Sampann Utpadan India Ltd Faces Increased Volatility Amid Declining Investor Participation

2025-03-28 11:00:13Sampann Utpadan India Ltd, a microcap company in the Power Generation and Distribution sector, experienced significant trading activity today, hitting its lower circuit limit. The stock closed at Rs 27.00, reflecting a minor decline of Rs 0.01 or 0.04%. Throughout the trading session, it reached an intraday high of Rs 27.89 but fell to a low of Rs 25.65, marking a notable drop of 5.04% from its peak. The total traded volume for the day was approximately 0.03966 lakh shares, resulting in a turnover of Rs 0.0103 crore. The stock has been on a downward trend, underperforming its sector by 4.2% and recording a cumulative decline of 9.28% over the past five days. Additionally, it has been trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a sustained period of weakness. Today's trading was characterized by high volatility, with an intraday volatility of 7.1%. The delivery...

Read MoreSampann Utpadan India Ltd Navigates Market Volatility Amid Strong Historical Returns

2025-03-24 18:00:37Sampann Utpadan India Ltd, operating in the power generation and distribution sector, has shown significant activity in the market today, with its stock rising by 3.42%. This performance stands in contrast to the Sensex, which increased by 1.40%. The company's market capitalization is currently at Rs 110.00 crore, categorizing it as a microcap stock. Over the past year, Sampann Utpadan India has delivered a return of 31.89%, significantly outperforming the Sensex's 7.07% during the same period. However, the stock has faced challenges in the short term, with a year-to-date decline of 25.42%, while the Sensex has remained relatively stable, down only 0.20%. In terms of valuation, the company has a price-to-earnings (P/E) ratio of -34.23, which is notably lower than the industry average of 22.38. This discrepancy may reflect underlying financial challenges or market perceptions. Technical indicators sugge...

Read More

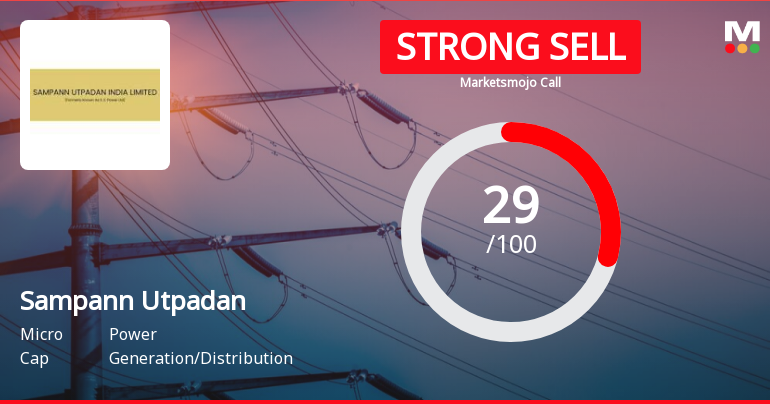

Sampann Utpadan India Faces Financial Challenges Amid Positive Sales Growth and High Debt

2025-03-19 08:11:04Sampann Utpadan India, a microcap in the power sector, has recently adjusted its evaluation, reflecting its market position. The company reported strong net sales and a solid debtors turnover ratio, but faces challenges with a high debt burden and a significant profit decline, highlighting its complex financial landscape.

Read MoreSampann Utpadan India Ltd Shows Resilience Amid Low Trading Volumes

2025-03-12 11:00:14Sampann Utpadan India Ltd, a microcap player in the Power Generation and Distribution sector, has shown significant activity today as it hit its upper circuit limit. The stock reached an intraday high of Rs 31.48, reflecting a notable increase of 4.97% from its previous close. This performance marks a 4.47% change, indicating a strong day for the company, which has outperformed its sector by 4.05%. The stock opened with a gap up of 2.5%, signaling positive momentum from the start of the trading session. Despite the strong performance, the total traded volume was relatively low at 0.00627 lakh shares, with a turnover of approximately Rs 0.001965645 crore. The last traded price stood at Rs 31.33, slightly below the day's high. In terms of moving averages, the stock is currently higher than its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Notably, investor p...

Read More

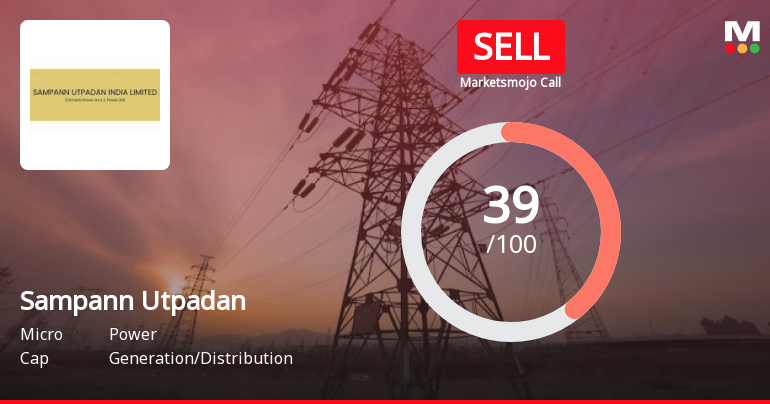

Sampann Utpadan India Faces Financial Risks Amid Positive Sales Growth and High Debt

2025-03-10 08:07:53Sampann Utpadan India, a microcap in the power sector, recently adjusted its evaluation, highlighting its financial performance with net sales of Rs 23.84 crore for December 2024. Despite a strong annual growth rate, the company faces challenges from a high debt burden and stagnant operating profit, indicating underlying financial risks.

Read MoreSampann Utpadan India Ltd Hits Upper Circuit Amid Declining Investor Participation

2025-03-06 15:00:10Sampann Utpadan India Ltd, operating in the Power Generation and Distribution sector, has shown remarkable activity today as it hit its upper circuit limit. The stock reached an intraday high of Rs 31.21, reflecting a notable increase of 4.98% from its previous close. This surge contributed to a total change of Rs 1.33, marking a percentage change of 4.47%. The stock opened with a gap up of 2.59% and has been on a positive trajectory, gaining for the last three consecutive days with a cumulative return of 12.32% during this period. Despite the positive performance, the stock's delivery volume has seen a decline of 32.48% compared to the five-day average, indicating a potential shift in investor participation. With a market capitalization of Rs 126.58 crore, Sampann Utpadan India Ltd remains a microcap player in its industry. The total traded volume today was approximately 0.06886 lakh shares, resulting in...

Read MoreSampann Utpadan India Ltd Sees Strong Buying Activity Amid Price Gains

2025-03-05 13:40:10Sampann Utpadan India Ltd is witnessing significant buying activity, with the stock rising by 4.98% today, notably outperforming the Sensex, which gained only 1.01%. This marks a positive shift in the stock's performance, especially considering its 1-week gain of 1.16% compared to the Sensex's decline of 1.17%. However, over the past month, Sampann Utpadan has faced a decline of 16.23%, while the Sensex fell by 5.81%. The stock's performance over longer periods shows a mixed trend. Over three years, Sampann Utpadan has increased by 62.02%, significantly higher than the Sensex's 35.69%. In the five-year span, it has surged by an impressive 1350.24%, compared to the Sensex's 91.64%. Over ten years, the stock has risen by 408.21%, while the Sensex has increased by 150.35%. Today's trading saw an open gap up, indicating strong buyer sentiment. The stock is currently above its 5-day moving average but remains ...

Read MoreSampann Utpadan India Ltd Hits Upper Circuit Limit Amid Mixed Long-Term Trends

2025-03-05 13:01:14Sampann Utpadan India Ltd, a microcap company in the Power Generation and Distribution sector, has made headlines today by hitting its upper circuit limit. The stock reached a high price of 29.73, reflecting a notable change of 1.38. The last traded price stands at 29.7, indicating a strong performance in the market. Today's trading session saw a total traded volume of approximately 0.25315 lakh shares, resulting in a turnover of around 0.072 crore. The stock outperformed its sector by 0.58%, showcasing its resilience amid market fluctuations. While it is currently above its 5-day moving average, it remains below the 20-day, 50-day, 100-day, and 200-day moving averages, indicating mixed trends in its longer-term performance. Despite a significant drop in delivery volume, which fell by 72.33% compared to the 5-day average, the stock's liquidity remains adequate for trading. With a market capitalization of ...

Read More

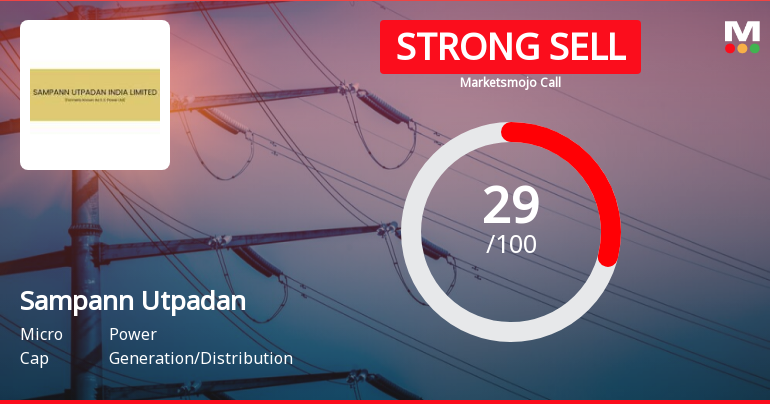

Sampann Utpadan India Reports Strong Sales Amid High Debt Concerns and Profit Decline

2025-03-05 08:12:22Sampann Utpadan India, a microcap in the power sector, has reported strong third-quarter financials, including record net sales of Rs 23.84 crore. However, the company faces challenges with a high debt burden and stagnant operating profit, raising concerns about its long-term financial health despite recent stock performance.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSETrading Window for dealing in the Securities of the Company by the Designated Person and their immediate relative shall remail close from 1 April 2025 to till 48 hours after declaration of financial results by the Company for the quarter and year ended 31.03.2025

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

05-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for UNICO Global Opportunities Fund Ltd

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

05-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for EBISU Global Opportunities Fund Ltd

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available