Sayaji Hotels Faces Technical Trend Shifts Amid Market Volatility and Mixed Performance

2025-04-02 08:07:41Sayaji Hotels, a microcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 287.00, showing a slight increase from the previous close of 280.90. Over the past year, the stock has experienced a high of 425.00 and a low of 240.00, indicating notable volatility. In terms of technical indicators, the MACD and KST are both showing bearish signals on a weekly and monthly basis, while the Bollinger Bands reflect a mildly bearish stance. The moving averages also indicate a mildly bearish trend on a daily basis. Notably, the Dow Theory shows no significant trend in both weekly and monthly assessments, suggesting a period of consolidation. When comparing the company's performance to the Sensex, Sayaji Hotels has shown a mixed return profile. Over the past week, the stock returned 8.69%, contrasti...

Read More

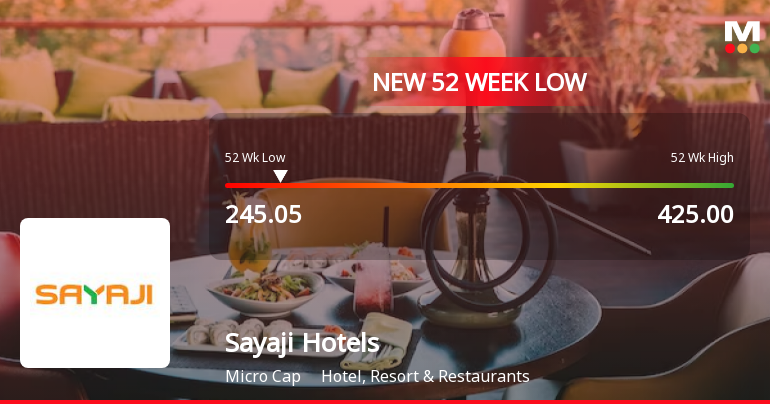

Sayaji Hotels Faces Significant Market Challenges Amidst Sustained Stock Decline

2025-02-19 09:37:33Sayaji Hotels has faced significant volatility, hitting a new 52-week low of Rs. 245.05 amid a 9.67% decline over two days. The stock is trading below multiple moving averages and has dropped 21.64% over the past year, contrasting with the Sensex's 4.28% gain.

Read More

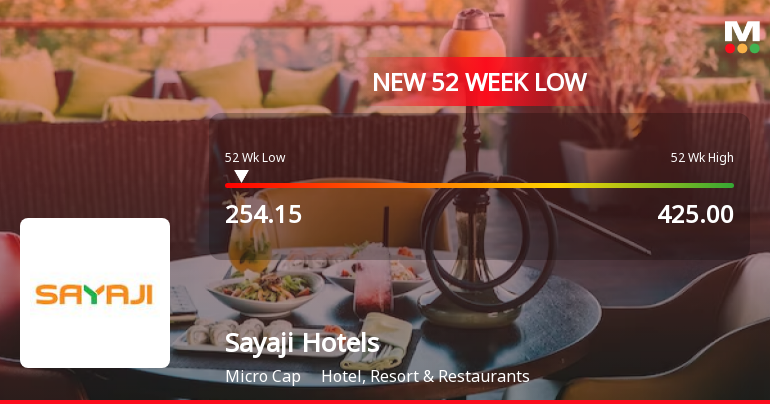

Sayaji Hotels Hits 52-Week Low Amid Broader Sector Decline and Underperformance

2025-02-18 11:56:20Sayaji Hotels has faced notable volatility, hitting a new 52-week low of Rs. 254.15 amid a broader sector decline. The stock has underperformed its industry and is trading below key moving averages, reflecting ongoing challenges. Over the past year, it has declined significantly compared to the Sensex's gains.

Read More

Sayaji Hotels Faces Continued Volatility Amid Broader Sector Challenges

2025-02-17 11:05:26Sayaji Hotels has faced notable volatility, hitting a new 52-week low amid a downward trend, losing 14.02% over three days. Despite an intraday recovery, the stock remains below key moving averages, reflecting ongoing challenges in a competitive market, contrasting with the Sensex's positive performance over the past year.

Read More

Sayaji Hotels Hits 52-Week Low Amid Broader Sector Challenges in October 2023

2025-02-14 15:05:20Sayaji Hotels has reached a new 52-week low, reflecting a significant decline over the past two days and underperformance compared to the broader Hotel, Resort & Restaurants sector. The company's stock has dropped notably over the past year, contrasting with gains in the Sensex, indicating ongoing challenges in the microcap segment.

Read More

Sayaji Hotels Reports Mixed Financial Results Amid Record Quarterly Sales Growth

2025-02-06 17:28:17Sayaji Hotels has released its financial results for the quarter ending December 2024, showcasing a mix of achievements and challenges. While the company recorded its highest quarterly net sales in five quarters and a peak in operating profit, it also faced declines in profit after tax and profit before tax, alongside rising interest expenses.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

07-Apr-2025 | Source : BSEDisclosure of Credit Rating

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

04-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Sayaji Hotels Ltd |

| 2 | CIN NO. | L51100TN1982PLC124332 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 15.00 |

| 4 | Highest Credit Rating during the previous FY | BBB+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | ICRA LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: cs@sayajigroup.com

Designation: Chief Financial Officer

EmailId: cfo@sayajigroup.com

Date: 04/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the Quarter ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available