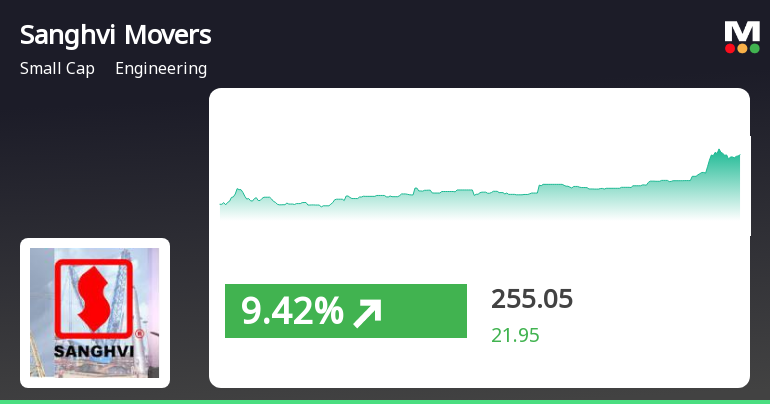

Sanghvi Movers Experiences Significant Reversal Amid Broader Market Recovery Trends

2025-03-27 13:45:20Sanghvi Movers, a small-cap engineering firm, experienced notable trading activity on March 27, 2025, reversing a three-day decline. The stock reached an intraday high of Rs 257.8 amid high volatility. While it has outperformed the Sensex over the past week, it remains down year-to-date.

Read MoreSanghvi Movers Adjusts Valuation Grade Amidst Challenging Market Conditions

2025-03-27 08:00:10Sanghvi Movers, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 233.10, with a previous close of 238.35. Over the past year, Sanghvi Movers has faced significant challenges, posting a stock return of -62.68%, contrasting sharply with the Sensex's gain of 6.65% during the same period. Key financial metrics reveal a price-to-earnings (PE) ratio of 12.31 and an EV to EBITDA ratio of 6.44, indicating a competitive position within its industry. The company's return on capital employed (ROCE) is reported at 17.81%, while the return on equity (ROE) stands at 15.92%. In comparison to its peers, Sanghvi Movers presents a more favorable valuation profile, particularly when juxtaposed with companies like GMM Pfaudler and MTAR Technologies, which exhibit significantly higher PE ratios and ...

Read More

Sanghvi Movers Faces Valuation Shift Amid Mixed Financial Indicators and Underperformance

2025-03-24 08:04:00Sanghvi Movers, a small-cap engineering firm, has recently experienced a score adjustment reflecting changes in its financial metrics and market position. The company shows mixed technical trends and significant underperformance over the past year, yet maintains strong management efficiency and a solid ability to service its debt.

Read More

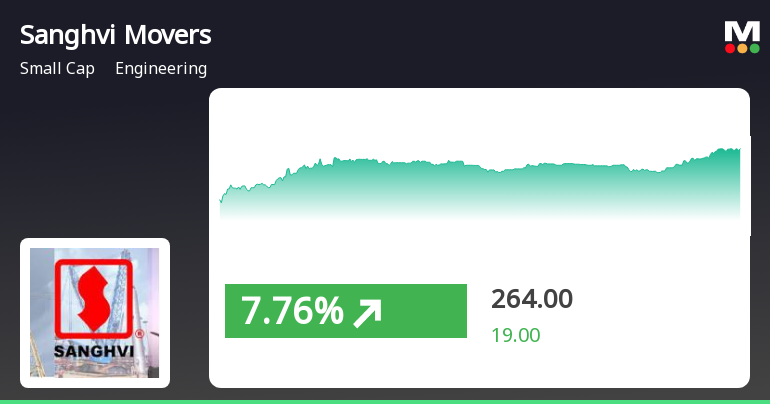

Sanghvi Movers Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 14:45:22Sanghvi Movers, a small-cap engineering firm, has seen notable activity, outperforming its sector recently. The stock has shown a strong upward trend over the past week, reaching an intraday high. Meanwhile, the broader market, including the Sensex and BSE Small Cap index, has also experienced gains.

Read MoreSanghvi Movers Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-21 08:00:25Sanghvi Movers, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 245.00, showing a notable increase from the previous close of 239.30. Over the past week, Sanghvi Movers has demonstrated a stock return of 7.24%, significantly outperforming the Sensex, which returned 3.41% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans towards a mildly bearish stance. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands and Moving Averages indicate a bearish trend on a daily basis, while the KST reflects a bearish outlook on a weekly basis but mildly bearish on a monthly scale. Sanghvi Movers has experienced a challenging year, with a year-to-date retu...

Read More

Sanghvi Movers Faces Reevaluation Amid Shifting Market Sentiment and Valuation Concerns

2025-03-20 08:05:12Sanghvi Movers, a small-cap engineering firm, has experienced a recent evaluation adjustment due to changes in technical indicators and valuation metrics. The company faces financial challenges, particularly in profitability, while maintaining strong management efficiency and debt management. Its stock has underperformed compared to broader market indices over the past year.

Read MoreSanghvi Movers Adjusts Valuation Amidst Mixed Performance in Engineering Sector

2025-03-20 08:00:07Sanghvi Movers, a small-cap player in the engineering sector, has recently undergone a valuation adjustment. The company's current price stands at 239.30, reflecting a slight increase from the previous close of 232.65. Over the past year, Sanghvi Movers has faced challenges, with a return of -53.26%, contrasting sharply with the Sensex's gain of 4.77% during the same period. However, the company has shown resilience over longer time frames, with a remarkable 697.00% return over the past five years, significantly outperforming the Sensex's 166.72%. Key financial metrics for Sanghvi Movers include a PE ratio of 12.64 and an EV to EBITDA ratio of 6.59, which position it within a competitive landscape. In comparison to its peers, Sanghvi Movers exhibits a lower valuation profile, particularly when contrasted with companies like Unimech Aerospace and MTAR Technologies, which are noted for their higher valuation...

Read MoreSanghvi Movers Faces Mixed Technical Trends Amidst Volatile Market Conditions

2025-03-19 08:00:47Sanghvi Movers, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 232.65, showing a slight increase from the previous close of 229.00. Over the past week, the stock has demonstrated a return of 4.09%, outperforming the Sensex, which returned 1.62% in the same period. Despite this short-term performance, the longer-term picture reveals challenges for Sanghvi Movers. Year-to-date, the stock has seen a decline of 24.14%, while the Sensex has only dipped by 3.63%. Over the past year, the stock's performance has been particularly concerning, with a significant drop of 55.99%, contrasting sharply with the Sensex's gain of 3.51%. Technical indicators present a mixed picture, with the MACD showing mildly bullish signals on a weekly basis but turning mildly bearish monthly. The Bollinger Bands and KST...

Read MoreSanghvi Movers Shows Mixed Technical Trends Amidst Market Challenges and Volatility

2025-03-18 08:00:39Sanghvi Movers, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 229.00, showing a slight increase from the previous close of 228.45. Over the past year, Sanghvi Movers has faced significant challenges, with a return of -57.01%, contrasting sharply with the Sensex's modest gain of 2.10% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and KST metrics also reflect a bearish sentiment in both weekly and monthly evaluations. Notably, the stock's moving averages indicate a bearish trend on a daily basis. In terms of returns, Sanghvi Movers has demonstrated resilience over longer periods, with a rem...

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

31-Mar-2025 | Source : BSESanghvi Movers Limited has informed the Exchange about the publication regarding dispatch of Postal Ballot Notice and E-voting information

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

28-Mar-2025 | Source : BSESanghvi Movers Limited has submitted the Postal Ballot Notice

Closure of Trading Window

28-Mar-2025 | Source : BSESanghvi Movers Limited has informed the Exchange about the Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Sanghvi Movers Ltd has declared 300% dividend, ex-date: 20 Aug 24

Sanghvi Movers Ltd has announced 1:2 stock split, ex-date: 27 Sep 24

No Bonus history available

No Rights history available