Technical Indicators Signal Bearish Sentiment for SEPC Amid Market Volatility

2025-03-26 08:03:46SEPC, a small-cap player in the capital goods industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 15.03, down from a previous close of 16.06, with a 52-week high of 33.50 and a low of 12.03. Today's trading saw a high of 16.37 and a low of 15.00, indicating some volatility. The technical summary for SEPC reveals a bearish sentiment across several indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish tendencies. The KST indicator aligns with this sentiment, indicating a bearish trend on the weekly scale and a mildly bearish stance monthly. Notably, the Dow Theory presents a mildly bullish view on a weekly basis, contrasting with the overall bearish indicators. In terms of performance, SEPC's stock return over th...

Read MoreSEPC Faces Mixed Technical Trends Amidst Significant Market Volatility

2025-03-24 08:02:01SEPC, a small-cap player in the capital goods industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 16.08, showing a slight increase from the previous close of 15.71. Over the past year, SEPC has experienced a 52-week high of 33.50 and a low of 12.03, indicating significant volatility. The technical summary reveals a mixed outlook, with various indicators suggesting a mildly bearish trend. The MACD and Bollinger Bands both reflect bearish conditions on a weekly basis, while the monthly indicators show a mildly bearish stance. The moving averages indicate a similar mildly bearish sentiment, and the KST also aligns with this trend. Notably, the On-Balance Volume (OBV) presents a bullish signal on a weekly basis, contrasting with the overall bearish indicators. In terms of performance, SEPC's stock return has varied significantly over...

Read MoreSEPC Experiences Valuation Grade Change Amidst Distinct Financial Metrics and Market Positioning

2025-03-24 08:00:45SEPC, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 77.29, while its price-to-book value is recorded at 1.77. Additionally, SEPC's enterprise value to EBITDA ratio is 67.41, indicating a significant valuation relative to its earnings before interest, taxes, depreciation, and amortization. In comparison to its peers, SEPC's financial ratios highlight a distinct positioning within the industry. For instance, Patel Engineering, categorized as very attractive, has a much lower price-to-earnings ratio of 10.29, while Ramky Infrastructure and Bharat Bijlee also show more favorable valuations with ratios of 13.33 and 24.03, respectively. This contrast underscores SEPC's relatively higher valuation metrics, which may reflect its unique market dynamics or ope...

Read MoreSEPC Ltd Shows High Trading Volume Amidst Mixed Performance and Investor Participation Decline

2025-03-18 10:00:44SEPC Ltd, a small-cap player in the capital goods industry, has emerged as one of the most active equities today, with a total traded volume of 18,444,986 shares and a total traded value of approximately Rs 291.06 crores. The stock opened at Rs 16.42, matching its previous close, but has since seen a decline, with a last traded price of Rs 15.18, marking a 0.33% return for the day. Despite this activity, SEPC has underperformed its sector, which recorded a 1.55% return today. The stock's performance against key moving averages shows it is currently above the 5-day and 20-day averages but below the 50-day, 100-day, and 200-day averages, indicating mixed momentum. Investor participation has also seen a decline, with delivery volume dropping by 33.52% compared to the 5-day average, totaling 671,100 shares. However, the stock remains liquid enough for trades sized at Rs 1.16 crores, based on 2% of the 5-day ...

Read More

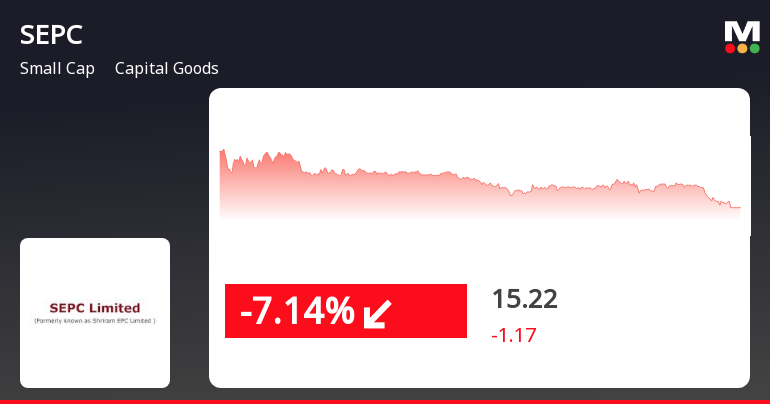

Small-Cap SEPC Faces Volatility Amid Broader Market Resilience and Mixed Signals

2025-03-17 15:50:22SEPC, a small-cap company in the capital goods sector, saw a notable decline on March 17, 2025, following two days of gains. Its performance indicates mixed signals in relation to moving averages, while the broader market, represented by the Sensex, has shown resilience amidst SEPC's volatility.

Read MoreSEPC Ltd Experiences High Trading Volume Amid Price Decline and Sector Underperformance

2025-03-17 10:00:12SEPC Ltd, a small-cap player in the capital goods industry, has emerged as one of the most active equities today, with a total traded volume of 6,195,664 shares and a total traded value of approximately Rs 99.32 crore. The stock opened at Rs 16.42, matching its previous close, but has since seen a decline, currently trading at Rs 16.10. Despite the notable trading activity, SEPC has underperformed its sector by 3.54% today, marking a reversal after two consecutive days of gains. The stock's performance is reflected in its movement relative to key moving averages; it remains above the 5-day and 20-day moving averages but below the 50-day, 100-day, and 200-day averages. Investor participation has seen a significant uptick, with delivery volume on March 13 rising by 101.32% compared to the 5-day average, indicating increased trading interest. Additionally, the stock's liquidity remains robust, accommodatin...

Read MoreSEPC Adjusts Valuation Grade Amidst Mixed Performance and Market Positioning

2025-03-17 08:00:41SEPC, a small-cap player in the capital goods sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 78.78, while its price-to-book value is recorded at 1.80. Additionally, SEPC's enterprise value to EBITDA ratio is 68.56, indicating a significant valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance, SEPC has shown varied returns over different periods. Over the past week, the stock has returned 17.58%, contrasting with a slight decline in the Sensex. However, year-to-date, SEPC's return is down by 22.83%, while the Sensex has also faced a decline of 5.52%. Notably, over a three-year span, SEPC has outperformed the Sensex with a return of 112.09% compared to the index's 32.90%. When compared to its peers, SEPC's valuation metrics are no...

Read MoreSEPC Ltd Sees Surge in Trading Activity and Investor Participation Amid Market Volatility

2025-03-13 10:00:14SEPC Ltd, a small-cap company in the capital goods sector, has emerged as one of the most active equities today, with a total traded volume of 23,470,643 shares and a total traded value of approximately Rs 387.27 crore. The stock opened at Rs 15.90, reflecting a gain of 3.65%, and reached an intraday high of Rs 17.39, marking a notable increase of 9.52% from its previous close of Rs 15.34. Today’s performance indicates that SEPC has outperformed its sector by 9.44%, continuing a positive trend with consecutive gains over the last two days, resulting in a total return of 30.94% during this period. The stock has exhibited high volatility, with an intraday volatility of 6.86%, and the weighted average price suggests that more volume was traded closer to the low price. Investor participation has also seen a significant rise, with delivery volume on March 12 reaching 1.99 crore, up 329.86% compared to the five...

Read More

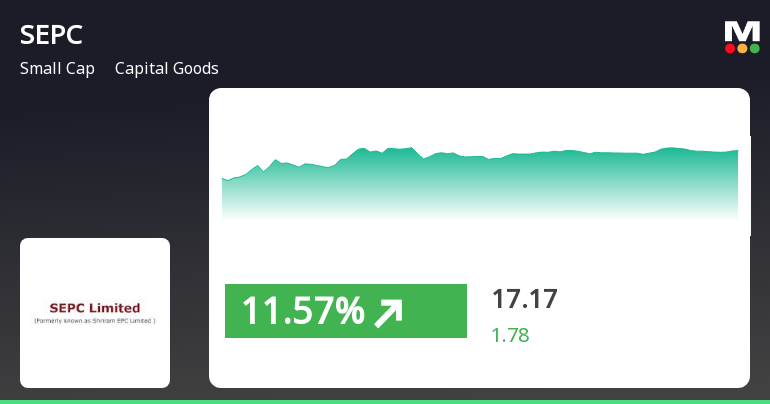

Small-Cap SEPC Surges Amid High Volatility, Outperforming Sector Trends

2025-03-13 09:50:21SEPC, a small-cap company in the capital goods sector, experienced notable trading activity, gaining 12.22% on March 13, 2025. The stock has shown strong performance over two days, with significant volatility and current prices above several short-term moving averages. In the broader market, the Sensex also opened higher.

Read MoreIntimation Of Final Acceptance Certificates Issued By Steel Authority Of India Limited

27-Mar-2025 | Source : BSEWe inform the Exchange about the receipt of Final Acceptance Certificates issued by Steel Authority of India Limited. Detailed letter is enclosed.

Closure of Trading Window

26-Mar-2025 | Source : BSEWe inform the Exchange regarding the closure of the trading window for the Designated Persons and their immediate relatives from April 01 2025 upto 48 hours from the declaration of financial results for the quarter and financial year ended March 31 2025. Detailed letter is enclosed.

Intimation Regarding Execution Of Framework Agreement

12-Mar-2025 | Source : BSEWe hereby intimate the exchange of the execution of framework agreement. Detailed Letter is enclosed.

Corporate Actions

No Upcoming Board Meetings

SEPC Ltd has declared 12% dividend, ex-date: 11 Sep 12

No Splits history available

No Bonus history available

SEPC Ltd has announced 6:55 rights issue, ex-date: 25 Jun 24