Samkrg Pistons Faces Declining Sales and Profit Amid Broader Market Gains

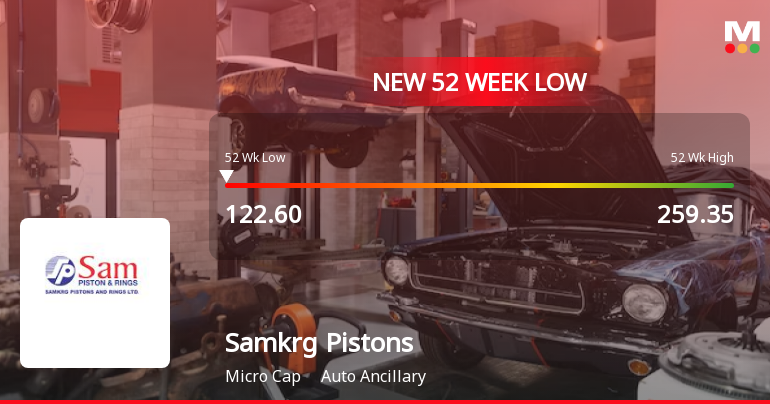

2025-03-28 11:40:15Samkrg Pistons & Rings, an auto ancillary microcap, has reached a new 52-week low, reflecting a year-long decline of 12.89%. Financial metrics indicate challenges, including decreasing net sales and operating profit. Despite a low debt-to-equity ratio and decent ROCE, the stock's underperformance raises concerns for investors.

Read More

Samkrg Pistons Faces Market Challenges Amid Broader Sector Volatility and Declining Sales

2025-03-26 15:36:32Samkrg Pistons & Rings has faced notable volatility, reaching a new 52-week low and experiencing a three-day losing streak. Over the past year, the company has underperformed compared to the broader market, with declining net sales and profit metrics. Despite low debt levels, technical indicators suggest ongoing market concerns.

Read More

Samkrg Pistons Faces Continued Decline Amidst Weak Financial Performance and Market Volatility

2025-03-17 10:06:17Samkrg Pistons & Rings, a microcap in the auto ancillary sector, has seen notable volatility, reaching a new 52-week low. The stock has declined for four consecutive days and is trading below key moving averages. Financial metrics indicate a decline in net sales and operating profit over recent years.

Read More

Samkrg Pistons Hits New Low Amid Broader Auto Ancillary Sector Challenges

2025-03-03 10:35:34Samkrg Pistons & Rings, a microcap in the auto ancillary sector, has reached a new 52-week low, reflecting a significant performance decline. The stock has underperformed its sector and is trading below key moving averages, indicating a sustained downward trend amid broader challenges in the industry.

Read More

Samkrg Pistons Faces Significant Volatility Amidst Broader Market Gains

2025-02-18 11:53:00Samkrg Pistons & Rings, a microcap in the auto ancillary sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has declined consistently over the past three days and has faced challenges over the past year, contrasting with broader market gains.

Read More

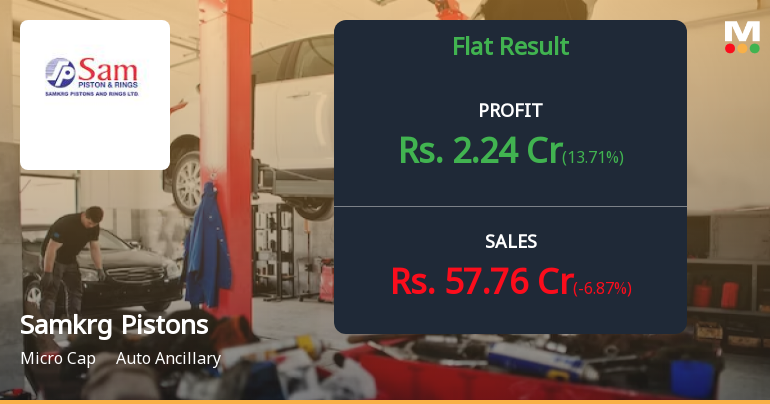

Samkrg Pistons Reports Mixed Financial Results for December Quarter, Highlights Key Performance Metrics

2025-02-06 16:11:48Samkrg Pistons & Rings has released its financial results for the quarter ending December 2024, showcasing a mixed performance. While the Debtors Turnover Ratio reached a five-period high, the company faced challenges with a significant decline in Profit After Tax and lower net sales compared to previous quarters.

Read More

Samkrg Pistons & Rings Reports Increased Profit Amidst Long-Term Growth Challenges

2025-02-01 18:29:54Samkrg Pistons & Rings, a microcap in the auto ancillary sector, has recently seen an evaluation adjustment. The company reported a significant profit increase for the nine months ending September 2024, alongside its highest operating cash flow. However, it faces challenges with declining net sales and operating profit over the past five years.

Read More

Samkrg Pistons Reports Strong Quarterly Profit Amid Long-Term Growth Challenges

2025-01-27 18:46:28Samkrg Pistons & Rings, an auto ancillary microcap, recently experienced a change in evaluation following a quarter of positive financial performance, marked by increased profit after tax and peak operating cash flow. However, challenges persist with declining net sales and operating profit over five years, alongside a bearish stock trend.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Samkrg Pistons & Rings Ltd- |

| 2 | CIN NO. | L27310TG1985PLC005423 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 15.93 |

| 4 | Highest Credit Rating during the previous FY | BBB+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY AND COMPLIANCE OFFICER

EmailId: investor@samkrg.com

Designation: Chief Financial Officer

EmailId: mgrfinance@samkrg.com

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Disclosure Under Regulation 31(4) Of SEBI (SAST) Regulations 2011 As Of March 31 2025

08-Apr-2025 | Source : BSESubmission of disclosure under Regulation 31(4) of SEBI (SAST) Regulations 2011 as on March 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSESubmission of Compliance Certificate under regulation 74(5) of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Samkrg Pistons & Rings Ltd has declared 20% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available