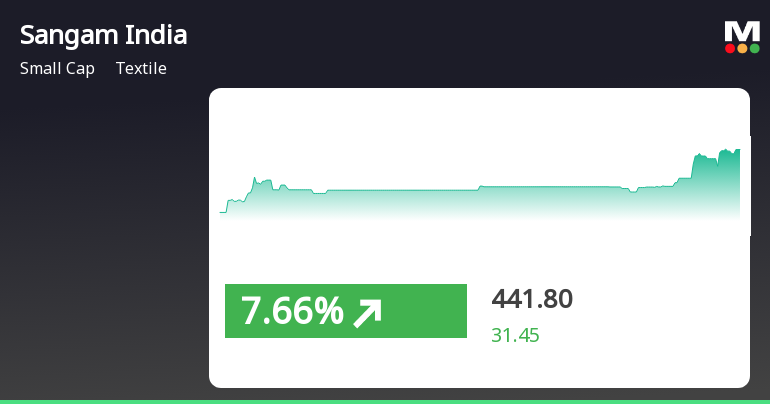

Sangam (India) Shows Resilience with Notable Rebound Amid Market Volatility

2025-04-03 14:45:22Sangam (India), a small-cap textile company, experienced notable trading activity on April 3, 2025, reversing a two-day decline. The stock showed high volatility, reaching an intraday high after opening lower. Over the past month, it has significantly outperformed the Sensex, reflecting strong market resilience.

Read MoreSangam India Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-25 08:02:04Sangam India, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 413.30, showing a notable increase from the previous close of 344.15. Over the past year, Sangam India has experienced a 0.34% return, while the Sensex has returned 7.07% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Interestingly, Bollinger Bands indicate a bullish trend on both weekly and monthly scales, suggesting some volatility in price movements. The daily moving averages reflect a mildly bearish sentiment, while the KST shows a bearish trend on a weekly basis and mildly bearish on a monthly basis. Sangam India's performance over various time frames ...

Read MoreSangam India Experiences Valuation Grade Change Amid Strong Stock Performance and Industry Resilience

2025-03-25 08:00:20Sangam India, a small-cap player in the textile industry, has recently undergone a valuation adjustment. The company's current price stands at 413.30, reflecting a significant rise from the previous close of 344.15. Over the past week, Sangam has demonstrated a robust stock return of 30.26%, outperforming the Sensex, which returned 5.14% in the same period. Key financial metrics for Sangam include a PE ratio of 51.34 and an EV to EBITDA ratio of 12.84. The company also shows a dividend yield of 0.48% and a return on capital employed (ROCE) of 5.94%. In comparison to its peers, Sangam's valuation metrics indicate a relatively higher PE ratio, while its EV to EBITDA ratio is more favorable than some competitors, suggesting a competitive position within the market. When looking at the broader industry landscape, Sangam's performance over the past five years has been remarkable, with a return of 1011.02%, sig...

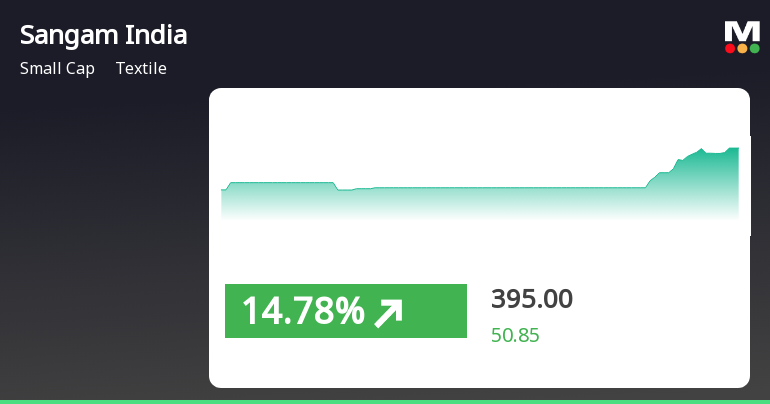

Read MoreSangam (India) Ltd Experiences Surge in Buying Activity and Price Momentum

2025-03-24 14:45:06Sangam (India) Ltd is witnessing significant buying activity, with the stock surging by 20.09% today, notably outperforming the Sensex, which gained only 1.41%. Over the past week, Sangam has recorded a remarkable 30.26% increase, reflecting strong momentum as it has experienced consecutive gains for the last five days. The stock reached an intraday high of Rs 413.3, indicating robust buyer interest. In terms of longer-term performance, Sangam has shown resilience, with a 41.66% increase over the past three years, compared to the Sensex's 35.41%. Over five years, the stock has skyrocketed by 1011.02%, significantly outpacing the Sensex's 192.38% growth. Despite a slight decline of 2.74% over the last three months, the stock's recent performance highlights a resurgence in buyer confidence. Factors contributing to the current buying pressure may include positive market sentiment within the textile industry ...

Read More

Sangam (India) Stock Surges Amid Broader Market Gains and High Volatility

2025-03-24 11:35:20Sangam (India), a small-cap textile company, saw notable stock activity on March 24, 2025, with a significant increase. The stock has shown a strong upward trend over the past week, reaching an intraday high amid high volatility. In contrast, its performance over the last three months indicates a decline.

Read MoreSangam India Adjusts Valuation Grade Amidst Competitive Textile Industry Landscape

2025-03-18 08:00:26Sangam India, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 317.30, with a previous close of 329.15. Over the past year, Sangam has experienced a stock return of -18.05%, contrasting with a modest 2.10% return from the Sensex. Key financial metrics for Sangam include a PE ratio of 39.41 and an EV to EBITDA ratio of 10.94, which positions it distinctly within its industry. The company's return on capital employed (ROCE) stands at 5.94%, while its return on equity (ROE) is recorded at 4.29%. Additionally, Sangam's dividend yield is 0.63%, indicating a commitment to shareholder returns. When compared to its peers, Sangam's valuation metrics highlight a competitive landscape. For instance, Indo Count Industries and Sanathan Textile also hold attractive valuations, while Lux Industries and ...

Read More

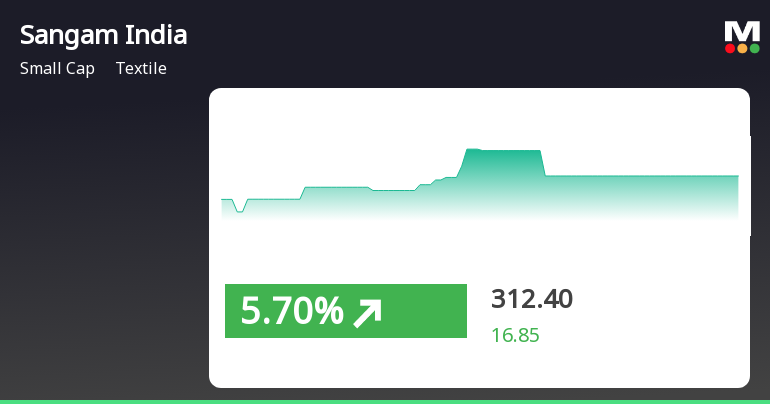

Sangam (India) Stock Rebounds Amid Broader Small-Cap Market Recovery

2025-03-05 10:15:22Sangam (India), a small-cap textile company, experienced a notable stock price increase on March 5, 2025, reversing a six-day decline. Despite today's gains, the stock remains below key moving averages and has faced significant declines over the past week, month, and year, reflecting ongoing market challenges.

Read MoreSangam India Experiences Valuation Grade Change Amidst Market Performance Challenges

2025-03-05 08:00:22Sangam India, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (PE) ratio of 36.71 and a price-to-book value of 1.49, indicating its market valuation relative to its book value. Additionally, its enterprise value to EBITDA stands at 10.51, while the EV to EBIT is recorded at 18.65, showcasing its operational efficiency. In terms of returns, Sangam India has faced challenges over various periods, with a year-to-date return of -28.61%, significantly underperforming compared to the Sensex, which returned -6.59% in the same timeframe. Over the past year, the company's stock has declined by 38.96%, contrasting sharply with the Sensex's modest drop of 1.19%. However, looking at a longer horizon, Sangam has shown resilience with a five-year return of 468.91%, outperforming the...

Read More

Sangam (India) Faces Significant Stock Volatility Amidst Textile Market Challenges

2025-03-03 10:06:04Sangam (India), a small-cap textile company, is experiencing notable stock volatility, currently trading close to its 52-week low. The stock has declined significantly over the past year, underperforming its sector and indicating a bearish trend across various moving averages, reflecting ongoing challenges in the competitive market.

Read MoreRevised Intimation Regarding Fire Incident

26-Mar-2025 | Source : BSERevised Intimation regarding Fire Incident occurred at Denim Division located at Village Billiya Kalan Chittorgarh Road Bhilwara under Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements) Regulation 2015.

Clarification sought from Sangam India Ltd

26-Mar-2025 | Source : BSEThe Exchange has sought clarification from Sangam India Ltd on March 26 2025 with reference to significant movement in price in order to ensure that investors have latest relevant information about the company and to inform the market so that the interest of the investors is safeguarded.

The reply is awaited.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Sangam (India) Ltd has declared 20% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

No Rights history available