Sakthi Sugars Experiences Valuation Grade Change Amidst Industry Performance Disparities

2025-03-07 08:00:36Sakthi Sugars, a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at -13.83, indicating challenges in profitability. In contrast, its price-to-book value is recorded at 1.81, suggesting a moderate valuation relative to its equity. Key performance indicators reveal an EV to EBITDA ratio of 16.54 and an EV to sales ratio of 1.23, which provide insights into the company's operational efficiency and revenue generation capabilities. The return on capital employed (ROCE) is at 3.23%, while the return on equity (ROE) is noted at -13.06%, highlighting the company's struggles in generating returns for shareholders. When compared to its peers, Sakthi Sugars presents a unique position. While it faces challenges, other companies in the sector, such as Dhampur Sugar and Avadh Sugar, exhibit more...

Read More

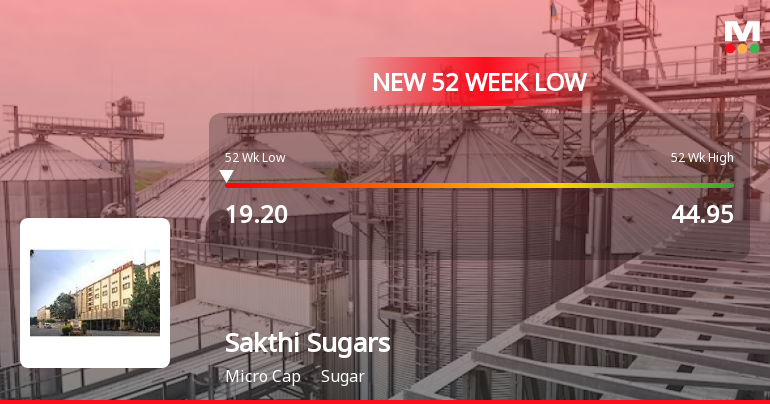

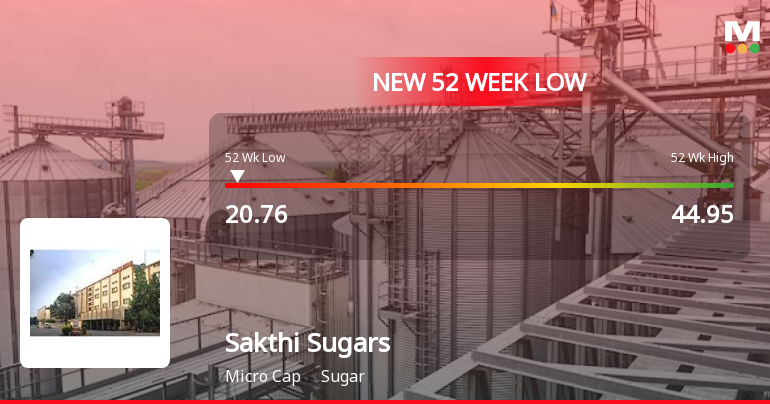

Sakthi Sugars Faces Ongoing Challenges Amid Broader Sugar Sector Weakness

2025-03-03 10:35:18Sakthi Sugars has faced notable volatility, hitting a new 52-week low and continuing a downward trend with a significant decline over the past three days. The stock is trading below multiple moving averages and has underperformed its sector, reflecting ongoing challenges in a weak market environment.

Read MoreSakthi Sugars Experiences Valuation Grade Change Amidst Financial Metric Adjustments

2025-02-24 12:56:32Sakthi Sugars, a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting changes in its financial metrics. The company's price-to-earnings (PE) ratio stands at -14.11, indicating a challenging earnings environment. In contrast, its price-to-book value is recorded at 1.84, suggesting a moderate valuation relative to its assets. The enterprise value to EBITDA ratio is noted at 16.62, while the EV to EBIT ratio is significantly higher at 37.09, which may indicate varying profitability levels. Additionally, the EV to sales ratio is 1.23, and the EV to capital employed is 1.13, providing insights into the company's operational efficiency. Sakthi Sugars' return on capital employed (ROCE) is at 3.23%, and the return on equity (ROE) is reported at -13.06%, reflecting the company's current profitability challenges. When compared to its peers, Sakthi Sugars shows a distinc...

Read More

Sakthi Sugars Faces Continued Decline Amid Broader Sugar Market Challenges

2025-02-18 11:52:27Sakthi Sugars has faced notable volatility, hitting a new 52-week low and experiencing a 15.74% decline over four consecutive days. The stock underperformed its sector, trading below key moving averages, and has dropped 42.70% over the past year, contrasting with the Sensex's positive performance.

Read More

Sakthi Sugars Faces Persistent Challenges Amid Significant Stock Volatility in October 2023

2025-02-14 09:35:16Sakthi Sugars has faced significant volatility, hitting a new 52-week low and underperforming its sector. The stock has declined consecutively over two days, contributing to a challenging year with a notable decrease in value. It currently trades below key moving averages, indicating ongoing struggles in the competitive sugar market.

Read More

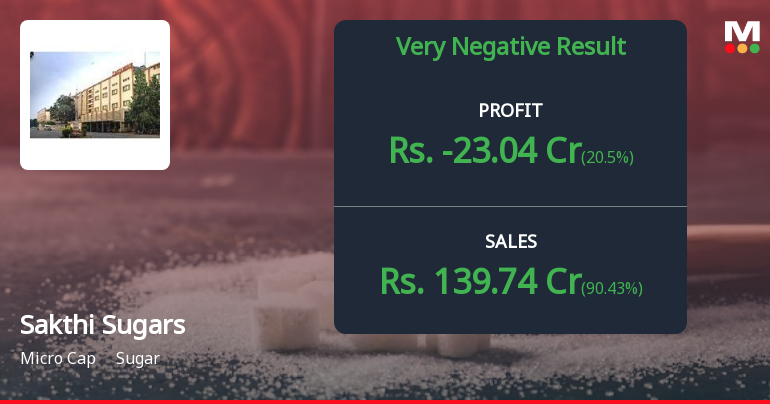

Sakthi Sugars Reports Financial Results Indicating Challenges in December 2024 Performance

2025-02-13 16:09:19Sakthi Sugars has announced its financial results for the quarter ending December 2024, revealing a shift in performance metrics. The company's score has adjusted to -20 from -15 over the past three months, indicating challenges faced during the reporting period that may affect its standing in the sugar industry.

Read More

Sakthi Sugars Faces Ongoing Challenges Amid Significant Stock Volatility in October 2023

2025-02-13 10:05:14Sakthi Sugars has faced significant volatility, hitting a new 52-week low of Rs. 23.78 and underperforming its sector. Over the past year, the stock has declined by 31.98%, contrasting with the Sensex's positive performance. Current trading levels remain below key moving averages, indicating ongoing challenges.

Read More

Sakthi Sugars Faces Continued Volatility Amid Broader Sugar Sector Challenges

2025-02-12 10:05:15Sakthi Sugars has faced significant volatility, reaching a new 52-week low and experiencing a seven-day decline totaling 12.91%. The stock has underperformed the broader market, with a one-year drop of 37.11%, while the sugar sector also reports challenges, reflecting ongoing difficulties in a competitive landscape.

Read More

Sakthi Sugars Hits 52-Week Low Amid Broader Sugar Sector Challenges

2025-02-11 10:35:13Sakthi Sugars has reached a new 52-week low, continuing a six-day downward trend with an overall decline of 8.77%. The stock is trading below all major moving averages, and the broader sugar sector has also faced challenges, with Sakthi Sugars down nearly 40% over the past year.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEBased on the certificate received from MUFG Intime India Private Limited Registrar and Transfer Agent (RTA) of the Company we hereby certify that the securities received for dematerialisation during the quarter ended 31st March 2025 have been confirmed rejected and the security certificates received were mutilated and cancelled after due verification and the name of the depositories have been substituted as the registered owner within the prescribed times lines in our records

Closure of Trading Window

26-Mar-2025 | Source : BSEWe wish to inform you that the Trading Window Closure for dealing in the shares of the Company will remain closed for designated persons and their immediate relatives from end of quarter ending 31st March 2025 till 48 hours after the date of declaration of unaudited/audited quarterly financial results for the quarter ending 31st March 2025.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

25-Mar-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform that the Company has received an order from Income Tax Department raising a demand for payment of Income Tax.

Corporate Actions

No Upcoming Board Meetings

Sakthi Sugars Ltd has declared 15% dividend, ex-date: 06 Dec 07

No Splits history available

No Bonus history available

No Rights history available