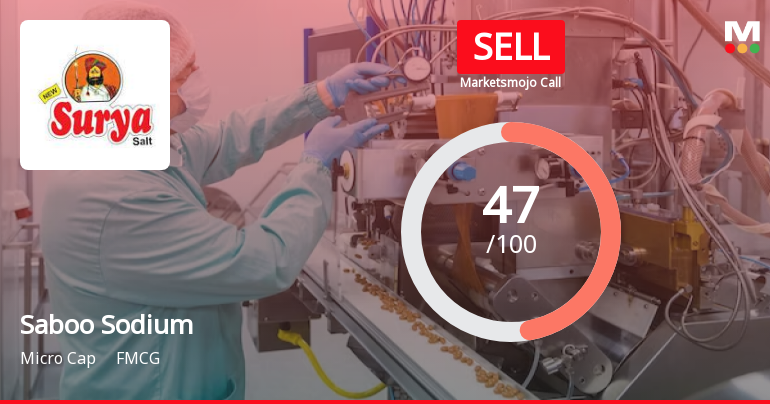

Saboo Sodium Chloro Experiences Valuation Grade Change Amid Competitive FMCG Landscape

2025-03-27 08:00:03Saboo Sodium Chloro, a microcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its current market position and financial metrics. The company's price-to-earnings ratio stands at 30.54, while its price-to-book value is recorded at 1.48. Additionally, the enterprise value to EBITDA ratio is 16.61, indicating a moderate valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of profitability, Saboo Sodium's return on capital employed (ROCE) is 5.88%, and its return on equity (ROE) is 4.84%. These figures provide insight into the company's efficiency in generating returns from its capital and equity. When compared to its peers, Saboo Sodium's valuation metrics present a varied landscape. For instance, Vadilal Enterprises is positioned at a significantly higher valuation, while Sarveshwar Foods and Mishtann Foods show different f...

Read More

Saboo Sodium Chloro Reports Strong Sales Growth Amid Long-Term Financial Concerns

2025-03-11 08:03:01Saboo Sodium Chloro, a microcap in the FMCG sector, has reported a strong third-quarter performance for FY24-25, with net sales rising to Rs 26.66 crore, a 26.77% annual increase. However, the company faces long-term challenges, including a high debt-to-EBITDA ratio and underperformance against market benchmarks.

Read More

Saboo Sodium Chloro Reports Strong Sales Growth Amid Long-Term Financial Concerns

2025-03-06 08:01:34Saboo Sodium Chloro, a microcap in the FMCG sector, has reported a strong third-quarter performance for FY24-25, with net sales reaching Rs 26.66 crore, a 26.77% increase. However, challenges remain regarding long-term financial stability, highlighted by a high debt-to-EBITDA ratio and a lower average return on capital employed.

Read More

Saboo Sodium Chloro Reports Growth Amid Concerns Over Long-Term Financial Stability

2025-03-05 08:01:25Saboo Sodium Chloro, a microcap in the FMCG sector, has recently adjusted its evaluation following a positive third-quarter performance, with net sales reaching Rs 26.66 crore, a 26.77% annual increase. However, challenges remain regarding long-term financial strength and debt servicing capabilities, impacting the company's overall outlook.

Read MoreSaboo Sodium Chloro's Stock Activity Highlights Market Volatility and Long-Term Growth Potential

2025-03-04 18:00:10Saboo Sodium Chloro Ltd, a microcap player in the FMCG sector, has shown significant activity today, with its stock rising by 7.82%. This uptick comes against a backdrop of broader market performance, as the Sensex experienced a slight decline of 0.13%. Over the past year, Saboo Sodium Chloro has outperformed the Sensex, achieving a return of 3.84% compared to the index's drop of 1.19%. Despite today's positive movement, the stock has faced challenges in the short term, with a 14.54% decline over the past month and a year-to-date performance down by 26.33%. The company's market capitalization stands at Rs 75.00 crore, with a price-to-earnings (P/E) ratio of 34.30, notably lower than the industry average of 50.01. Technical indicators suggest a bearish trend in the short term, with moving averages and Bollinger Bands reflecting negative momentum. However, the three-year performance shows a decline of 14.69...

Read MoreSaboo Sodium Chloro Shows Mixed Technical Trends Amid Market Fluctuations

2025-02-25 10:26:18Saboo Sodium Chloro, a microcap player in the FMCG sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 20.65, showing a slight increase from the previous close of 20.00. Over the past year, Saboo Sodium has experienced a 2.18% return, slightly outperforming the Sensex, which recorded a return of 2.05% in the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Bollinger Bands also reflect a bearish outlook for both weekly and monthly assessments. Moving averages present a mildly bullish signal on a daily basis, contrasting with the overall bearish sentiment observed in other indicators. The company's performance over various time frames reveals a mixed picture. While it has faced challenges in the short term, wi...

Read More

Saboo Sodium Chloro Reports Strong Q3 FY24-25 Growth Amid Score Revision

2025-01-28 15:45:48Saboo Sodium Chloro has reported strong financial results for the quarter ending December 2024, with a Profit After Tax of Rs 4.11 crore, reflecting a 56.87% year-on-year growth. Net sales for the half-yearly period reached Rs 26.66 crore, indicating a 26.77% increase compared to the previous year.

Read More

Saboo Sodium Chloro Reports Mixed Q2 FY24-25 Results Amid Financial Challenges

2025-01-27 18:31:48Saboo Sodium Chloro, a microcap in the FMCG sector, has recently seen an evaluation adjustment amid mixed performance indicators. The company reported strong second-quarter financial results, including significant growth in net sales and operating cash flow, while also facing challenges related to high debt levels and limited profitability.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Saboo Sodium Chloro Ltd |

| 2 | CIN NO. | L24117RJ1993PLC007830 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 20.70 |

| 4 | Highest Credit Rating during the previous FY | na |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: company secretary and compliance officer

EmailId: accounts@suryasalt.com

Designation: na

EmailId: accounts@suryasalt.com

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Non -Applicability Of Large Corporate

07-Apr-2025 | Source : BSENon applicability of Large Corportae

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEcertificaate under regulation 74(5)

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Saboo Sodium Chloro Ltd has announced 74:100 rights issue, ex-date: 15 Jun 22