biotech has faced challenges, with a return of -14.62%, significantly underperforming compared to the Sensex, which recorded a mere -1.19% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly but lacks a definitive signal monthly. Bollinger Bands and Dow Theory both reflect a mildly bearish stance on a weekly and monthly basis. Meanwhile, the KST shows a bullish monthly trend, contrasting with its bearish weekly outlook....

Read More

Rossari Biotech Faces Significant Stock Volatility Amidst Market Challenges

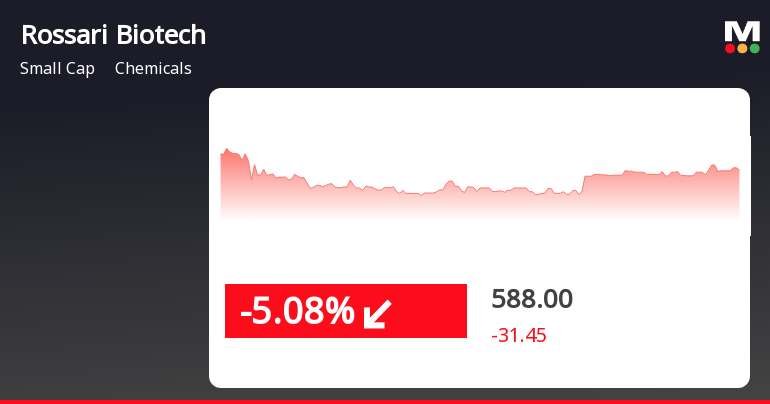

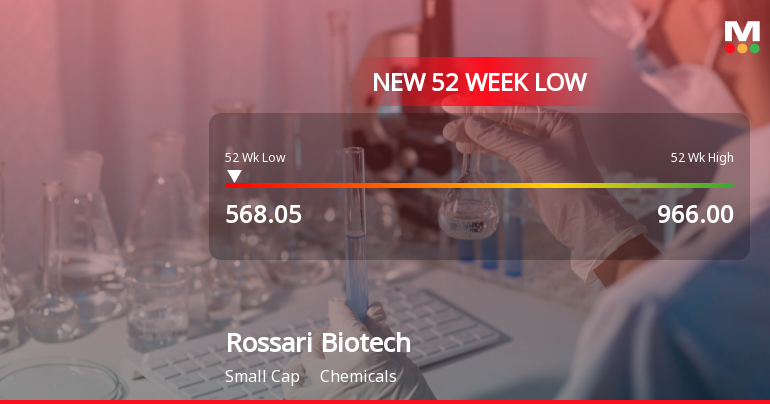

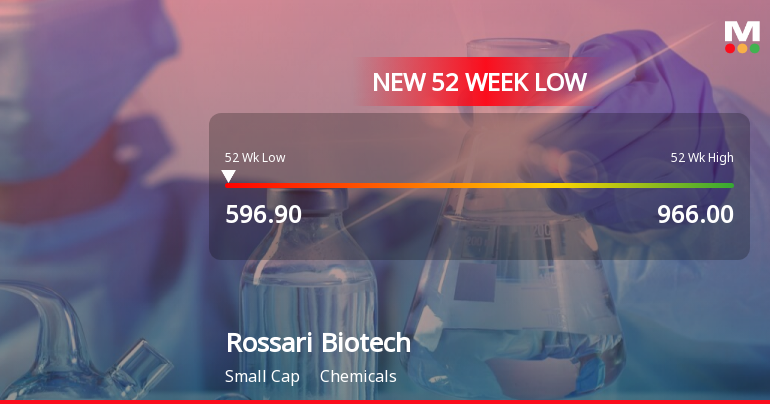

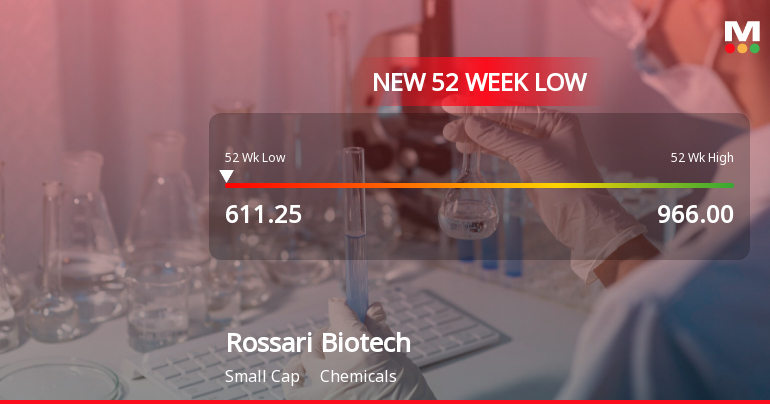

2025-03-03 10:15:59Rossari Biotech's stock has faced notable volatility, declining significantly and reaching a new 52-week low. The company is trading below all major moving averages, reflecting a sustained downward trend. Over the past month, its performance has sharply lagged behind the broader market, indicating ongoing challenges in the current environment.

Read More

Rossari Biotech Faces Significant Volatility Amid Broader Chemicals Sector Challenges

2025-03-03 09:37:50Rossari Biotech has faced notable volatility, hitting a new 52-week low of Rs. 580 and underperforming its sector. The stock is trading below all key moving averages and has declined 21.28% over the past year, contrasting with the Sensex's minimal decrease, indicating ongoing challenges in the chemicals market.

Read MoreRossari Biotech Faces Technical Challenges Amidst Market Evaluation Revision

2025-03-03 08:01:10Rossari Biotech, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 619.45, showing a slight increase from the previous close of 617.50. Over the past year, Rossari Biotech has faced challenges, with a return of -17.1%, contrasting sharply with a modest gain of 1.24% in the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly but lacks a clear direction monthly. Bollinger Bands and moving averages also reflect bearish tendencies, suggesting a cautious outlook. In terms of performance, Rossari Biotech has experienced significant declines over multiple time frames, including a yea...

Read MoreRossari Biotech Faces Technical Challenges Amidst Broader Market Trends

2025-03-02 08:01:09Rossari Biotech, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 619.45, slightly above its previous close of 617.50. Over the past year, Rossari Biotech has faced challenges, with a return of -17.1%, contrasting sharply with a modest gain of 1.24% in the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly but lacks a definitive signal on a monthly basis. Bollinger Bands and moving averages also reflect bearish tendencies, suggesting a cautious market environment. In terms of performance, Rossari Biotech has seen a significant decline over multiple time frames, with a year-to-da...

Read MoreRossari Biotech Faces Mixed Technical Signals Amid Market Volatility

2025-03-01 08:01:08Rossari Biotech, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 619.45, showing a slight increase from the previous close of 617.50. Over the past year, the stock has experienced significant volatility, with a 52-week high of 966.00 and a low of 582.40. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish signals on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands and moving averages are both indicating bearish trends, suggesting a cautious outlook. The KST shows a bearish trend weekly, contrasting with a bullish monthly signal, while the On-Balance Volume (OBV) reflects no trend weekly and a mildly bullish stance m...

Read More

Rossari Biotech Hits 52-Week Low Amid Ongoing Sector Challenges and Declining Performance

2025-02-28 09:39:21Rossari Biotech has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is trading below key moving averages, indicating a persistent downward trend. Over the past year, it has seen a notable decline compared to broader market gains.

Read More

Rossari Biotech Faces Sustained Downward Trend Amid Market Challenges

2025-02-18 11:57:12Rossari Biotech has faced significant volatility, hitting a new 52-week low of Rs. 612.05 and experiencing a 16.43% decline over the past nine trading days. The company's performance has lagged behind its sector, with a 17.02% drop over the past year, amidst ongoing market challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSERossari Biotech Limited has informed the Exchange regarding the Trading Window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations 2015.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

20-Feb-2025 | Source : BSEIntimation under Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) 2015.

Corporate Actions

No Upcoming Board Meetings

Rossari Biotech Ltd has declared 25% dividend, ex-date: 16 Aug 24

No Splits history available

No Bonus history available

No Rights history available