Sandhar Technologies Shows Mixed Technical Trends Amid Market Volatility

2025-04-03 08:05:43Sandhar Technologies Limited, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 397.00, showing a slight increase from the previous close of 384.95. Over the past year, Sandhar Technologies has faced challenges, with a return of -23.6%, contrasting with a 3.67% gain in the Sensex during the same period. In terms of technical indicators, the MACD and KST metrics indicate a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish trend, suggesting some volatility in the stock's performance. Moving averages on a daily basis align with this sentiment, indicating a cautious market stance. Despite these technical trends, Sandhar Technologies has shown resilience in shorter time frames, with a notable return of ...

Read MoreSandhar Technologies Adjusts Valuation Grade Amid Competitive Auto Ancillary Landscape

2025-04-02 08:02:34Sandhar Technologies Limited, a player in the auto ancillary sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company currently boasts a price-to-earnings (PE) ratio of 17.18 and a price-to-book value of 2.17. Its enterprise value to EBITDA stands at 7.87, while the EV to EBIT is recorded at 14.24. Additionally, Sandhar's PEG ratio is notably low at 0.46, indicating potential growth relative to its earnings. In terms of profitability, Sandhar Technologies has a return on capital employed (ROCE) of 11.98% and a return on equity (ROE) of 12.19%. The company also offers a dividend yield of 0.83%. When compared to its peers, Sandhar Technologies demonstrates a competitive edge with its valuation metrics. For instance, while Banco Products and Sharda Motor are categorized as attractive, they exhibit higher PE ratios and EV to EBITDA figures. In c...

Read MoreSandhar Technologies Shows Mixed Technical Trends Amid Strong Short-Term Performance

2025-03-25 08:05:29Sandhar Technologies Limited, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 413.10, showing a notable movement from the previous close of 405.35. Over the past week, Sandhar Technologies has demonstrated a strong performance with a return of 18.84%, significantly outpacing the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands also indicate a mildly bearish trend, aligning with the overall technical summary. Notably, the stock's moving averages reflect a mildly bearish stance on a daily basis, while the On-Balance Volume (OBV) shows a bullish trend on a monthly scale. Looking at the company's performance over v...

Read More

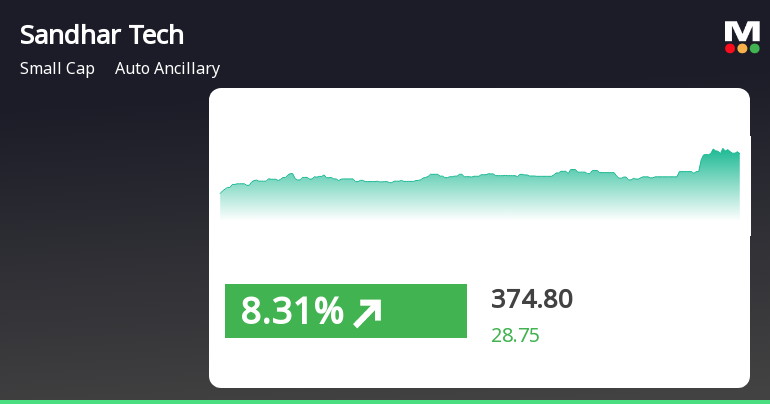

Sandhar Technologies Shows Strong Short-Term Gains Amid High Volatility in Auto Sector

2025-03-05 12:50:27Sandhar Technologies Limited, a small-cap auto ancillary firm, experienced a significant rise on March 5, 2025, outperforming its sector. The stock has shown consecutive gains over three days, reaching an intraday high while displaying high volatility. Despite recent gains, it has faced challenges with a year-to-date decline.

Read More

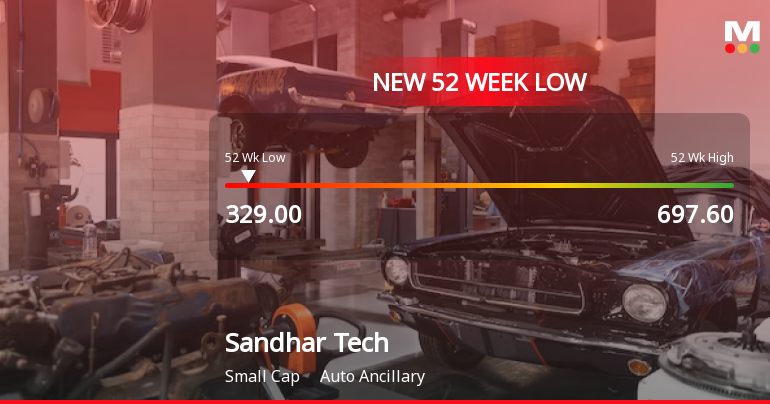

Sandhar Technologies Hits 52-Week Low Amidst Signs of Potential Trend Reversal

2025-03-03 14:21:11Sandhar Technologies Limited, a small-cap auto ancillary firm, reached a new 52-week low today, reflecting a significant decline over the past year. Despite this, the stock showed signs of recovery with a gain after several days of losses, although it remains below key moving averages.

Read More

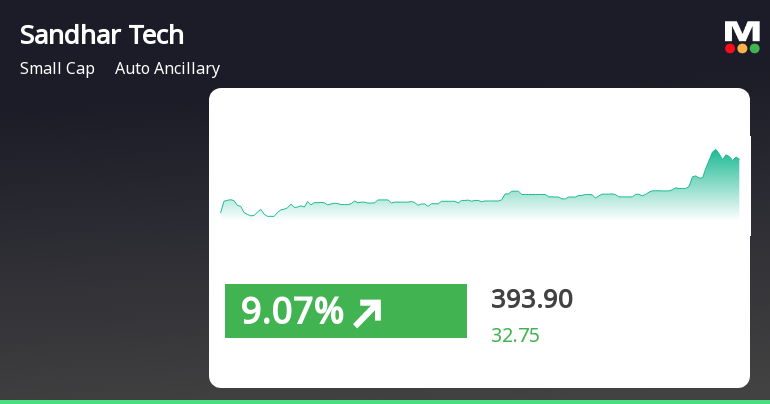

Sandhar Technologies Shows Strong Short-Term Gains Amid Sector Volatility

2025-02-20 11:50:26Sandhar Technologies Limited, a small-cap auto ancillary company, saw notable trading activity on February 20, 2025, with significant gains and high volatility. The stock reached an intraday high of Rs 405.65 and has outperformed its sector recently, despite a less favorable performance over the past month.

Read More

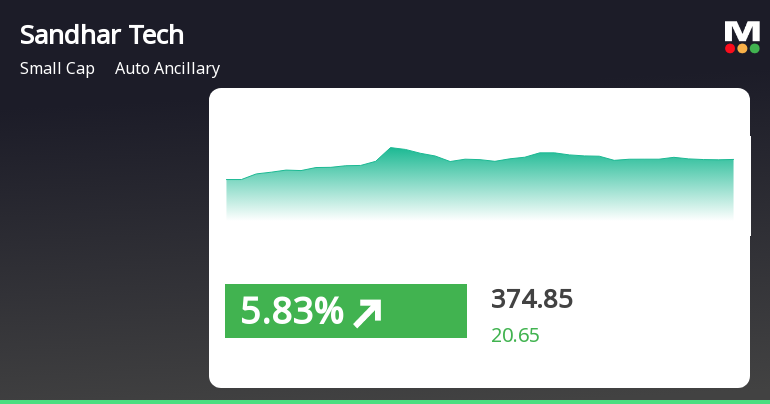

Sandhar Technologies Shows Significant Turnaround Amidst Ongoing Market Volatility

2025-02-19 09:35:32Sandhar Technologies Limited, a small-cap auto ancillary firm, experienced a notable rebound on February 19, 2025, after eight days of decline. The stock outperformed its sector and reached an intraday high, although it remains below key moving averages, reflecting ongoing volatility and challenges in the broader market.

Read More

Sandhar Technologies Faces Significant Volatility Amidst Declining Stock Performance

2025-02-17 09:41:15Sandhar Technologies Limited, a small-cap auto ancillary company, has seen significant volatility, hitting a new 52-week low of Rs. 330.15. The stock has declined 24.98% over the past week and is trading below all major moving averages, reflecting a challenging trend compared to the broader market.

Read MoreSandhar Technologies Faces Significant Volatility Amidst Extended Decline in Auto Ancillary Sector

2025-02-17 09:35:43Sandhar Technologies Limited, a small-cap player in the auto ancillary sector, has experienced significant volatility in today's trading session. The stock opened with a notable loss of 9.53%, reflecting a broader trend of decline, as it has now fallen for seven consecutive days, accumulating a total drop of 21.4% over this period. Today, Sandhar Technologies hit a new 52-week low of Rs. 330.15, marking a decline of 9.94% at its intraday low. The stock's performance has underperformed its sector by 2.66%, with a one-day decline of 7.38% compared to the Sensex's modest drop of 0.66%. Over the past month, the stock has seen a steep decline of 26.87%, while the Sensex has only decreased by 1.54%. Additionally, Sandhar Technologies is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. The high volatility observed today, with an intraday volat...

Read MoreAnnouncement under Regulation 30 (LODR)-Diversification / Disinvestment

08-Apr-2025 | Source : BSEUpdate on previous intimation dated 27th March 2025-Disinvestment of joint Venture namely Jinyoung Sandhar Mechatronics Private Limited.

Announcement under Regulation 30 (LODR)-Credit Rating

31-Mar-2025 | Source : BSEPlease Find attached Credit Rating received from ICRA Limited dated 31-03-2025

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Sandhar Technologies Limited has declared 32% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available