Sangal Papers Faces Significant Volatility Amid Weak Fundamentals and High Debt Concerns

2025-03-11 15:06:38Sangal Papers, a microcap in the Paper & Paper Products sector, hit a new 52-week low amid significant trading volatility. The company's fundamentals show weaknesses, including a low Return on Capital Employed and a high Debt to EBITDA ratio, compounded by a substantial percentage of pledged promoter shares.

Read More

Sangal Papers Faces Significant Volatility Amidst Ongoing Market Challenges

2025-03-03 14:20:28Sangal Papers, a microcap in the Paper & Paper Products sector, has hit a new 52-week low of Rs. 172 amid significant volatility. The stock has underperformed its sector and has consistently traded below key moving averages, reflecting ongoing challenges in the market over the past year.

Read More

Sangal Papers Faces Significant Volatility Amidst Persistent Downward Trend in Market

2025-02-28 13:35:32Sangal Papers, a microcap in the Paper & Paper Products sector, has faced significant volatility, hitting a new 52-week low. The stock has shown erratic trading patterns and is currently below all major moving averages, reflecting ongoing challenges in the market, with a year-over-year decline contrasting with the Sensex's modest gain.

Read More

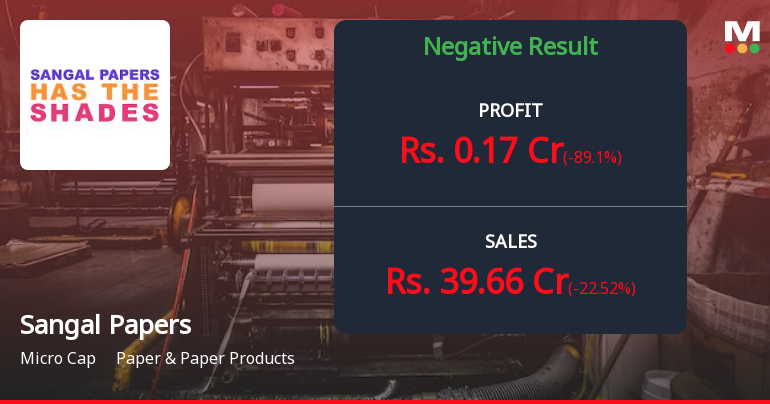

Sangal Papers Reports Decline in Financial Performance Amid Operational Challenges in December 2024

2025-02-13 18:32:03Sangal Papers has released its financial results for the quarter ending December 2024, revealing a decline in key metrics. Profit Before Tax and Profit After Tax have decreased significantly, while net sales and operating profit margins have also fallen. The Debtors Turnover Ratio indicates challenges in debt settlement.

Read More

Sangal Papers Reports Strong Q2 FY24-25 Results Amid Long-Term Financial Challenges

2025-02-10 18:36:47Sangal Papers, a microcap in the Paper & Paper Products sector, recently adjusted its evaluation following positive Q2 FY24-25 results, including a significant profit before tax and record net sales. However, the company faces long-term challenges, including a high debt-to-EBITDA ratio and pledged promoter shares.

Read More

Sangal Papers Reports Q2 FY24-25 Profit Growth Amid Long-Term Financial Challenges

2025-02-03 18:20:16Sangal Papers, a microcap in the Paper & Paper Products sector, recently adjusted its evaluation following a strong second quarter FY24-25, marked by significant profit growth. However, challenges persist, including weak long-term fundamentals, a high Debt to EBITDA ratio, and a substantial portion of pledged promoter shares.

Read MoreCOMPLIANCE CERTIFICATE UNDER REGULATION 40(9) OF SEBI (LODR) REGULATIONS 2015.

08-Apr-2025 | Source : BSECOMPLIANCE CERTIFICAE UNDER REGULATION 40(9) OF SEBI (LODR) REGULATIONS 2015.

Disclosure Under Regulation 31(4) Of SEBI(Substantial Acquisition Of Shares And Takeover)Regulations 2011 For The F. Y. Ended 31/03/2025

05-Apr-2025 | Source : BSEDisclosure under Regulation 31(4) of SEBI (SAST) Regulations 2011.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificat under Regulation 74(5) of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available