Safari Industries Faces Significant Stock Decline Amid Broader Market Challenges

2025-03-10 14:45:22Safari Industries (India) has seen a notable decline in its stock price, underperforming its sector amid broader market challenges. The stock is currently trading below key moving averages, indicating bearish momentum. Despite a year-to-date decline, it has shown significant long-term growth over the past five years.

Read More

Safari Industries Faces Financial Challenges Amidst Strong Management Efficiency and Growth Potential

2025-03-06 08:07:52Safari Industries (India) has recently adjusted its evaluation, reflecting challenges in financial performance for Q3 FY24-25, with declines in key metrics. Despite this, the company showcases strong management efficiency and a promising long-term growth trajectory, supported by stable institutional holdings and consistent outperformance of the BSE 500 index.

Read MoreSafari Industries Faces Bearish Technical Trends Amidst Market Volatility

2025-03-06 08:01:44Safari Industries (India), a midcap player in the plastic products sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2073.45, showing a slight increase from the previous close of 2054.00. Over the past year, the stock has reached a high of 2,837.20 and a low of 1,627.40, indicating significant volatility. In terms of technical indicators, the weekly and monthly MACD readings suggest a bearish sentiment, while the Bollinger Bands also reflect a bearish trend. The moving averages on a daily basis align with this sentiment, further emphasizing the current market conditions. Notably, the KST shows a bearish trend on a weekly basis, with a mildly bearish outlook on a monthly scale. When comparing the stock's performance to the Sensex, Safari Industries has experienced a decline over various periods. In the last week, the stock returne...

Read MoreSafari Industries Shows Long-Term Growth Amid Recent Market Volatility

2025-03-05 18:00:22Safari Industries (India) Ltd, a mid-cap player in the plastic products industry, has shown notable activity in the stock market today. The company's market capitalization stands at Rs 10,015.00 crore, with a price-to-earnings (P/E) ratio of 68.30, significantly higher than the industry average of 39.22. In terms of performance, Safari Industries has experienced a mixed trajectory over various time frames. Over the past year, the stock has gained 0.68%, slightly outperforming the Sensex, which rose by 0.07%. However, the stock has faced challenges in the short term, with a 1-day increase of 0.95% compared to the Sensex's 1.01% rise. The 1-week performance shows a decline of 6.92%, while the 1-month performance is down by 11.37%, both underperforming against the Sensex. Longer-term metrics reveal a more favorable picture, with a remarkable 372.15% increase over three years and an impressive 608.75% rise o...

Read More

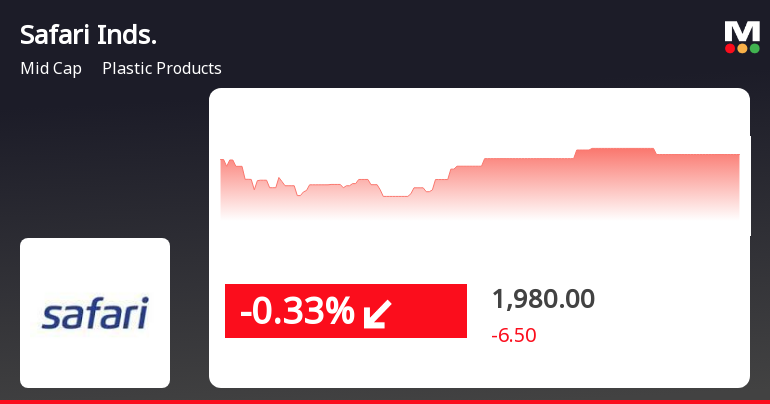

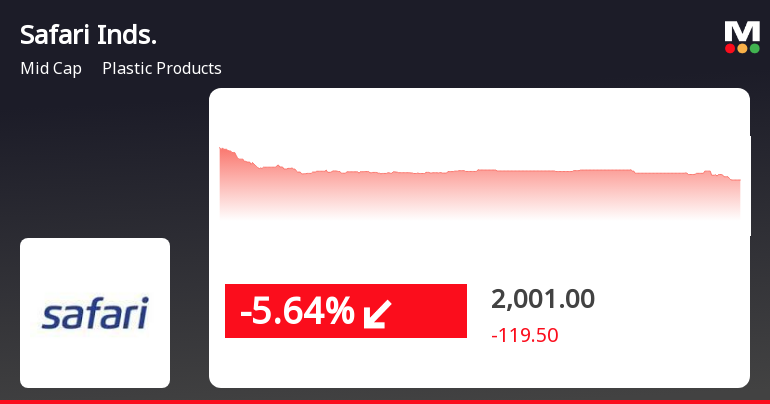

Safari Industries Faces Continued Decline Amid Broader Market Challenges and Volatility

2025-03-03 18:00:32Safari Industries (India) has faced a notable decline, with a 5.64% drop today, contributing to a 10.17% loss over three days. The stock is trading below key moving averages, indicating a bearish trend. In contrast, the broader market shows mixed performance, with large-cap stocks remaining resilient.

Read More

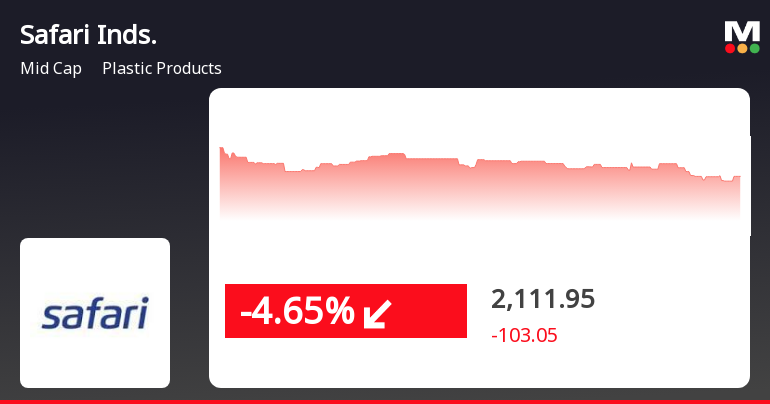

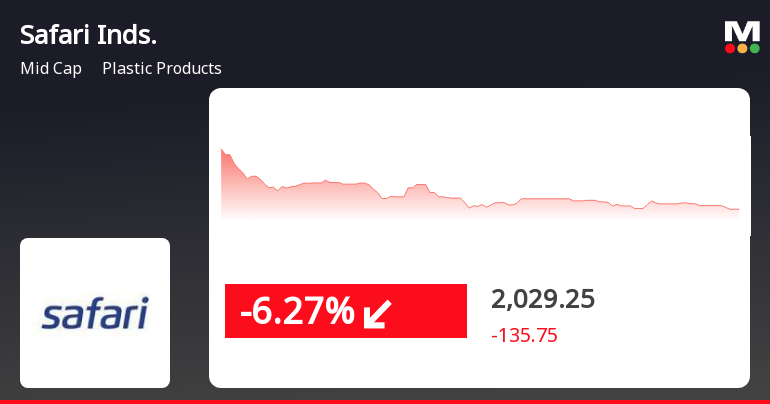

Safari Industries Faces Significant Stock Decline Amid Broader Market Challenges

2025-02-28 14:50:21Safari Industries (India) has faced a significant decline in stock performance, dropping 5.19% on February 28, 2025. The stock opened lower and reached an intraday low, marking a consecutive decline over two days. It has underperformed its sector and is trading below key moving averages.

Read More

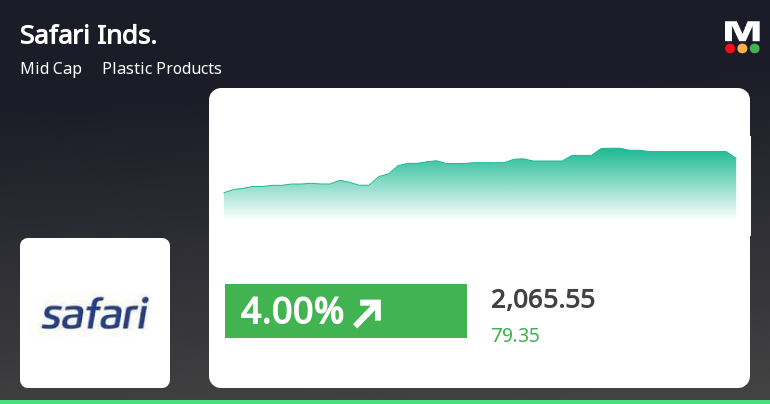

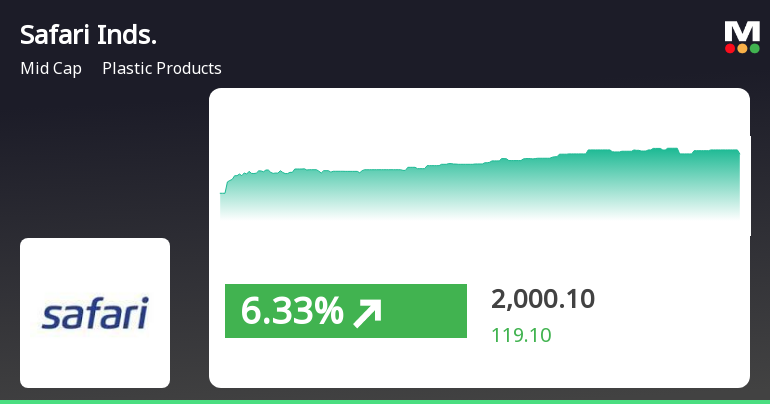

Safari Industries Shows Strong Short-Term Gains Amid Broader Market Volatility

2025-02-20 10:05:22Safari Industries (India) has experienced significant trading activity, gaining 5.05% on February 20, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, reaching an intraday high. However, it has faced challenges over the past month, indicating volatility in the plastic products industry.

Read More

Safari Industries Shows Signs of Recovery Amidst Market Volatility and Decline

2025-02-19 12:10:47Safari Industries (India) saw a significant performance shift on February 19, 2025, after three days of decline, with its stock outpacing its sector. Despite recent volatility, the company remains positioned higher than its 5-day moving average, indicating mixed signals in its short to medium-term outlook.

Read More

Safari Industries Faces Significant Stock Volatility Amid Broader Market Stability

2025-02-10 10:20:23Safari Industries (India) has faced notable stock volatility on February 10, 2025, with a significant decline and underperformance compared to its sector. The stock has dropped 17.85% over five days and is trading below key moving averages, indicating a challenging trend amid broader market conditions.

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

07-Apr-2025 | Source : BSEIntimation of Schedule of Analyst/ Investor Meeting

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Deed Of Conveyance Entered By Safari Manufacturing Limited

31-Mar-2025 | Source : BSEDeed of Conveyance entered by Safari Manufacturing Limited

Corporate Actions

No Upcoming Board Meetings

Safari Industries (India) Ltd has declared 75% dividend, ex-date: 19 Nov 24

Safari Industries (India) Ltd has announced 2:10 stock split, ex-date: 22 Sep 17

Safari Industries (India) Ltd has announced 1:1 bonus issue, ex-date: 12 Dec 23

No Rights history available