Savita Oil Technologies Adjusts Valuation Grade Amid Market Volatility and Competitive Metrics

2025-03-12 08:00:17Savita Oil Technologies, a small-cap player in the lubricants industry, has recently undergone a valuation adjustment. The company's current price stands at 383.00, reflecting a notable shift from its previous close of 401.90. Over the past year, Savita has experienced a stock return of -5.72%, contrasting with a slight gain of 0.82% in the Sensex. Key financial metrics for Savita Oil Technologies include a PE ratio of 23.18 and an EV to EBITDA ratio of 17.97. The company also boasts a dividend yield of 1.04% and a return on capital employed (ROCE) of 12.37%. In comparison to its peers, Savita's valuation metrics indicate a competitive position, particularly when juxtaposed with Panama Petrochem and Veedol Corporation, which have lower PE ratios and differing EV to EBITDA ratios. While Savita's recent performance has shown volatility, particularly over the past month with a return of -15.12%, its long-ter...

Read More

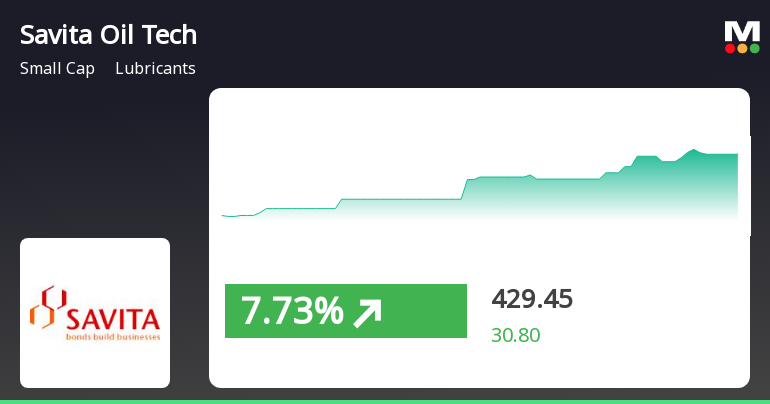

Savita Oil Technologies Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-07 10:30:52Savita Oil Technologies has shown strong performance recently, gaining for four consecutive days and achieving an 18.04% return. The stock is currently above its short-term moving averages but below longer-term ones. In the broader market, small-cap stocks are leading, with the BSE Small Cap index up 1.02%.

Read More

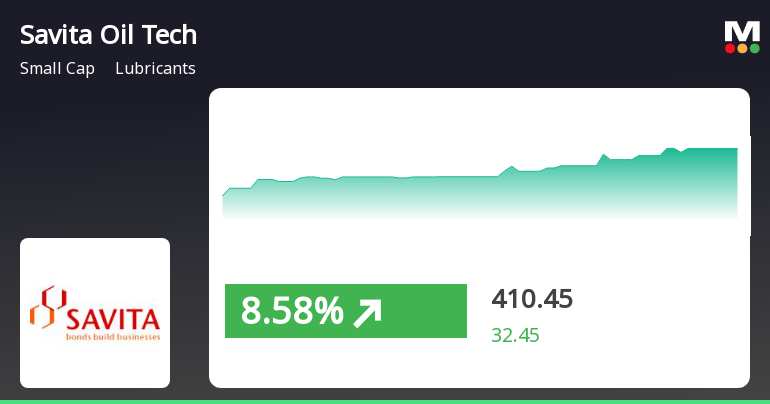

Savita Oil Technologies Shows Strong Performance Amidst Mixed Market Trends

2025-03-06 10:15:20Savita Oil Technologies has experienced notable activity, achieving a third consecutive day of gains and outperforming its sector. The stock opened higher and reached an intraday peak, while the lubricants sector showed positive movement. In the broader market, the Sensex faced a slight decline, with small-cap stocks performing well.

Read MoreSavita Oil Technologies Experiences Valuation Grade Change Amidst Market Challenges

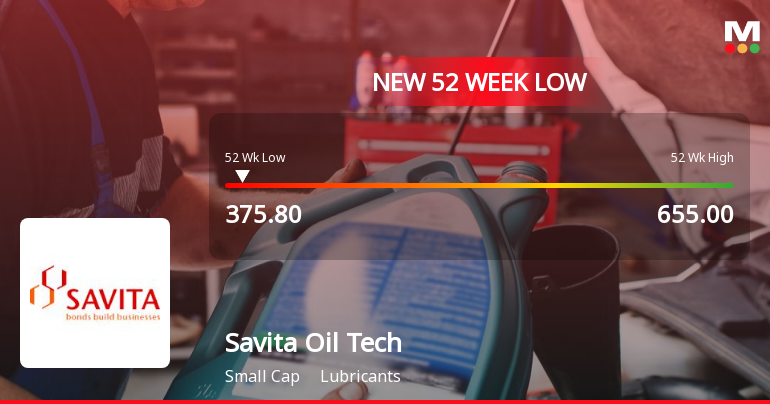

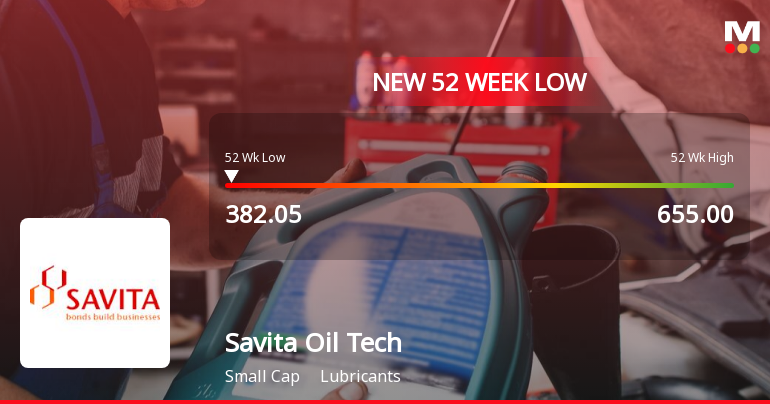

2025-03-04 08:00:19Savita Oil Technologies, a small-cap player in the lubricants industry, has recently undergone a valuation adjustment. The company's current price stands at 363.05, reflecting a notable shift from its previous close of 380.05. Over the past year, Savita has experienced a stock return of -19.59%, contrasting with a modest -0.98% return from the Sensex, indicating a challenging performance relative to the broader market. Key financial metrics for Savita Oil Technologies include a price-to-earnings (PE) ratio of 21.97 and an EV to EBITDA ratio of 16.95. The company also boasts a return on capital employed (ROCE) of 12.37% and a return on equity (ROE) of 10.45%. These figures suggest a solid operational performance, although the stock has faced volatility, with a 52-week high of 655.00 and a low of 357.10. In comparison to its peers, Savita Oil Technologies holds a competitive position, with its valuation met...

Read More

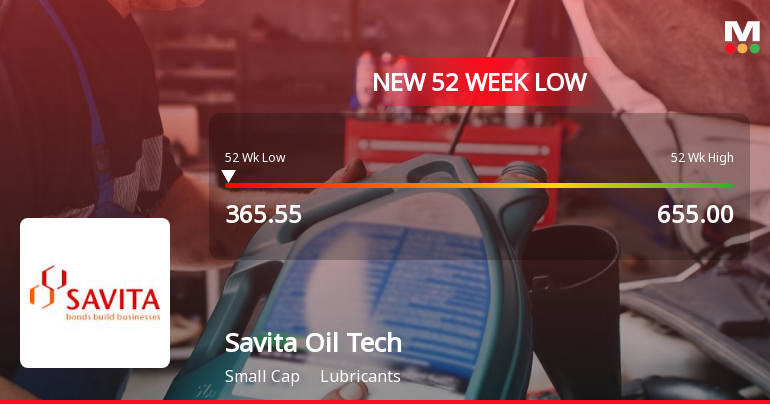

Savita Oil Technologies Faces Persistent Bearish Trend Amid Significant Stock Volatility

2025-03-03 10:06:34Savita Oil Technologies, a small-cap lubricants company, has faced notable volatility, hitting a new 52-week low. The stock has underperformed its sector and recorded a significant decline over the past week and year. It is currently trading below multiple moving averages, reflecting ongoing bearish trends.

Read More

Savita Oil Technologies Faces Continued Volatility Amid Broader Sector Challenges

2025-02-28 10:05:38Savita Oil Technologies has faced notable volatility, hitting a 52-week low and declining for four consecutive days. Despite outperforming its sector, the stock remains below key moving averages, reflecting a bearish trend. Over the past year, it has declined 12.09%, contrasting with the Sensex's gain.

Read More

Savita Oil Technologies Faces Challenges Amid Weak Stock Performance and Market Competition

2025-02-18 13:05:31Savita Oil Technologies, a small-cap lubricants company, is facing significant challenges as its stock approaches a 52-week low. The stock has underperformed its sector and is trading below key moving averages, reflecting a bearish trend. Over the past year, it has declined while the Sensex has gained.

Read More

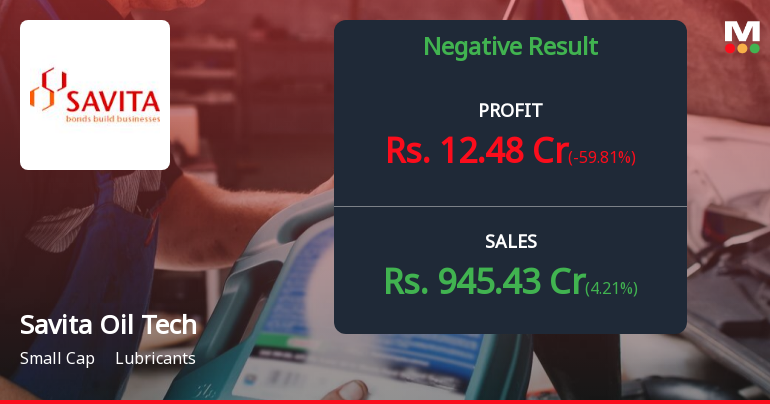

Savita Oil Technologies Reports Mixed Financial Results, Highlighting Operational Challenges and Improved Debt Management in December 2024

2025-02-13 17:24:17Savita Oil Technologies has released its financial results for the quarter ending December 2024, showcasing a mix of performance indicators. While the Debtors Turnover Ratio reached a five-period high, key metrics such as Profit Before Tax, Profit After Tax, and Operating Profit have all declined, reflecting operational challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate for the quarter ended 31st March 2025 is enclosed

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

24-Mar-2025 | Source : BSEPursuant to Regulation 30(6) read with Part A of Schedule III and other applicable provisions if any of the Securities and Exchange Board of India (Listing Obligations & Disclosure Requirements) Regulations 2015 we would like to inform you that the officials of the Company will be interacting with Investors/Analysts (Participants).

Announcement under Regulation 30 (LODR)-Investor Presentation

19-Feb-2025 | Source : BSEInvestor Presentation of Q3 FY 2024-25 is enclosed

Corporate Actions

No Upcoming Board Meetings

Savita Oil Technologies Ltd has declared 200% dividend, ex-date: 17 Sep 24

Savita Oil Technologies Ltd has announced 2:10 stock split, ex-date: 01 Sep 22

Savita Oil Technologies Ltd has announced 2:3 bonus issue, ex-date: 17 Jan 07

No Rights history available