SAL Automotive Adjusts Evaluation Score Amid Strong Profit Growth and Debt Concerns

2025-04-02 08:31:22SAL Automotive, a microcap in the auto ancillary sector, has recently adjusted its evaluation score, reflecting a shift in technical trends. The company has shown impressive annual operating profit growth of 61.19% and has outperformed the BSE 500 index over the past three years, despite facing challenges with debt and profitability.

Read MoreSAL Automotive Adjusts Valuation Amid Competitive Auto Ancillary Market Dynamics

2025-03-11 08:00:35SAL Automotive, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 570.50, reflecting a notable increase from the previous close of 533.00. Over the past year, SAL Automotive has demonstrated a return of 10.64%, outperforming the Sensex, which remained flat during the same period. Key financial metrics for SAL Automotive include a PE ratio of 25.43 and an EV to EBITDA ratio of 11.72, indicating its market positioning within the industry. The company also boasts a return on capital employed (ROCE) of 13.17% and a return on equity (ROE) of 13.19%, suggesting a solid operational performance. In comparison to its peers, SAL Automotive's valuation metrics reveal a diverse landscape. For instance, Z F Steering is positioned at a higher valuation level, while Rane (Madras) is currently loss-making. Other competitors like Rico Auto ...

Read MoreSAL Automotive Ltd Sees Significant Buying Activity Amidst Strong Long-Term Gains

2025-03-07 13:45:38SAL Automotive Ltd is witnessing significant buying activity, with the stock gaining 6.39% today, notably outperforming the Sensex, which rose only 0.08%. Over the past week, SAL Automotive has recorded a total increase of 6.75%, while the Sensex gained 1.64%. This marks a consecutive gain for the stock over the last two days, resulting in a total return of 17.16% during this period. The stock opened with a gap up of 6.3% today and reached an intraday high of Rs 533.15. Despite this positive momentum, SAL Automotive's performance over the past month shows a decline of 14.53%, compared to a 4.44% drop in the Sensex. However, the stock has demonstrated strong long-term performance, with a remarkable 289.30% increase over the past five years, significantly outpacing the Sensex's 98.00% rise. Factors contributing to the current buying pressure may include recent market trends, investor sentiment, or company-s...

Read MoreSAL Automotive Ltd Experiences Surge Amidst Strong Buying Activity and Market Rebound

2025-03-06 15:35:10SAL Automotive Ltd is witnessing significant buying activity today, with the stock surging by 10.14%, notably outperforming the Sensex, which recorded a modest gain of 0.83%. This performance marks a strong rebound after a challenging month, where the stock had declined by 16.55%, compared to the Sensex's drop of 4.76%. Today, SAL Automotive opened with a gap up of 2.2% and reached an intraday high of Rs 501.15. Despite the positive momentum today, the stock's performance over the past week shows a slight decline of 0.17%, while the Sensex fell by 0.37%. Over the longer term, SAL Automotive's performance has been mixed, with a notable 134.24% increase over three years, significantly outpacing the Sensex's 36.82% rise during the same period. The current buying pressure could be attributed to various factors, including market sentiment, recent developments in the auto ancillary sector, or company-specific ...

Read MoreSAL Automotive Adjusts Valuation Amid Competitive Market Dynamics and Mixed Peer Metrics

2025-02-24 12:57:46SAL Automotive, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 530.00, reflecting a decline from its previous close of 562.90. Over the past year, SAL Automotive has experienced a stock return of -2.77%, contrasting with a positive return of 1.96% for the Sensex. Key financial metrics for SAL Automotive include a PE ratio of 25.09 and an EV to EBITDA ratio of 11.58. The company also boasts a return on capital employed (ROCE) of 13.17% and a return on equity (ROE) of 13.19%. In comparison to its peers, SAL Automotive's valuation metrics indicate a relatively higher PE ratio when juxtaposed with companies like IST and Rico Auto Industries, which have significantly lower PE ratios but varying valuation standings. The broader industry landscape shows a mix of valuations among competitors, with some classified as very expensi...

Read More

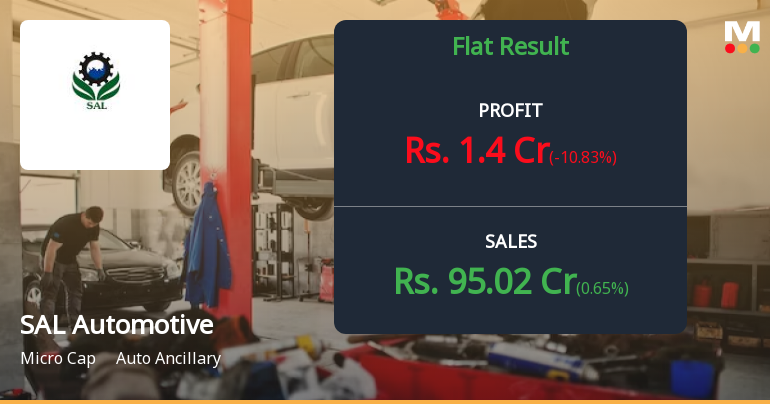

SAL Automotive Reports Highest Operating Profit in Five Quarters for December 2024 Quarter

2025-02-10 18:52:21SAL Automotive has announced its financial results for the quarter ending December 2024, showcasing significant improvements in performance metrics. The company achieved its highest operating profit in five quarters at Rs 3.59 crore, alongside a peak profit before tax of Rs 2.07 crore, indicating enhanced financial strength.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEDear Sir Please find attached herewith a copy of certificate under Regulation 75(5) of SEBI (Depository and participants) Regulations 2018

Announcement under Regulation 30 (LODR)-Allotment

04-Apr-2025 | Source : BSEPlease find attached intimation regarding Allotment of Bonus Share.

Announcement under Regulation 30 (LODR)-Newspaper Publication

28-Mar-2025 | Source : BSEPursuant to provision of Regulation 42 and 47 of SEBI (LODR) Regulations 2015 Enclosed copy of advertisement published in Financial Express (English) and Ajit (Punjabi) on 28.03.2025 for the notice of record date for bonus issue of Equity Shares.

Corporate Actions

No Upcoming Board Meetings

SAL Automotive Ltd has declared 45% dividend, ex-date: 17 Sep 24

No Splits history available

SAL Automotive Ltd has announced 1:1 bonus issue, ex-date: 03 Apr 25

No Rights history available