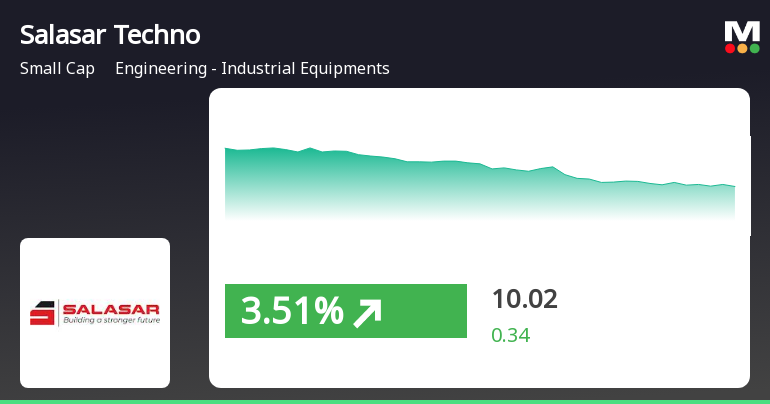

Salasar Techno Engineering Shows Resilience Amid Broader Market Decline

2025-04-01 11:40:48Salasar Techno Engineering's stock surged today, contrasting with a broader market decline. After three days of losses, it rebounded, opening higher and reaching an intraday peak. While recent performance shows a decline over the past week and year, it has demonstrated significant long-term gains over three and five years.

Read MoreSalasar Techno Engineering Adjusts Valuation Grade Amid Mixed Performance Metrics

2025-04-01 08:00:42Salasar Techno Engineering has recently undergone a valuation adjustment, reflecting its current financial standing within the engineering and industrial equipment sector. The company's price-to-earnings ratio stands at 29.00, while its price-to-book value is recorded at 2.03. Key metrics such as the EV to EBIT ratio are at 16.10, and the EV to EBITDA ratio is noted at 14.51, indicating a solid operational performance. In terms of returns, Salasar Techno has shown a mixed performance against the Sensex. Over the past week, the stock returned 2.1%, outperforming the Sensex's 0.66%. However, on a year-to-date basis, the company has faced a decline of 41.9%, contrasting with the Sensex's slight drop of 0.93%. Notably, over a five-year period, Salasar Techno has delivered an impressive return of 974.92%, significantly surpassing the Sensex's 159.65%. When compared to its peers, Salasar Techno's valuation metr...

Read More

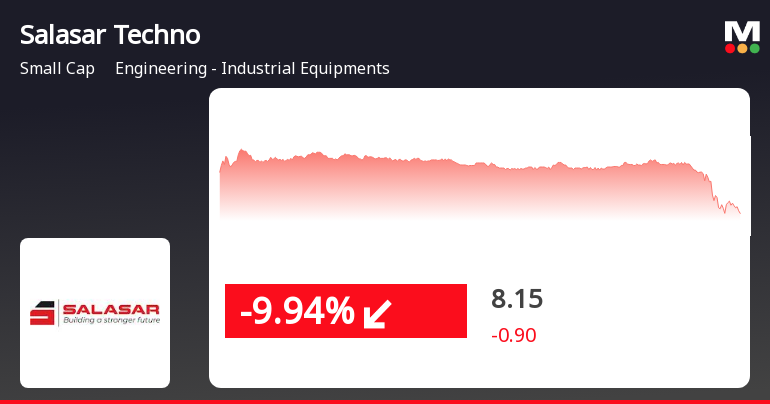

Salasar Techno Engineering Faces Significant Stock Volatility Amid Broader Market Gains

2025-03-28 14:50:24Salasar Techno Engineering has faced notable stock volatility, declining for three consecutive days and underperforming its sector. Currently trading below key moving averages, the stock has decreased significantly over the past month and year-to-date, contrasting with the broader market's performance. Long-term gains remain overshadowed by recent challenges.

Read More

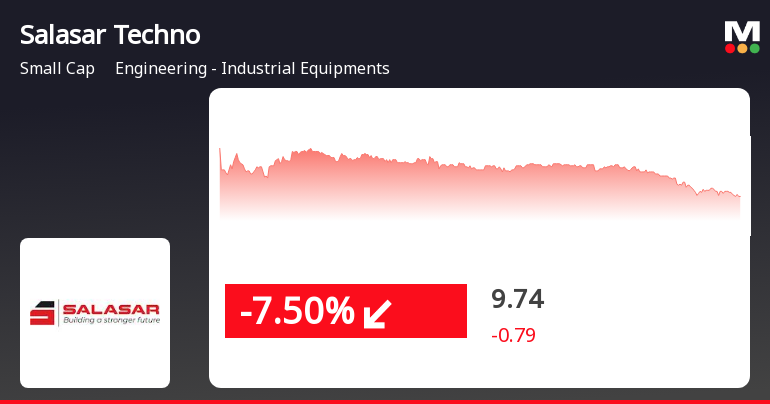

Salasar Techno Engineering Faces Decline Amid Broader Market Sentiment Shift

2025-03-26 14:50:23Salasar Techno Engineering, a small-cap company in the Engineering - Industrial Equipment sector, has seen a notable decline today after three days of gains. The stock's performance contrasts with the broader market, which has experienced fluctuations, and it has shown mixed momentum in relation to its moving averages.

Read MoreSalasar Techno Engineering Sees Surge in Trading Activity Amid Mixed Market Performance

2025-03-26 10:00:16Salasar Techno Engineering Ltd, a small-cap player in the Engineering - Industrial Equipment sector, has emerged as one of the most active equities today, with a total traded volume of 6,843,577 shares and a total traded value of approximately Rs 687.78 lakhs. The stock opened at Rs 10.55 and reached a day high of Rs 10.55, while the day low was recorded at Rs 9.86. As of the latest update, the last traded price (LTP) stands at Rs 10.05. Despite its active trading, Salasar Techno Engineering has underperformed its sector by 5.12% today, marking a reversal after three consecutive days of gains. The stock's performance is currently above its 5-day and 20-day moving averages but remains below the 50-day, 100-day, and 200-day moving averages, indicating mixed momentum. Investor participation has notably increased, with a delivery volume of 2.49 crore shares on March 25, reflecting a rise of 113.73% compared t...

Read MoreSalasar Techno Engineering Sees Surge in Trading Activity and Investor Participation

2025-03-25 10:00:20Salasar Techno Engineering Ltd, a small-cap player in the Engineering - Industrial Equipment sector, has emerged as one of the most active stocks by volume today. The company’s shares, trading under the symbol SALASAR, saw a total traded volume of 25,837,344 shares, with a total traded value of approximately Rs 2,795.60 lakhs. The stock opened at Rs 10.50, reaching a day high of Rs 11.30 and a day low of Rs 10.30, with a last traded price of Rs 10.31. Notably, Salasar Techno Engineering has outperformed its sector by 8.8% today, marking a 7.45% return for the day. Over the past three days, the stock has shown a remarkable upward trend, gaining 30.85% in returns. Investor participation has also increased, with a delivery volume of 1.53 crore shares on March 24, reflecting a 57.41% rise compared to the five-day average. The stock's liquidity remains robust, accommodating trade sizes of Rs 0.33 crore based ...

Read More

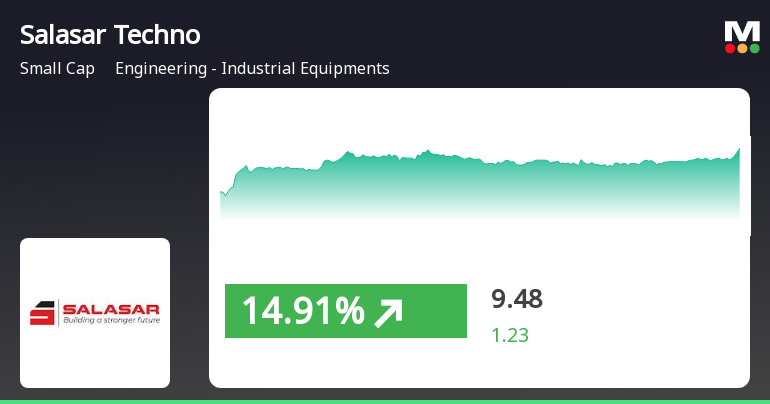

Salasar Techno Engineering Experiences Notable Stock Surge Amid Broader Market Gains

2025-03-25 09:35:23Salasar Techno Engineering has experienced notable trading activity, with significant gains and high volatility. The stock has outperformed its sector recently and achieved substantial returns over the past few days. However, its performance over the past year contrasts sharply with broader market trends, reflecting a significant decline.

Read MoreSalasar Techno Engineering Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-25 08:00:59Salasar Techno Engineering has recently undergone a valuation adjustment, reflecting its current standing in the engineering and industrial equipment sector. The company, categorized as a small-cap entity, has reported a price-to-earnings (PE) ratio of 34.03 and an enterprise value to EBITDA ratio of 16.53. These metrics indicate a competitive positioning within its industry, although they suggest a higher valuation compared to some peers. In terms of financial performance, Salasar Techno has a return on capital employed (ROCE) of 11.06% and a return on equity (ROE) of 7.65%. These figures provide insight into the company's efficiency in generating returns relative to its capital and equity. When compared to its peers, Salasar Techno's valuation metrics stand out. For instance, while it maintains an attractive valuation, other companies in the sector exhibit a wide range of valuation profiles, with some c...

Read MoreSalasar Techno Engineering Stock Surges Amid Increased Investor Participation and Volatility

2025-03-24 12:00:11Salasar Techno Engineering Ltd, a small-cap player in the Engineering - Industrial Equipment sector, has made headlines today as its stock hit the upper circuit limit, closing at an intraday high of Rs 9.67. This marks a significant increase of 19.98%, reflecting a change of Rs 1.61. The stock has shown remarkable performance, outperforming its sector by 18.91% and achieving a notable 20.27% rise over the past two days. Today's trading session saw a total volume of approximately 272.05 lakh shares, resulting in a turnover of Rs 24.73 crore. The stock traded within a wide range of Rs 1.53, with a low of Rs 8.14. Notably, the stock's volatility was high, with an intraday volatility of 6.73%, indicating active trading dynamics. In terms of moving averages, Salasar Techno Engineering's stock is currently above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day ave...

Read MoreDisclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

09-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Alok Kumar & Others

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

09-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Alok Kumar & Others

Board Meeting Outcome for Outcome Of The Board Meeting Held On 26.03.2025

26-Mar-2025 | Source : BSEPlease find enclosed outcome of the Board Meeting held today on 26.03.2025.

Corporate Actions

No Upcoming Board Meetings

Salasar Techno Engineering Ltd has declared 10% dividend, ex-date: 15 Sep 23

Salasar Techno Engineering Ltd has announced 1:10 stock split, ex-date: 27 Jun 22

Salasar Techno Engineering Ltd has announced 4:1 bonus issue, ex-date: 01 Feb 24

No Rights history available