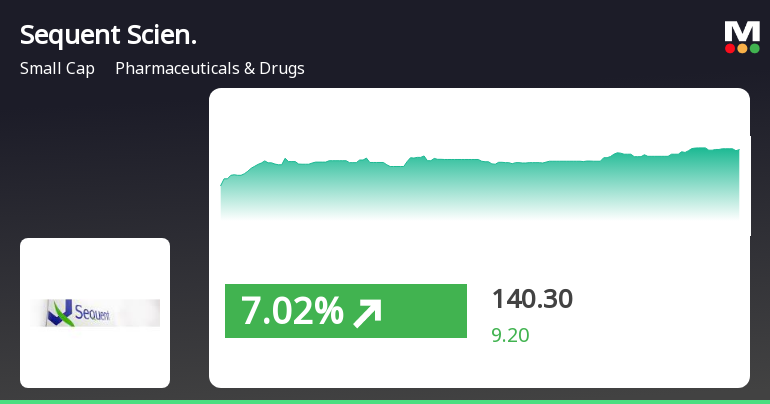

Sequent Scientific Adjusts Valuation Grade Amid Competitive Pharmaceutical Landscape

2025-04-03 08:00:06Sequent Scientific, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 137.10, reflecting a slight increase from the previous close of 135.50. Over the past year, Sequent has shown a return of 11.37%, outperforming the Sensex, which returned 3.67% in the same period. Key financial metrics for Sequent include a PE ratio of 194.75 and an EV to EBITDA ratio of 26.02, indicating a premium valuation compared to its peers. In contrast, Unichem Laboratories, categorized as expensive, has a significantly lower PE ratio of 54.64, while Orchid Pharma is noted for its very expensive valuation with a PE of 36.58. Sequent's return on capital employed (ROCE) is reported at 6.42%, and its return on equity (ROE) is at 2.86%, which are critical indicators of its operational efficiency. The company's performance over various time f...

Read MoreSequent Scientific Experiences Valuation Grade Change Amidst Market Dynamics in Pharmaceuticals Sector

2025-03-27 08:00:05Sequent Scientific, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 133.10, reflecting a notable decline from its previous close of 136.80. Over the past year, Sequent has shown a return of 17.22%, outperforming the Sensex, which recorded a 6.65% return in the same period. Key financial metrics for Sequent include a PE ratio of 189.07 and an EV to EBITDA ratio of 25.34. The company's return on capital employed (ROCE) is reported at 6.42%, while the return on equity (ROE) is at 2.86%. These figures indicate a unique positioning within the industry, especially when compared to its peers. In comparison, companies like Hikal and Unichem Laboratories are categorized differently in terms of valuation, with PE ratios of 66.14 and 55.17, respectively. This highlights the varying financial health and market perceptions ...

Read More

Sequent Scientific Faces Technical Shift Amid Positive Financial Performance and Increased Institutional Interest

2025-03-26 08:02:54Sequent Scientific, a small-cap pharmaceutical company, has experienced a shift in its technical outlook, now reflecting a more bearish stance. Despite this, the company reported positive quarterly financial results, including growth in profit before tax and net profit, while institutional investors have increased their stakes, indicating confidence in its potential.

Read MoreSequent Scientific Faces Technical Trend Adjustments Amid Market Volatility

2025-03-26 08:00:35Sequent Scientific, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 136.80, reflecting a decline from the previous close of 144.85. Over the past year, Sequent Scientific has experienced a stock return of 17.73%, outperforming the Sensex, which recorded a return of 7.12% during the same period. However, the company's performance has been less favorable in shorter time frames, with a year-to-date return of -22.27%, contrasting sharply with the Sensex's slight decline of -0.16%. In terms of technical indicators, the weekly MACD and Bollinger Bands signal bearish trends, while the monthly KST shows a bullish stance. The moving averages indicate a bearish sentiment on a daily basis. The stock's performance has been volatile, with a 52-week high of 240.90 and a low of 91.85, highlighting significant fluctu...

Read More

Sequent Scientific Faces Evaluation Shift Amid Mixed Financial Performance and Institutional Interest

2025-03-20 08:02:05Sequent Scientific has recently experienced a change in its evaluation, reflecting a shift in market sentiment. Despite a decline in operating profits over five years, the company has reported positive quarterly results and generated a significant return over the past year, with increased institutional investor interest.

Read MoreSequent Scientific Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:00:33Sequent Scientific, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 144.60, showing a notable increase from the previous close of 139.05. Over the past year, Sequent Scientific has demonstrated a robust performance with a return of 26.23%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD shows a bearish trend on a weekly basis while indicating bullish momentum monthly. The Relative Strength Index (RSI) remains neutral, and Bollinger Bands suggest a mildly bearish stance on a weekly basis, contrasting with a mildly bullish monthly perspective. Moving averages and the KST also reflect bearish tendencies on a weekly scale, while the Dow Theory and On-Balance...

Read More

Sequent Scientific Shows Recovery Amid Broader Small-Cap Market Gains

2025-03-18 11:45:17Sequent Scientific experienced a notable rebound on March 18, 2025, after five days of decline, with the stock reaching an intraday high. Despite today's gains, the stock remains below key moving averages, reflecting a longer-term bearish trend. The broader market saw positive movement, particularly in small-cap stocks.

Read More

Sequent Scientific Shows Positive Financial Trends Amid Long-Term Profitability Challenges

2025-03-17 10:29:10Sequent Scientific, a small-cap pharmaceutical company, has recently adjusted its evaluation amid positive financial trends, including four consecutive quarters of growth. However, it faces long-term challenges with declining operating profits. Institutional investors have increased their stake, and the stock has outperformed the broader market over the past year.

Read MoreSequent Scientific Faces Bearish Technical Trends Amidst Market Volatility

2025-03-17 08:00:16Sequent Scientific, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 136.65, down from a previous close of 140.85, with a notable 52-week range between 91.85 and 240.90. Today's trading saw a high of 144.50 and a low of 135.00, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a challenging environment for the stock. The KST indicator presents a mixed picture, being bearish weekly but bullish monthly, which adds complexity to the overall assessment. In terms of performance, Sequent Scientific has faced significant challenges compared to the Sensex. Over ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliances- Certificate under Reg. 74 (5) of SEBI (DP) Regulation 2018

Registered Office Of The Company Has Been Shifted From Maharashtra To Telangana

01-Apr-2025 | Source : BSERegistered office of the Company has been shifting from Maharashtra to Telangana

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Sequent Scientific Ltd has declared 25% dividend, ex-date: 08 Sep 21

Sequent Scientific Ltd has announced 2:10 stock split, ex-date: 25 Feb 16

No Bonus history available

No Rights history available