Salzer Electronics Faces Technical Shift Amid Strong Financial Performance and Growing Institutional Interest

2025-04-02 08:19:47Salzer Electronics has experienced a recent evaluation adjustment influenced by technical indicators, reflecting a shift in market sentiment. Despite this, the company has shown strong financial performance, with significant growth in net sales and operating profit, alongside increased institutional interest, indicating confidence in its fundamentals.

Read MoreSalzer Electronics Faces Technical Trend Adjustments Amid Strong Long-Term Performance

2025-04-02 08:05:20Salzer Electronics, a small-cap player in the capital goods industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 1,070.25, slightly down from the previous close of 1,075.60. Over the past year, Salzer Electronics has shown notable performance, with a return of 32.15%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the MACD reflects a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands indicate a bearish trend weekly, contrasting with a mildly bullish stance monthly. Moving averages also suggest a mildly bearish trend on a daily basis. Salzer Electronics has experienced fluctuations in its stock price, with a 52-week high of 1,650....

Read MoreSalzer Electronics Shows Resilience Amid Mixed Market Performance and Long-Term Growth

2025-04-01 18:00:15Salzer Electronics Ltd, a small-cap player in the capital goods industry, has shown notable performance metrics amid fluctuating market conditions. With a market capitalization of Rs 1,913.00 crore, the company currently has a price-to-earnings (P/E) ratio of 27.30, significantly lower than the industry average of 40.35. Over the past year, Salzer Electronics has outperformed the Sensex, achieving a return of 32.15% compared to the index's 2.72%. However, recent trends indicate a mixed performance. Today, the stock experienced a slight decline of 0.50%, while the Sensex fell by 1.80%. In the past week, Salzer's stock decreased by 2.31%, slightly better than the Sensex's 2.55% drop. On a broader scale, the company has demonstrated impressive long-term growth, with a remarkable 448.99% increase over three years and an astounding 1645.92% rise over five years. Despite facing challenges in the short term, inc...

Read More

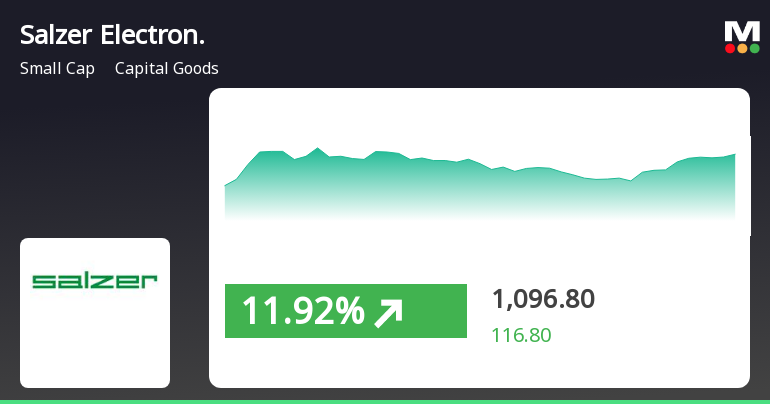

Salzer Electronics Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-24 09:35:23Salzer Electronics has shown notable stock activity, gaining 12.31% on March 24, 2025, and outperforming its sector. The stock opened with a significant gain and reached an intraday high, reflecting high volatility. Over the past year, it has delivered a return of 25.88%, surpassing the Sensex's performance.

Read MoreSalzer Electronics Opens Strong with 18.88% Gain, Outperforming Sector Trends

2025-03-24 09:35:20Salzer Electronics, a small-cap player in the capital goods sector, has shown significant activity today, opening with a notable gain of 18.88%. The stock has outperformed its sector by 11.05%, reflecting a strong performance relative to broader market trends. Over the past two days, Salzer Electronics has delivered a cumulative return of 14.31%, indicating a positive momentum. Today, the stock reached an intraday high of Rs 1165, showcasing high volatility with an intraday fluctuation of 8.95%. In terms of moving averages, the stock is currently above its 5-day, 20-day, and 200-day averages, while remaining below the 50-day and 100-day averages, suggesting mixed short-term trends. In the context of broader market performance, Salzer Electronics has achieved a 10.98% gain over the past day, significantly outperforming the Sensex, which rose by only 0.53%. Over the last month, the stock has also outpaced t...

Read MoreSalzer Electronics Shows Mixed Technical Trends Amid Strong Long-Term Growth Performance

2025-03-18 08:02:09Salzer Electronics, a small-cap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 884.55, showing a notable shift from its previous close of 865.80. Over the past year, Salzer Electronics has demonstrated a robust performance with a return of 30.68%, significantly outpacing the Sensex, which recorded a return of 2.10% in the same period. In terms of technical indicators, the company's moving averages on a daily basis suggest a positive trend, while the monthly MACD indicates a mildly bearish stance. The Bollinger Bands present a mixed picture, with a mildly bearish outlook on the weekly chart and a mildly bullish perspective on the monthly chart. The KST shows a bearish trend weekly but flips to bullish on a monthly basis, indicating some volatility in market sentiment. Notably, Salzer Electronics has ...

Read More

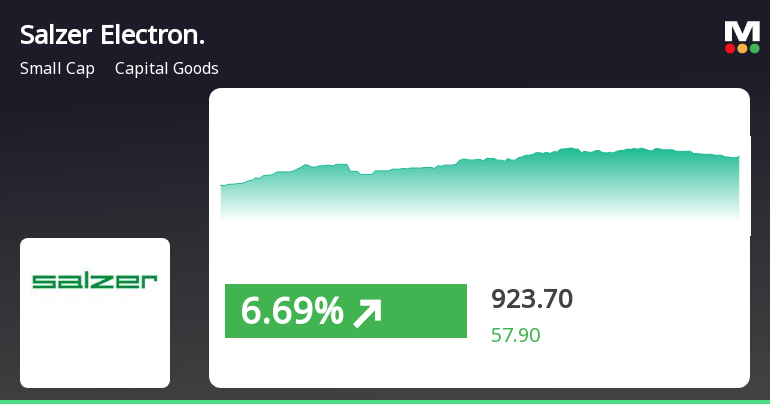

Salzer Electronics Shows Strong Performance Amid Broader Market Trends and Mixed Indicators

2025-03-17 10:45:21Salzer Electronics has experienced notable activity, gaining 7.01% on March 17, 2025, and outperforming its sector. The stock reached an intraday high of Rs 921 and has shown positive momentum with an 8.19% return over two days, reflecting resilience compared to broader market trends.

Read MoreSalzer Electronics Faces Mixed Technical Signals Amid Market Volatility

2025-03-11 08:02:44Salzer Electronics, a small-cap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 897.70, down from a previous close of 953.20, with a notable 52-week high of 1,650.00 and a low of 627.00. Today's trading saw a high of 971.95 and a low of 889.95, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands indicate a bearish trend weekly but a mildly bullish stance monthly. Moving averages suggest a mildly bullish outlook on a daily basis, while the KST reflects a mildly bearish trend weekly and bullish monthly. Dow Theory also indicates a mildly b...

Read MoreSalzer Electronics Faces Mixed Technical Signals Amid Market Volatility

2025-03-11 08:02:44Salzer Electronics, a small-cap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 897.70, down from a previous close of 953.20, with a notable 52-week high of 1,650.00 and a low of 627.00. Today's trading saw a high of 971.95 and a low of 889.95, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands indicate a bearish trend weekly but a mildly bullish stance monthly. Moving averages suggest a mildly bullish outlook on a daily basis, while the KST reflects a mildly bearish trend weekly and bullish monthly. Dow Theory also indicates a mildly b...

Read MoreCompliance Certificate For The Period Ended 31.03.2025

07-Apr-2025 | Source : BSEFiling of Compliance certificate under Reg.7(3) of SEBI(LODR)for the period ended 31.03.2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEFiling of compliance certificate under Reg. 74(5) of SEBI (DP)

Announcement under Regulation 30 (LODR)-Newspaper Publication

04-Apr-2025 | Source : BSEFiling of paper clipping of advertisement of Notice of Postal Ballot in the newspapers

Corporate Actions

No Upcoming Board Meetings

Salzer Electronics Ltd has declared 25% dividend, ex-date: 30 Aug 24

No Splits history available

No Bonus history available

No Rights history available