Sasken Technologies Faces Technical Trend Shifts Amid Market Volatility

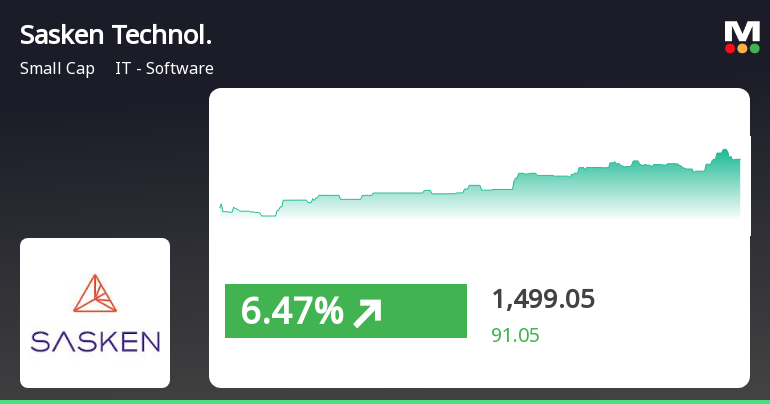

2025-03-25 08:04:24Sasken Technologies, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,483.65, showing a notable increase from the previous close of 1,408.00. Over the past week, the stock reached a high of 1,515.05 and a low of 1,401.00, indicating some volatility in its trading activity. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The Bollinger Bands also reflect a bearish outlook on a monthly basis. The daily moving averages are currently bearish, suggesting a cautious sentiment among traders. When comparing the company's performance to the Sensex, Sasken Technologies has shown varied returns over different periods. In the past week, the stock returned 9.53%, outperforming the Sensex, which retu...

Read MoreSasken Technologies Shows Short-Term Gains Amid Long-Term Performance Challenges

2025-03-24 18:00:23Sasken Technologies, a small-cap player in the IT software industry, has shown significant activity today, with its stock rising by 5.37%. This uptick comes against the backdrop of a broader market performance, as the Sensex increased by 1.40%. Over the past week, Sasken Technologies has outperformed the Sensex, with a weekly gain of 9.53% compared to the index's 5.14%. Despite today's positive movement, Sasken Technologies has faced challenges over the longer term. Its one-year performance stands at -4.15%, significantly lagging behind the Sensex, which has gained 7.07% in the same period. Year-to-date, the stock has declined by 30.02%, while the Sensex has remained relatively stable with a decrease of just 0.20%. In terms of valuation, Sasken Technologies has a price-to-earnings (P/E) ratio of 39.74, which is notably higher than the industry average of 30.59. This metric indicates that the stock may be ...

Read More

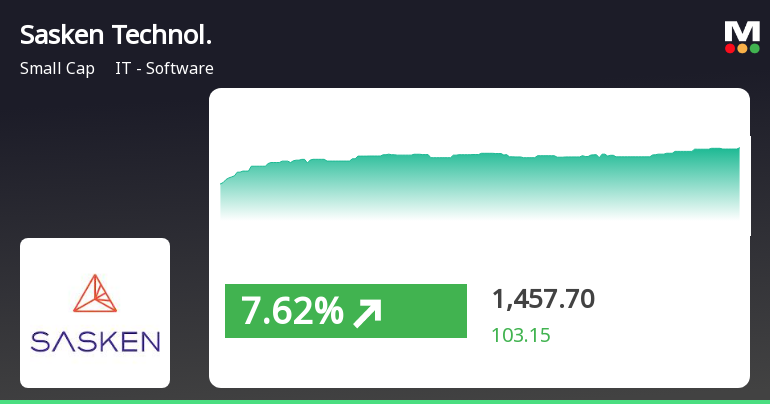

Sasken Technologies Shows Short-Term Gains Amid Mixed Long-Term Performance Trends

2025-03-24 14:50:21Sasken Technologies experienced notable trading activity, gaining 7.3% on March 24, 2025, and outperforming its sector. The stock's current price is above its 5-day moving average but below longer-term averages. Despite recent gains, it has faced challenges this year, with a year-to-date decline of 29.29%.

Read More

Sasken Technologies Shows Signs of Recovery Amid Broader Market Gains

2025-03-18 12:20:22Sasken Technologies experienced a significant rebound on March 18, 2025, after a week of declines, outperforming the broader market. Despite today's gains, the company has faced substantial losses over the past month and year-to-date, with its stock trading below key moving averages, indicating ongoing bearish trends.

Read MoreSasken Technologies Faces Mixed Technical Trends Amid Recent Market Challenges

2025-03-11 08:03:37Sasken Technologies, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,516.75, down from a previous close of 1,606.10, with a notable 52-week high of 2,365.55 and a low of 1,280.00. Today's trading saw a high of 1,617.70 and a low of 1,490.70. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish outlook. Moving averages present a mildly bullish signal on a daily basis, contrasting with the overall bearish sentiment observed in other metrics such as KST and Dow Theory. In terms of stock performance, Sasken Technologies has faced challenges compared to the Sensex. Over the past week, the stock returned -0.30%, while the Sensex gained 1.41%. The one-...

Read More

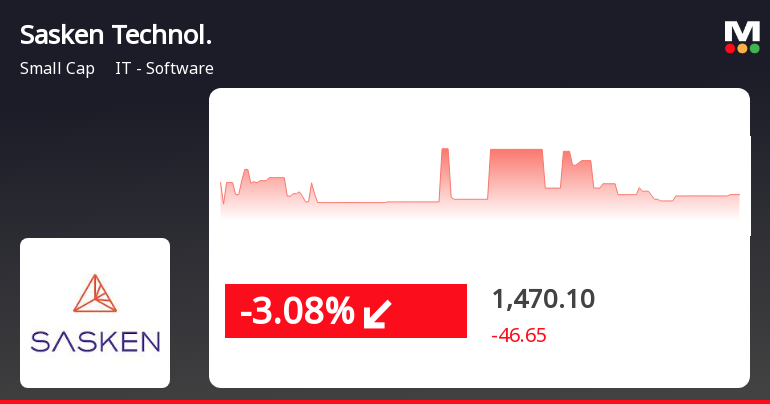

Sasken Technologies Faces Continued Decline Amid Broader Market Resilience

2025-03-10 15:30:32Sasken Technologies, a small-cap IT software firm, faced a notable decline on March 10, 2025, marking its third consecutive day of losses. The stock has underperformed against the broader market, with significant declines over the past month and year-to-date, and is trading below key moving averages.

Read MoreSasken Technologies Shows Mixed Technical Trends Amid Market Volatility

2025-03-06 08:02:00Sasken Technologies, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 1612.25, has shown a notable range in its performance, with a 52-week high of 2,365.55 and a low of 1,280.00. Today's trading saw the stock reach a high of 1661.00 and a low of 1579.65, indicating some volatility. In terms of technical indicators, the company exhibits a mixed picture. The MACD readings for both weekly and monthly periods are mildly bearish, while the Bollinger Bands show a bearish trend on a weekly basis but a mildly bullish outlook monthly. The moving averages present a mildly bullish signal on a daily basis, suggesting some short-term strength. When comparing Sasken's performance to the Sensex, the stock has faced challenges over various time frames. Over the past week, it recorded a return of -1.99%, underp...

Read MoreSasken Technologies Shows Mixed Technical Trends Amidst Long-Term Resilience in IT Sector

2025-03-03 08:01:26Sasken Technologies, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1613.35, showing a notable increase from the previous close of 1587.05. Over the past year, Sasken has experienced a 3.32% decline in stock return, contrasting with a 1.24% gain in the Sensex, highlighting a divergence in performance relative to the broader market. In terms of technical metrics, the MACD indicates a mildly bearish trend on a weekly basis, while the monthly perspective remains bullish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly evaluations. Additionally, Bollinger Bands reflect a bearish stance weekly but are mildly bullish on a monthly basis. Moving averages present a mildly bullish outlook daily, while the KST and Dow Theory metrics indica...

Read MoreSasken Technologies Shows Mixed Technical Trends Amidst Market Challenges and Long-Term Resilience

2025-03-02 08:01:24Sasken Technologies, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting current market dynamics. The company's stock price is currently at 1613.35, showing a slight increase from the previous close of 1587.05. Over the past year, Sasken has experienced a 3.32% decline, contrasting with a 1.24% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and KST suggest a mildly bearish sentiment, while the monthly MACD remains bullish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts, indicating a period of consolidation. Additionally, Bollinger Bands reflect a bearish trend on the weekly scale but are mildly bullish monthly. Sasken's stock has faced notable fluctuations, with a 52-week high of 2,365.55 and a low of 1,280.00. ...

Read MoreAnnouncement under Regulation 30 (LODR)-Scheme of Arrangement

08-Apr-2025 | Source : BSEThis is in continuation to our letter dated 9th November 2024 wherein we have informed your goodselves that the Board of Directors of the Company have considered and approved a proposal to acquire 100% share capital of BORQS International Holding Corp. along with its identified wholly owned subsidiaries (Target entities) either directly or through any of the subsidiaries. Sasken Design Solutions Pte. Ltd. a wholly owned subsidiary of the Company with its registered office in Singapore acquired 100% share capital of the BORQS International Holding Corp. for an aggregate consideration (including earn-outs) not exceeding US$ 40 million (up to ~Rs. 338 crores) subject to adjustments / completion of specified conditions as set out in the Share Purchase Agreement dated 8th April 2025. Following this acquisition the said target entities will become Step Down Subsdiaries (SDS) of the Company effective 8th April 2025. Kindly take the same on record.

Announcement under Regulation 30 (LODR)-Updates on Acquisition

08-Apr-2025 | Source : BSEThis is in continuation to our letter dated 9th November 2024 wherein we have informed your goodselves that the Board of Directors of the Company have considered and approved a proposal to acquire 100% share capital of BORQS International Holding Corp. along with its identified wholly owned subsidiaries (Target entities) either directly or through any of the subsidiaries. Please find enclosed letter and take the same on record.

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations) - Completion Of Acquisition

08-Apr-2025 | Source : BSEIn continuation to our letter dated 9th November 2024 please find enclosed letter regarding completion of acquisition. Kindly take the same on record.

Corporate Actions

No Upcoming Board Meetings

Sasken Technologies Ltd has declared 120% dividend, ex-date: 05 Nov 24

No Splits history available

No Bonus history available

No Rights history available