Sai Silks Faces Mixed Technical Trends Amidst Market Challenges and Fluctuating Prices

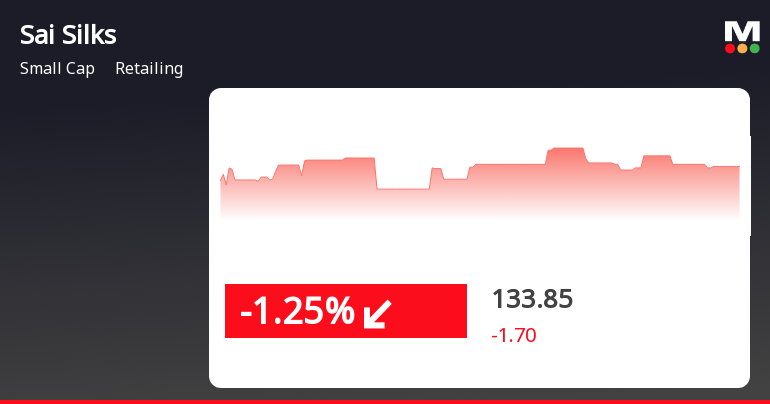

2025-04-02 08:10:28Sai Silks (Kalamandir), a smallcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 135.40, showing a slight increase from the previous close of 133.20. Over the past year, the stock has faced challenges, with a notable decline of 33.33%, contrasting sharply with a 2.72% gain in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly RSI presents a bullish signal. Bollinger Bands reflect a mildly bearish stance weekly, with a sideways trend monthly. Daily moving averages are bearish, and both the KST and Dow Theory indicate no clear trend. In terms of price movement, the stock has fluctuated between a 52-week high of 218.25 and a low of 125.35, with today's trading reaching a hig...

Read More

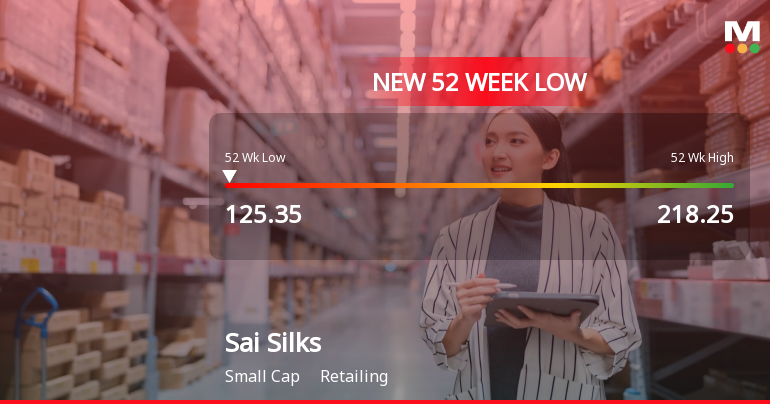

Sai Silks Hits 52-Week Low Amid Broader Market Resilience and Growth Potential

2025-03-17 15:44:49Sai Silks (Kalamandir) has hit a new 52-week low, continuing a downward trend with a notable decline over the past five days. Despite this, the company shows strong fundamentals, including a low Debt to EBITDA ratio and significant long-term growth in net sales and operating profit.

Read More

Sai Silks Faces Significant Volatility Amid Broader Market Resilience and Growth Potential

2025-03-17 15:44:49Sai Silks (Kalamandir) has faced notable volatility, reaching a 52-week low and experiencing a significant decline over the past five days. In contrast, the broader market, led by the mid-cap segment, has shown resilience. The company reports strong long-term growth and a low debt-to-EBITDA ratio, despite decreased institutional investor participation.

Read More

Sai Silks Faces Significant Volatility Amid Broader Market Decline and Trend Reversal Signals

2025-03-10 15:35:30Sai Silks (Kalamandir) faced notable volatility today, with a significant decline following three days of gains. The stock's performance metrics reveal underperformance against its sector and substantial losses over various time frames. It is currently trading below multiple moving averages, reflecting a bearish trend amid a broader market downturn.

Read More

Sai Silks Approaches 52-Week Low Amidst Significant Decline in Retail Sector

2025-03-03 09:37:59Sai Silks (Kalamandir), a small-cap retail player, is nearing a 52-week low, having declined 14.34% over the past five days. The stock has underperformed its sector and is trading below key moving averages, reflecting a bearish trend. Over the past year, it has dropped 41.90%.

Read MoreSai Silks Experiences Mixed Technical Trends Amidst Market Volatility

2025-03-03 08:01:33Sai Silks (Kalamandir), a small-cap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 135.45, has seen fluctuations with a 52-week high of 243.10 and a low of 134.00. Today's trading session recorded a high of 143.20 and a low of 134.00, indicating some volatility. The technical summary reveals a mixed picture. The MACD and Dow Theory indicators are bearish on a weekly basis, while the monthly indicators show a bullish signal for the RSI. The moving averages and Bollinger Bands also reflect bearish trends, while the On-Balance Volume (OBV) indicates a mildly bearish stance on a weekly basis, contrasting with a bullish monthly outlook. In terms of performance, Sai Silks has faced significant challenges compared to the Sensex. Over the past week, the stock has returned -13.64%, while the Sensex has only declined...

Read MoreSai Silks Experiences Technical Trend Shift Amidst Ongoing Market Challenges

2025-03-02 08:01:31Sai Silks (Kalamandir), a small-cap player in the retailing industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 135.45, reflecting a notable decline from its previous close of 142.85. Over the past year, the stock has faced significant challenges, with a return of -42.7%, contrasting sharply with a modest gain of 1.24% in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD and Dow Theory both reflect bearish trends on a weekly basis, while the daily moving averages also suggest a bearish outlook. However, the On-Balance Volume (OBV) shows a mildly bearish trend, indicating some underlying activity despite the overall negative sentiment. In terms of performance, the stock has experienced a 52-week high of 243.10 and a low of 134.00, with today's trading reflecting a high of 143.20 a...

Read MoreSai Silks Faces Technical Trend Challenges Amid Market Volatility and Declining Performance

2025-03-01 08:01:30Sai Silks (Kalamandir), a smallcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 135.45, down from a previous close of 142.85, with a notable 52-week high of 243.10 and a low of 134.00. Today's trading saw a high of 143.20 and a low of 134.00, indicating some volatility. The technical summary reveals a mixed picture. The MACD and Dow Theory indicators are bearish on both weekly and monthly bases, while the Relative Strength Index (RSI) shows no signal weekly but is bullish monthly. The On-Balance Volume (OBV) indicates a mildly bearish trend weekly, contrasting with a bullish monthly outlook. Moving averages and Bollinger Bands also reflect bearish sentiments on a daily and weekly basis. In terms of performance, Sai Silks has faced significant challenges compared to the Sensex. Over the past week, th...

Read More

Sai Silks Hits 52-Week Low Amid Persistent Downward Trend in Retail Sector

2025-02-28 09:39:33Sai Silks (Kalamandir) has reached a new 52-week low, reflecting a significant decline in its stock performance. Over the past year, the company has faced challenges, with a notable drop compared to the broader market. The stock continues to trade below key moving averages, highlighting ongoing downward momentum.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEPlease find the enclosed compliance certificate as per Regulation 74(5) of SEBI (DP) Regulations

Q4 Business Update And Disclosure Under Reg 30

02-Apr-2025 | Source : BSEQ4 Business update and Disclosure under Reg 30 of SEBI (LODR) Regulations

Closure of Trading Window

28-Mar-2025 | Source : BSEThe Trading window for dealing in shares of the company for all the designated person and their immediate relatives will remain closed from 1st April 2025 till 48 hours after the declaration of Audited financials results for the quarter and year ended 31st March 2025

Corporate Actions

No Upcoming Board Meetings

Sai Silks (Kalamandir) Ltd has declared 50% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available