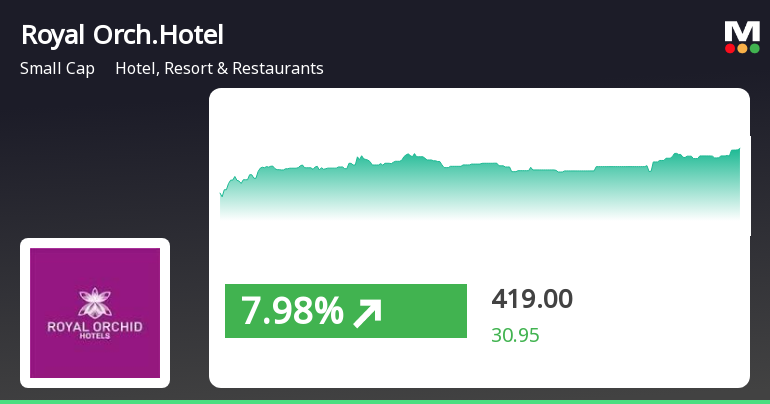

Royal Orchid Hotels Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:02:36Royal Orchid Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 416.00, slightly up from the previous close of 412.35. Over the past year, Royal Orchid Hotels has demonstrated resilience, achieving a return of 5.95%, while the Sensex recorded a return of 3.67% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands and On-Balance Volume (OBV) both reflect bullish signals on weekly and monthly charts, suggesting a positive momentum in trading activity. However, the KST and moving averages present a more nuanced picture, with some indicators showing mild bearish tendencies on a monthly basis. In terms of returns...

Read More

Royal Orchid Hotels Faces Valuation Shift Amid Financial Challenges and Market Dynamics

2025-04-02 08:12:12Royal Orchid Hotels has recently experienced an evaluation adjustment reflecting changes in its financial metrics and market position. This revision highlights the company's valuation profile, competitive positioning, and consistent returns, while also acknowledging challenges such as a high debt-to-EBITDA ratio and flat quarterly performance.

Read MoreRoyal Orchid Hotels Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:03:57Royal Orchid Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 412.35, showing a notable increase from the previous close of 388.05. Over the past year, Royal Orchid Hotels has demonstrated resilience, with a return of 8.70%, significantly outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly perspective shows a mildly bearish trend. The Bollinger Bands indicate a bullish stance on both weekly and monthly charts, suggesting a stable price movement. Daily moving averages also reflect a bullish sentiment, although the KST presents a mixed view with a bullish weekly trend and a mildly bearish monthly outlook. The company's performance over various time frame...

Read MoreRoyal Orchid Hotels Adjusts Valuation Grade, Reflecting Strong Competitive Position and Performance

2025-04-02 08:01:04Royal Orchid Hotels has recently undergone a valuation adjustment, reflecting its strong performance metrics within the hotel, resort, and restaurant industry. The company currently boasts a price-to-earnings (PE) ratio of 22.29 and an EV to EBITDA ratio of 18.28, indicating a competitive position in the market. Additionally, its return on equity (ROE) stands at 23.41%, showcasing effective management of shareholder equity. In comparison to its peers, Royal Orchid Hotels demonstrates a favorable valuation profile. For instance, while Samhi Hotels and Apeejay Surrendra Hotels are categorized as expensive and very expensive, respectively, Royal Orchid's metrics suggest a more attractive investment proposition. Furthermore, the company's return over various periods, including a remarkable 879.45% over the last decade, significantly outpaces the broader market, as indicated by the Sensex returns. Overall, Roy...

Read More

Royal Orchid Hotels Shows Resilience Amid Broader Market Decline and Sector Challenges

2025-04-01 14:45:18Royal Orchid Hotels has experienced notable gains, significantly outperforming the broader market and its sector. The stock has shown a consistent upward trend over the past two days and is trading above key moving averages, reflecting a strong market position despite a general market decline.

Read MoreRoyal Orchid Hotels Faces Short-Term Decline Amid Long-Term Positive Trends

2025-03-11 09:50:07Royal Orchid Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has experienced significant activity today, opening with a loss of 6.98%. The stock has underperformed its sector by 1.53%, marking a challenging day for investors. Over the past two days, Royal Orchid Hotels has seen a consecutive decline, with returns dropping by 4.51% during this period. Today, the stock reached an intraday low of Rs 359.95, reflecting the downward trend. Despite the recent struggles, it is noteworthy that Royal Orchid Hotels is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a longer-term positive trend in its price performance. In terms of broader market context, Royal Orchid Hotels has shown a 1-day performance decline of 3.26%, while the Sensex has decreased by only 0.42%. However, looking at the past month, the stock has performed well, with a ga...

Read MoreRoyal Orchid Hotels Faces Decline Amid Broader Market Challenges and Recent Gains

2025-03-10 13:05:08Royal Orchid Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has experienced significant activity today, opening with a loss of 6.82%. This decline marks a notable trend reversal after four consecutive days of gains. The stock underperformed its sector by 3.03%, reflecting broader market challenges. During intraday trading, Royal Orchid Hotels reached a low of Rs 367, contributing to a one-day performance drop of 3.10%. In contrast, the benchmark Sensex showed a slight gain of 0.28% during the same period. Over the past month, however, Royal Orchid Hotels has demonstrated resilience, with a performance increase of 7.36%, while the Sensex declined by 3.58%. Despite today's setbacks, the stock remains above its moving averages across various time frames, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. This positioning may indicate underlying strength in the stock'...

Read More

Royal Orchid Hotels Faces Debt Challenges Amidst Flat Financial Performance and Profit Growth

2025-03-06 08:02:56Royal Orchid Hotels has recently adjusted its evaluation, reflecting its current market position. The company reported flat financial performance for the quarter ending December 2024, with a notable profit increase. However, it faces challenges such as high debt levels and weak long-term growth fundamentals, while domestic mutual funds remain uninvolved.

Read MoreRoyal Orchid Hotels Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-06 08:00:55Royal Orchid Hotels, a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 374.00, showing a notable increase from the previous close of 349.30. Over the past year, the stock has experienced fluctuations, with a 52-week high of 435.35 and a low of 301.50. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling a bullish trend, while the monthly MACD presents a mildly bearish outlook. The daily moving averages also indicate a bullish stance, suggesting a mixed but generally positive technical environment. The KST and OBV metrics show a bullish trend on a weekly basis, while the monthly indicators reflect a more cautious stance. When comparing the stock's performance to the Sensex, Royal Orchid Hotels has demonstrated resilience, particularly over longe...

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

09-Apr-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (LODR) Regulations 2015 we are enclosing herewith the letter received from NSE.

Announcement under Regulation 30 (LODR)-Newspaper Publication

09-Apr-2025 | Source : BSEPursuant to Regulation 30 and 47 read with schedule III of SEBI (LODR) 2015 please find enclosed the copies of Newspaper Advertisements in Financial Express (English Version) on Page no. 14 and Vijayavani (Kannada Version) on page no. 12 for dispatch of Notice of Postal Ballot of the company and remote E- voting information for your record purpose.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

08-Apr-2025 | Source : BSEPursuant to Regulation 30 read with Schedule III of SEBI(Listing Obligations and Disclosure Requirements) Regulations 2015 and in continuation to our letter dated February 12 2025 intimating that the board of directors of the company based on the recommendation of the Nomination and Remuneration Committee approved the appointment of Mrs. Sunita Baljee (DIN - 00080737) as an additional director (Non-Executive Women Director) would be Non-Executive Director liable to retire by rotation subject to shareholders approval we are enclosing herewith a copy of the Postal Ballot Notice dated March 31 2025 along with the Explanatory Statement enclosed as Annexure -1 being despatched today i.e April 08 2025 for seeking the approval of the members on the special business as contained in the Postal Ballot Notice. The calender of events for the Postal Ballot is enclosed as Annexure 2.

Corporate Actions

No Upcoming Board Meetings

Royal Orchid Hotels Ltd has declared 25% dividend, ex-date: 30 Aug 24

No Splits history available

No Bonus history available

No Rights history available