S H Kelkar's Stock Shows Technical Trend Shifts Amid Market Volatility

2025-03-10 08:01:42S H Kelkar & Company, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 186.60, showing a slight increase from the previous close of 185.55. Over the past year, the stock has experienced a high of 335.25 and a low of 156.85, indicating significant volatility. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) does not signal any clear direction on both weekly and monthly charts. Bollinger Bands also reflect a mildly bearish stance on a weekly basis, with similar sentiments on the monthly chart. Daily moving averages indicate a bearish trend, while the KST shows a bearish outlook weekly but a bullish trend monthly. When comparing the company's performance to the Sensex, S H Kelkar has shown a not...

Read MoreS H Kelkar's Stock Shows Technical Trend Shifts Amid Market Volatility

2025-03-07 08:03:28S H Kelkar & Company, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 185.55, showing a slight increase from the previous close of 181.65. Over the past year, the stock has experienced a high of 335.25 and a low of 156.85, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, suggesting a lack of momentum. Bollinger Bands also indicate a mildly bearish trend on both weekly and monthly scales. Daily moving averages reflect a bearish sentiment, while the KST shows a mixed picture with a bearish weekly trend and a bullish monthly trend. The On-Balance Volume (OBV) indicates a mildly bullish stance on a weekly...

Read More

S H Kelkar & Company Faces Significant Volatility Amid Broader Market Challenges

2025-03-03 10:07:57S H Kelkar & Company, a small-cap chemicals firm, hit a new 52-week low today after experiencing significant intraday volatility. The stock has declined 25.14% over the past year, underperforming the Sensex. It is currently trading below key moving averages, indicating a sustained downward trend.

Read More

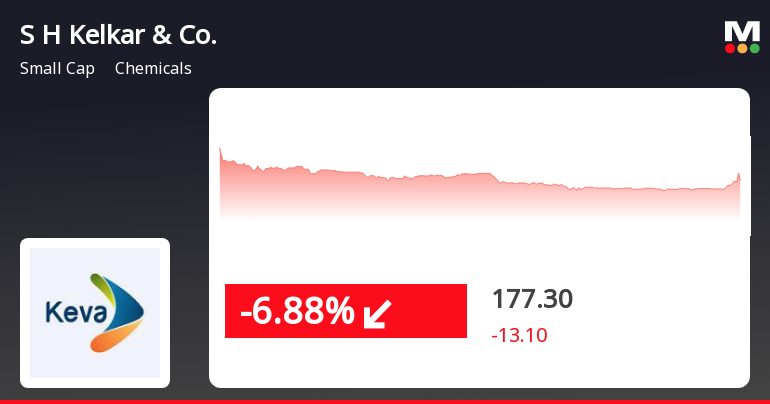

S H Kelkar Faces Market Challenges Amid Broader Trends in Chemicals Sector

2025-02-28 10:06:11S H Kelkar & Company, a small-cap chemicals firm, is trading near its 52-week low after a recent decline. Despite a brief intraday gain, the stock has struggled over the past three days and has underperformed compared to the Sensex over the past year, reflecting ongoing market challenges.

Read More

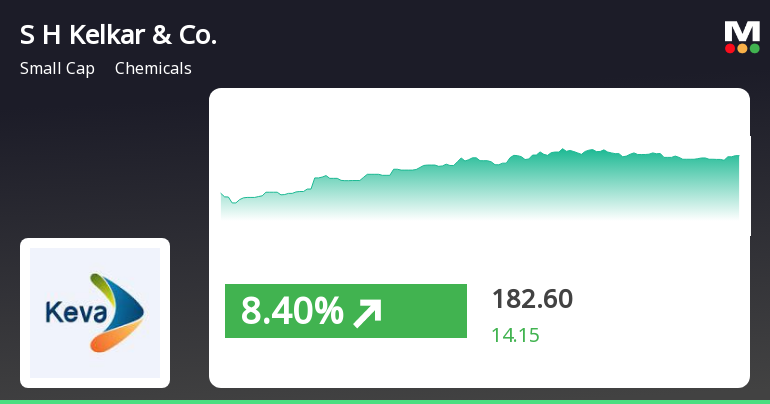

S H Kelkar & Company Experiences Notable Rebound Amid Broader Market Challenges

2025-02-24 10:50:22S H Kelkar & Company, a small-cap chemicals firm, experienced notable trading activity on February 24, 2025, with a significant intraday high. The stock outperformed its sector despite a decline over the past month, indicating a rebound amid broader market challenges and mixed performance across various moving averages.

Read More

S H Kelkar & Company Faces Significant Stock Volatility Amid Bearish Trends

2025-02-18 14:35:25S H Kelkar & Company, a small-cap chemicals firm, has faced notable stock volatility, trading near its 52-week low. The stock has declined consecutively over four days, underperforming its sector and moving averages, with a significant year-over-year drop contrasting with the overall market's gains.

Read More

S H Kelkar & Company Faces Continued Stock Decline Amid Market Volatility in February 2025

2025-02-14 12:15:46S H Kelkar & Company, a small-cap chemicals firm, has seen its stock price decline significantly, continuing a negative trend over two days. The stock has underperformed its sector and the broader market, with notable volatility and trading below key moving averages, indicating ongoing challenges.

Read More

S H Kelkar Reports Mixed Financial Results Amidst Industry Challenges in December 2024

2025-02-12 22:22:36S H Kelkar & Company has announced its financial results for the quarter ending December 2024, showcasing record net sales of Rs 543.21 crore. However, the company faces challenges with declining profit before tax and profit after tax, alongside a reduced operating profit margin and increased debt-equity ratio.

Read More

S H Kelkar Faces Financial Challenges Amid Declining Institutional Interest and Rising Debt Levels

2025-02-12 18:53:26S H Kelkar & Company, a small-cap chemicals firm, has recently experienced an evaluation adjustment amid flat financial performance for Q2 FY24. While net sales and operating profit showed growth over five years, rising interest expenses and a declining institutional stake highlight potential challenges in the company's financial landscape and market dynamics.

Read MoreIntimation Under Regulation 30 Of SEBI (LODR) Regulations 2015 - Receipt Of Insurance Claim (Interim Relief)

03-Apr-2025 | Source : BSEUpdate on receipt of insurance claim (Interim Relief)

Disclosure Pursuant To Regulation 30 Of The SEBI (LODR) Regulations 2015

03-Apr-2025 | Source : BSEIntimation regarding cautionary letters received from NSE and BSE

Business Update - Q4 FY 2024-25

03-Apr-2025 | Source : BSEBusiness Update - Q4 FY 2024-25

Corporate Actions

No Upcoming Board Meetings

S H Kelkar & Company Ltd has declared 7% dividend, ex-date: 12 Apr 24

No Splits history available

No Bonus history available

No Rights history available