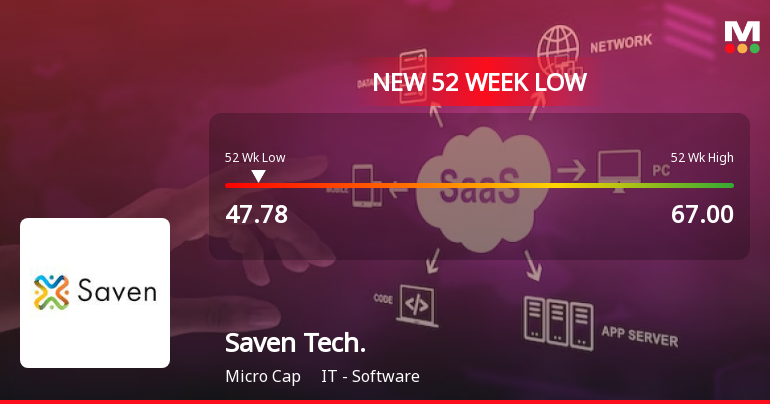

Saven Technologies Hits 52-Week Low Amid Ongoing Operational Challenges and Declining Performance

2025-03-28 16:05:29Saven Technologies, a microcap IT software firm, has reached a new 52-week low, continuing a downward trend with a notable decline over the past three days. The stock is trading below key moving averages, reflecting a bearish outlook, while its long-term fundamentals show weak growth and operational challenges.

Read MoreSaven Technologies Adjusts Valuation Grade Amid Competitive IT Software Landscape

2025-03-28 08:00:09Saven Technologies, a microcap player in the IT software industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings (P/E) ratio stands at 17.73, while its price-to-book value is recorded at 2.38. Other key metrics include an enterprise value to EBITDA ratio of 12.95 and a PEG ratio of 1.81. Saven Technologies also offers a dividend yield of 3.42%, with a return on capital employed (ROCE) of 23.63% and a return on equity (ROE) of 13.42%. In comparison to its peers, Saven Technologies presents a more favorable valuation profile. For instance, NINtec Systems is positioned at a significantly higher P/E ratio of 54.49, while InfoBeans Technology, another competitor, has a P/E of 19.85. Additionally, Saven's enterprise value to sales ratio of 2.91 is competitive against its industry counterparts. Despite recent stock performance challenges,...

Read MoreSaven Technologies Adjusts Valuation Amidst Competitive IT Software Landscape

2025-03-05 08:00:09Saven Technologies, a microcap player in the IT software industry, has recently undergone a valuation adjustment. The company's current price stands at 45.62, reflecting a notable shift from its previous close of 43.79. Over the past year, Saven has experienced a stock return of -29.83%, contrasting sharply with a mere -1.19% return from the Sensex during the same period. Key financial metrics for Saven include a PE ratio of 18.45 and an EV to EBITDA ratio of 13.57, which position it within a competitive landscape. The company's return on capital employed (ROCE) is reported at 23.63%, while its return on equity (ROE) stands at 13.42%. These figures highlight Saven's operational efficiency relative to its peers. In comparison, companies like Ksolves India and NINtec Systems exhibit higher valuation metrics, with PE ratios of 24.11 and 51.5, respectively. This suggests that while Saven Technologies has a fa...

Read More

Saven Technologies Hits 52-Week Low Amid Ongoing Market Pressures and Weak Fundamentals

2025-03-04 09:50:41Saven Technologies has reached a new 52-week low, continuing a trend of losses despite a slight outperformance against its sector. The company has seen a significant year-over-year decline and faces operational challenges, although it offers a high dividend yield and a reasonable return on equity. Technical indicators suggest ongoing bearish conditions.

Read More

Saven Technologies Faces Significant Volatility Amidst Sustained Downward Trend in IT Sector

2025-03-03 14:20:33Saven Technologies, a microcap IT software firm, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and declined over the past year. Currently trading below key moving averages, it offers a high dividend yield, attracting attention amid challenging market conditions.

Read More

Saven Technologies Hits New Low Amidst Ongoing Downward Trend and Sector Outperformance

2025-02-28 09:36:05Saven Technologies, an IT software microcap, has reached a new 52-week low, continuing a downward trend with a 6.37% drop over the past two days. Despite underperforming over the past year, the company offers a high dividend yield of 3.24%, providing some return to shareholders.

Read More

Saven Technologies Faces Competitive Challenges Amidst Approaching 52-Week Low

2025-02-27 13:35:15Saven Technologies, a microcap IT software firm, is nearing a 52-week low, with its stock underperforming its sector. Trading below key moving averages, the company has seen a 27.26% decline over the past year, contrasting with the Sensex's modest gain. It currently offers a dividend yield of 3.06%.

Read More

Saven Technologies Hits 52-Week Low Amid Broader Market Resilience Challenges

2025-02-25 09:49:15Saven Technologies, a microcap IT software firm, has reached a new 52-week low, reflecting a significant decline over the past year. Despite this, the stock has shown some resilience today, outperforming its sector and experiencing a slight recovery after previous declines. It currently offers a high dividend yield.

Read More

Saven Technologies Hits New Low Amidst Ongoing Downward Trend in IT Sector

2025-02-24 10:40:15Saven Technologies has reached a new 52-week low, continuing a downward trend with a recent decline of 2.52%. Despite outperforming its sector slightly, the stock is trading below key moving averages. Over the past year, it has declined by 23.11%, while maintaining a dividend yield of 3.03%.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEAttached

Board Meeting Outcome for Outcome Of Meeting

22-Mar-2025 | Source : BSEAttached

Announcement under Regulation 30 (LODR)-Cessation

22-Mar-2025 | Source : BSEAttached

Corporate Actions

No Upcoming Board Meetings

Saven Technologies Ltd has declared 150% dividend, ex-date: 18 Feb 25

No Splits history available

No Bonus history available

No Rights history available