Sakthi Finance Experiences Valuation Grade Change Amid Competitive Finance Sector Landscape

2025-04-01 08:00:16Sakthi Finance, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 45.99, with a notable 52-week range between 43.00 and 95.00. Recent trading activity shows a high of 46.50 and a low of 43.50 for the day. Key financial metrics reveal a PE ratio of 18.31 and a price-to-book value of 1.35. The company’s EV to EBIT is recorded at 10.01, while the EV to EBITDA stands at 9.60. Additionally, Sakthi Finance has a dividend yield of 1.34% and a return on capital employed (ROCE) of 10.44%, alongside a return on equity (ROE) of 7.35%. In comparison to its peers, Sakthi Finance's valuation metrics indicate a relatively higher position, particularly when juxtaposed with companies like Fedders Holding and Indl. & Prud. Inv., which maintain a fair valuation. Other competitors in the sector, such...

Read MoreSakthi Finance Experiences Valuation Grade Change Amidst Sector Dynamics and Performance Lag

2025-03-26 08:00:18Sakthi Finance, a microcap player in the finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 44.68, down from a previous close of 47.85, with a 52-week range between 43.00 and 95.00. Key financial metrics reveal a PE ratio of 17.79 and a price-to-book value of 1.31. The company also reports an EV to EBITDA of 9.55 and an EV to sales ratio of 6.57. Additionally, Sakthi Finance has a dividend yield of 1.38%, with a return on capital employed (ROCE) of 10.44% and a return on equity (ROE) of 7.35%. In comparison to its peers, Sakthi Finance's valuation metrics present a mixed picture. While it maintains a competitive PE ratio, other companies in the sector exhibit a wide range of valuations, with some classified as very expensive. Notably, the performance of Sakthi Finance has lagged behind the Sensex over va...

Read More

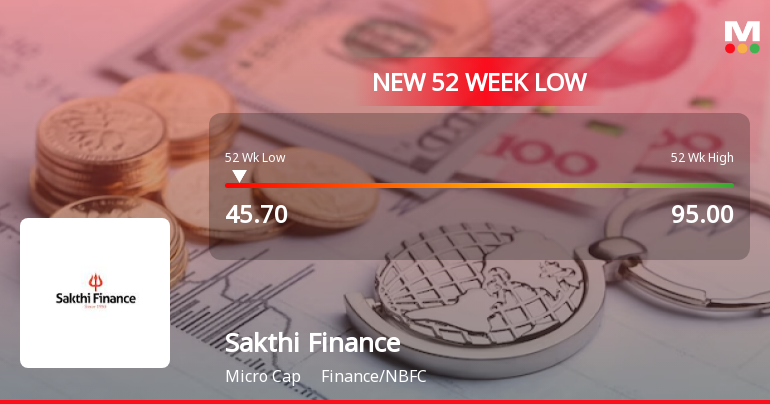

Sakthi Finance Faces Significant Volatility Amid Broader Market Challenges

2025-03-03 09:35:42Sakthi Finance, a microcap in the NBFC sector, has reached a new 52-week low amid significant volatility, underperforming its sector. The stock has fallen consecutively over two days and is trading below key moving averages, reflecting ongoing market challenges and a substantial decline over the past year.

Read More

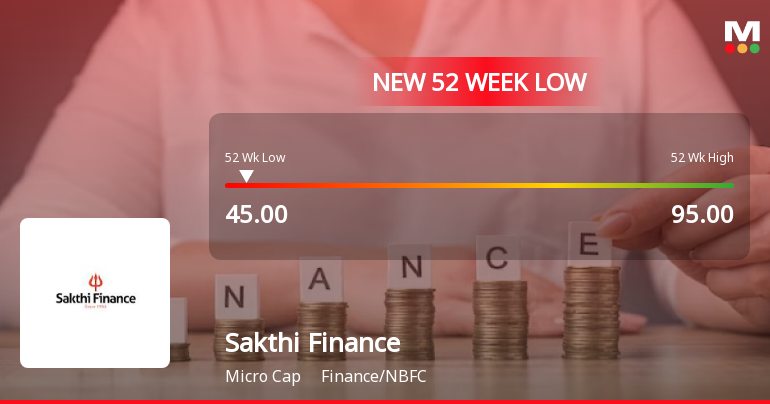

Sakthi Finance Faces Significant Price Pressure Amidst Market Volatility and Underperformance

2025-02-28 10:05:23Sakthi Finance, a microcap in the NBFC sector, has faced notable volatility, hitting a new 52-week low of Rs. 45. The stock has significantly underperformed its sector and has declined 39.68% over the past year, trading below key moving averages amid ongoing market challenges.

Read More

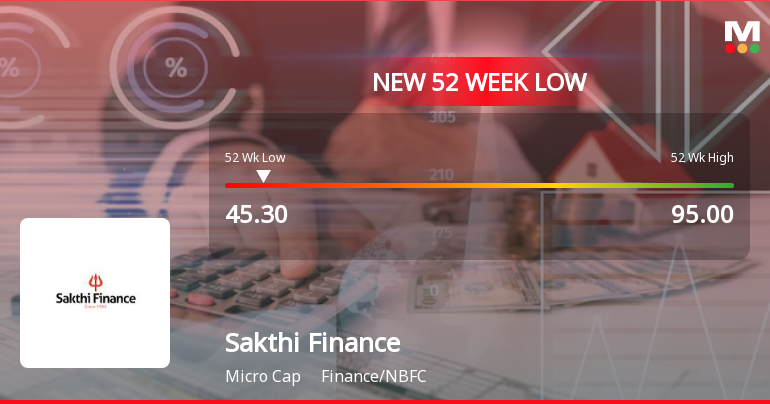

Sakthi Finance Faces Continued Volatility Amidst Sector Underperformance and Declining Stock Trends

2025-02-19 09:35:49Sakthi Finance has faced notable volatility, hitting a new 52-week low of Rs. 45.3 and underperforming its sector. The stock has dropped 12.88% over the past five days and 40.06% over the past year, highlighting ongoing challenges in its market performance amid a competitive landscape.

Read More

Sakthi Finance Faces Significant Volatility Amidst Sustained Downward Trend

2025-02-17 15:50:15Sakthi Finance, a microcap in the NBFC sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has declined consecutively over three days, with a notable drop over the past year, trading below key moving averages.

Read More

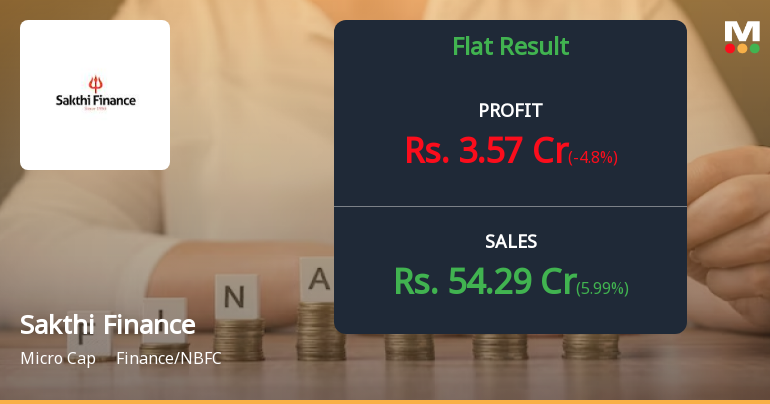

Sakthi Finance Reports Record Net Sales and Profit Metrics in December 2024 Results

2025-02-12 22:17:29Sakthi Finance announced its financial results for the quarter ending December 2024, revealing significant achievements in net sales, Profit Before Tax, and Profit After Tax, all reaching their highest levels in five quarters. The Earnings per Share also increased, indicating improved profitability for shareholders.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

05-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Sakthi Finance Ltd |

| 2 | CIN NO. | L65910TZ1955PLC000145 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 1032.53 |

| 4 | Highest Credit Rating during the previous FY | BBB |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | ICRA LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Chief Compliance Officer

EmailId: svenkatesh@sakthifinance.com

Designation: Chief Financial Officer

EmailId: ksundaramurthy@sakthifinance.com

Date: 05/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Allotment Of 1000000 Rated Secured Redeemable Non-Convertible Debentures (Ncds) Of Face Value Of Rs. 1000 Each.

04-Apr-2025 | Source : BSEAllotment of 1000000 Rated Secured. Redeemable Non-Convertible Debentures (NCDs) of face value of Rs. 1000 each aggregating Rs. 10000 Lakhs on Public Issue basis.

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

04-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for M Balasubramaniam

Corporate Actions

No Upcoming Board Meetings

Sakthi Finance Ltd has declared 8% dividend, ex-date: 03 Sep 24

No Splits history available

No Bonus history available

Sakthi Finance Ltd has announced 1:2 rights issue, ex-date: 24 Oct 07