Ruchi Infrastructure Experiences Valuation Grade Change Amidst Competitive Sector Landscape

2025-04-01 08:00:33Ruchi Infrastructure, a microcap player in the refined oil and vanaspati sector, has recently undergone a valuation adjustment. The company's current price stands at 6.54, down from a previous close of 7.93, reflecting a notable decline over the past year, with a stock return of -46.66% compared to a 5.11% return from the Sensex. Key financial metrics reveal a PE ratio of -154.36 and an EV to EBITDA ratio of 11.84, indicating a complex financial position. The company's return on capital employed (ROCE) is at 1.87%, while the return on equity (ROE) is recorded at 0.86%. In comparison to its peers, Ruchi Infrastructure's valuation metrics present a mixed picture. While it holds a fair valuation, competitors such as AVT Natural Products and KSE are positioned more favorably with attractive valuations. Other peers like BN Holdings are classified as risky, highlighting the varied financial health within the ...

Read More

Ruchi Infrastructure Faces Significant Financial Challenges Amidst Declining Performance Metrics

2025-03-28 15:09:18Ruchi Infrastructure, a microcap in the refined oil and vanaspati sector, is nearing a 52-week low, with a significant decline of 45.51% over the past year. The company faces challenges, including a negative CAGR in net sales, high debt levels, and disappointing financial results, indicating ongoing struggles.

Read MoreRuchi Infrastructure Sees Surge in Trading Activity Amid Strong Investor Engagement

2025-03-28 10:00:28Ruchi Infrastructure Ltd, a microcap player in the refined oil and vanaspati industry, has experienced significant trading activity today, hitting its upper circuit limit with a high price of Rs 8.91. The stock closed at Rs 7.96, reflecting a change of Rs 0.53, or a 7.13% increase. This performance outpaced the sector, which saw a 1.10% return, while the broader Sensex declined by 0.31%. Today's trading volume reached approximately 24.31 lakh shares, resulting in a turnover of Rs 2.05 crore. The stock has shown a positive trend, gaining 9.15% over the last two days, indicating a consistent upward movement. Notably, Ruchi Infrastructure's delivery volume surged by 157% compared to its five-day average, suggesting rising investor participation. In terms of moving averages, the stock is currently above its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Overall...

Read MoreRuchi Infrastructure Shows Resilience with Significant Trading Surge Amid Market Challenges

2025-03-27 11:00:11Ruchi Infrastructure Ltd, a microcap company in the refined oil and vanaspati industry, has experienced significant trading activity today, hitting its upper circuit limit. The stock reached an intraday high of Rs 8.91, reflecting a notable increase of 19.92% from its previous close. This surge marks a positive trend reversal after two consecutive days of decline. The stock opened with a gain of 6.19% and has traded within a wide range of Rs 1.11 throughout the day. With a total traded volume of approximately 9.11 lakh shares, the turnover stood at Rs 0.79 crore. The stock's last traded price was Rs 8.87, showing a change of Rs 1.44, or 19.38%. In terms of performance metrics, Ruchi Infrastructure has outperformed its sector by 15.8% today, while the broader market, represented by the Sensex, recorded a modest gain of 0.42%. The stock's weighted average price indicates that more volume was traded closer t...

Read MoreRuchi Infrastructure Experiences Valuation Grade Change Amidst Underperformance and Competitive Challenges

2025-03-26 08:00:39Ruchi Infrastructure, a microcap player in the refined oil and vanaspati sector, has recently undergone a valuation adjustment. The company's current price stands at 7.72, slightly down from the previous close of 7.79. Over the past year, Ruchi Infrastructure has experienced a stock return of -27.17%, contrasting with a 7.12% return from the Sensex, highlighting a significant underperformance relative to the broader market. Key financial metrics reveal a PE ratio of -182.21 and an EV to EBITDA ratio of 13.26, indicating challenges in profitability and operational efficiency. The company's return on capital employed (ROCE) is reported at 1.87%, while the return on equity (ROE) is at 0.86%, suggesting limited returns on investments and equity. In comparison to its peers, Ruchi Infrastructure's valuation metrics present a mixed picture. While some competitors like AVT Natural Products and KSE show more attra...

Read More

Ruchi Infrastructure Faces Significant Challenges Amid Declining Stock Performance and Weak Financial Metrics

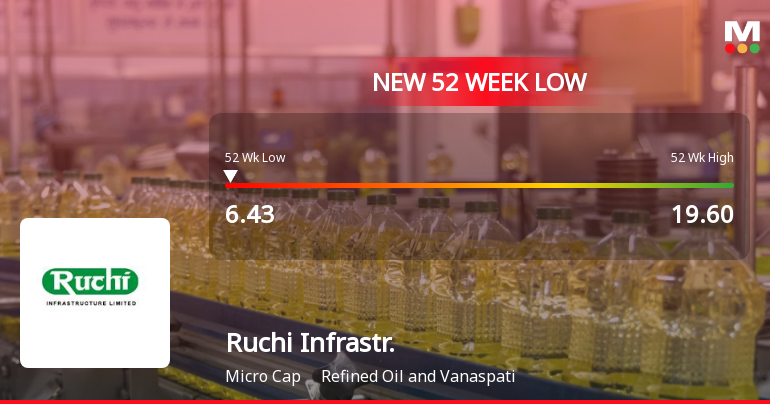

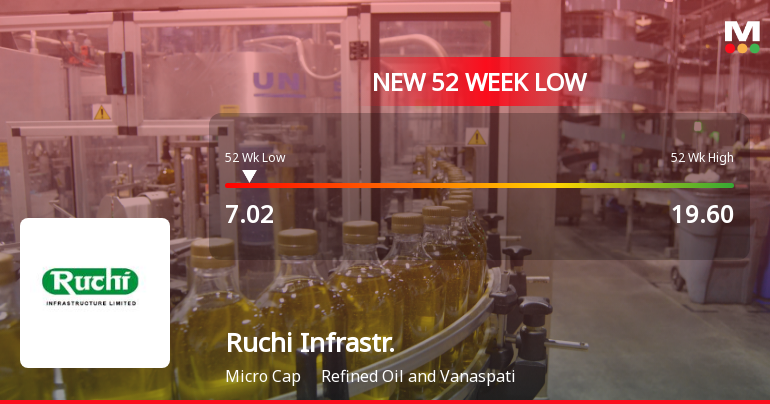

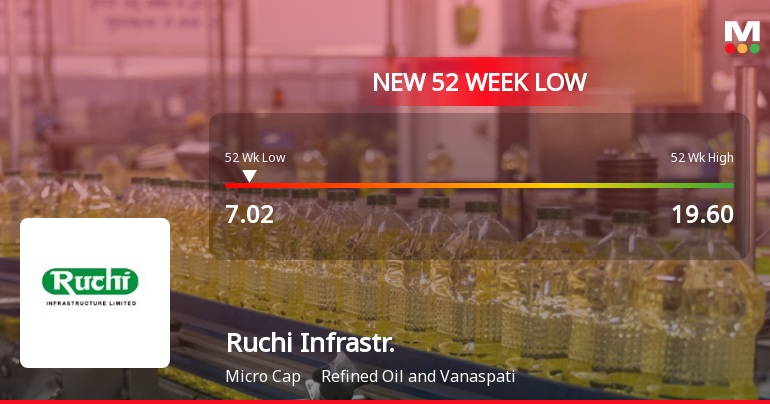

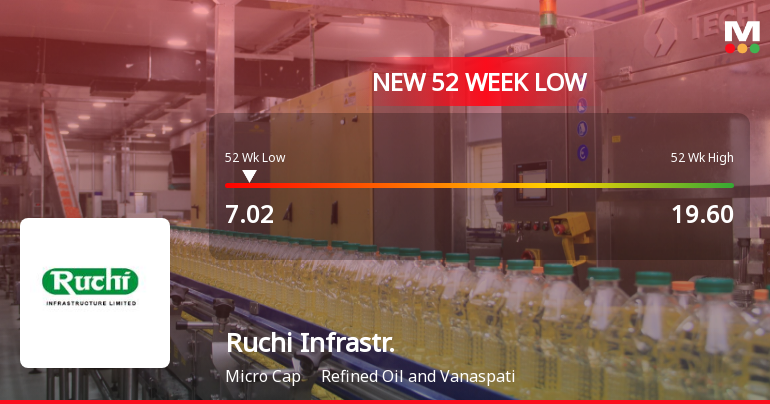

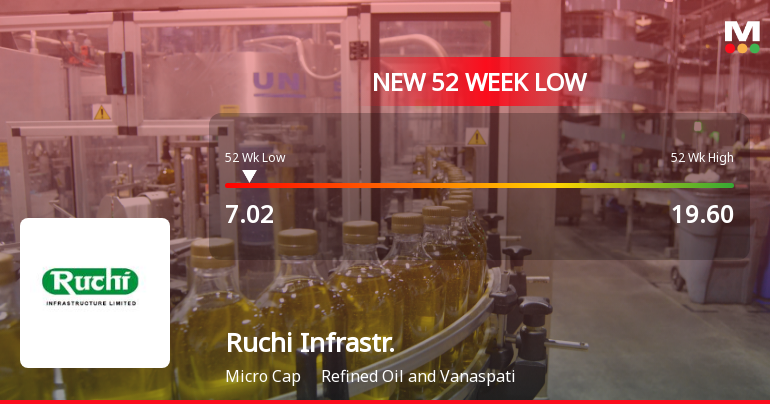

2025-03-17 09:50:43Ruchi Infrastructure, a microcap in the refined oil and vanaspati sector, has reached a new 52-week low amid ongoing challenges. The company has seen a 32.52% decline over the past year, with negative sales growth and high debt levels, while promoter confidence has decreased with a recent stake reduction.

Read More

Ruchi Infrastructure Faces Financial Struggles Amidst Industry Volatility and Declining Performance

2025-03-17 09:50:27Ruchi Infrastructure, a microcap in the refined oil and vanaspati sector, has faced significant volatility, reaching a new 52-week low. The company has seen a decline in net sales and high debt levels, with disappointing financial results and decreasing promoter confidence, indicating a challenging market position.

Read More

Ruchi Infrastructure Hits 52-Week Low Amid Weak Fundamentals and Declining Promoter Confidence

2025-03-17 09:50:22Ruchi Infrastructure, a microcap in the refined oil and vanaspati sector, has reached a new 52-week low amid mixed market sentiment. The company struggles with weak long-term fundamentals, high debt levels, and disappointing financial results, including a significant decline in profit before tax and low return on capital employed.

Read More

Ruchi Infrastructure Faces Significant Challenges Amid Broader Market Gains and Declining Performance Metrics

2025-03-17 09:50:19Ruchi Infrastructure, a microcap in the refined oil and vanaspati sector, has reached a new 52-week low amid mixed market sentiment. The company has struggled with declining sales growth, high debt levels, and low profitability, while promoter confidence has also diminished, indicating ongoing challenges for the firm.

Read MoreClosure of Trading Window

13-Mar-2025 | Source : BSEClosure of Trading Window.

Disclosure U/R 30 Of SEBI (LODR) Regulations 2015.

12-Mar-2025 | Source : BSEDisclosure u/r 30 of SEBI (LODR) Regulations 2015.

Details Of Equity Shares Dematerialized/Rematerialized During The Month Of February 2025.

01-Mar-2025 | Source : BSEDetails of equity shares dematerialized/rematerialized during the month of February 2025.

Corporate Actions

No Upcoming Board Meetings

Ruchi Infrastructure Ltd has declared 6% dividend, ex-date: 16 Sep 15

No Splits history available

No Bonus history available

No Rights history available