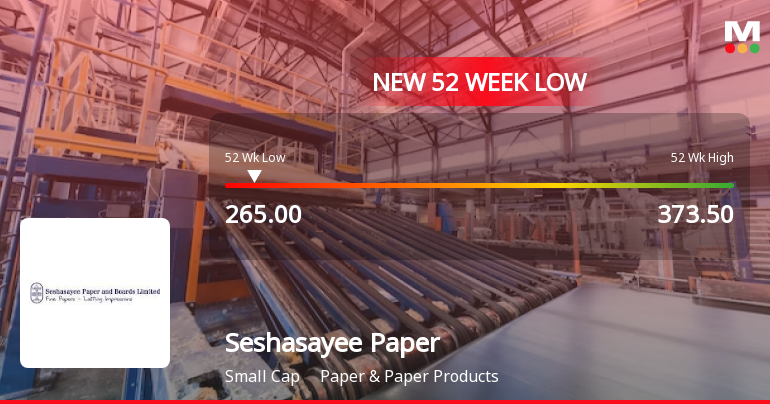

Seshasayee Paper & Boards Faces Persistent Decline Amidst Market Volatility and Poor Performance Metrics

2025-03-17 09:43:20Seshasayee Paper & Boards has faced notable volatility, hitting a 52-week low and experiencing a three-day losing streak. The stock has underperformed its sector and shown a significant decline over the past year, with ongoing negative results and concerning financial metrics, reflecting the company's ongoing struggles.

Read More

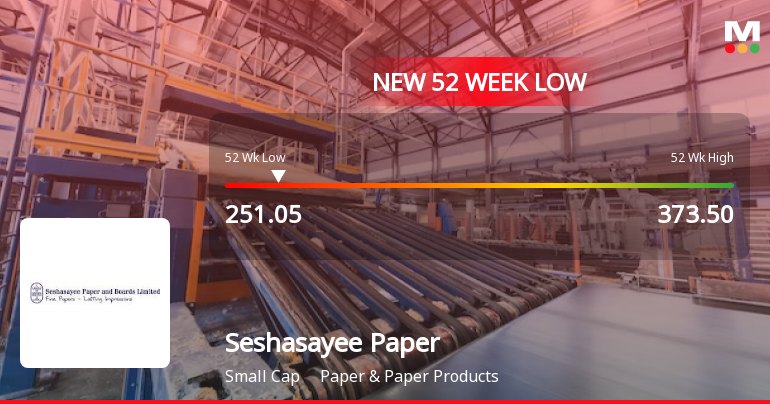

Seshasayee Paper & Boards Faces Operational Challenges Amidst Significant Stock Volatility

2025-03-17 09:43:16Seshasayee Paper & Boards has hit a new 52-week low, reflecting ongoing volatility and a significant decline in performance metrics. The company has faced negative financial results for six consecutive quarters, with declining operating profit and net sales, while trading below key moving averages indicates persistent operational challenges.

Read More

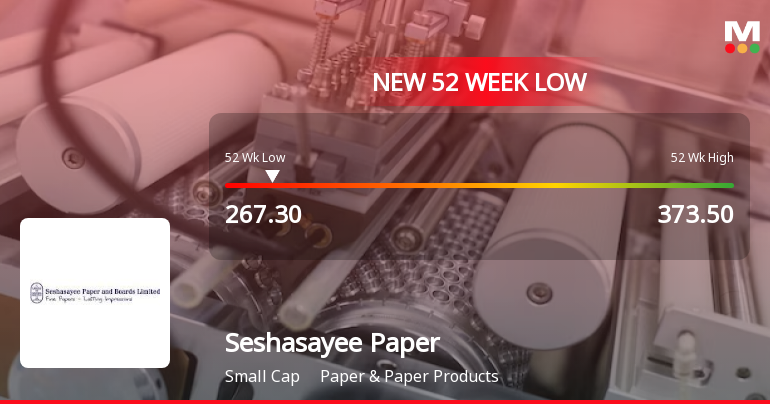

Seshasayee Paper & Boards Faces Significant Volatility Amid Declining Financial Performance

2025-03-13 14:05:31Seshasayee Paper & Boards has faced notable volatility, reaching a 52-week low after an initial gain. The stock has declined over the past year, with significant drops in net sales and operating profit. Despite low debt and high institutional holdings, technical indicators suggest a bearish outlook.

Read More

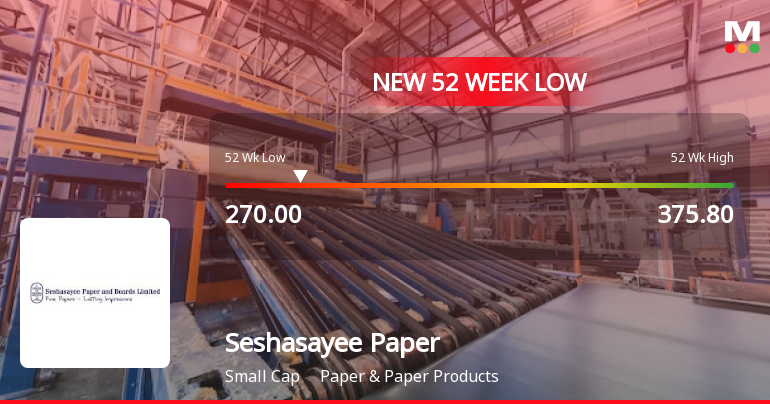

Seshasayee Paper & Boards Faces Volatility Amidst Ongoing Financial Struggles

2025-03-12 10:37:05Seshasayee Paper & Boards reached a new 52-week low today, despite an initial gain. The stock has shown high volatility and is trading below key moving averages, reflecting a bearish trend. The company has faced declining financial performance, with negative results over six quarters and a low return on capital employed.

Read MoreSeshasayee Paper & Boards Adjusts Valuation Grade Amid Competitive Industry Metrics

2025-03-12 08:00:15Seshasayee Paper & Boards has recently undergone a valuation adjustment, reflecting its current standing within the paper and paper products industry. The company exhibits a price-to-earnings (P/E) ratio of 12.22 and a price-to-book value of 0.86, indicating its market valuation relative to its book value. Additionally, key metrics such as the enterprise value to EBITDA ratio stand at 6.74, while the enterprise value to sales ratio is notably low at 0.58. The company's dividend yield is recorded at 1.86%, and it demonstrates a return on capital employed (ROCE) of 14.54% and a return on equity (ROE) of 9.74%. In comparison to its peers, Seshasayee Paper's valuation metrics suggest a competitive position, particularly when contrasted with JK Paper and West Coast Paper, which have lower P/E ratios and EV/EBITDA figures. Despite recent stock performance showing a decline over various periods, including a yea...

Read MoreTechnical Trends Indicate Bearish Sentiment for Seshasayee Paper & Boards Amid Market Fluctuations

2025-03-07 08:01:52Seshasayee Paper & Boards, a small-cap player in the Paper & Paper Products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 285.60, down from a previous close of 293.80, with a 52-week high of 373.50 and a low of 267.30. Today's trading saw a high of 295.80 and a low of 283.95. The technical summary indicates a bearish sentiment in the weekly moving averages, while the monthly indicators show a mildly bearish trend. The MACD reflects a bearish position on a weekly basis, with no significant signals from the RSI. Bollinger Bands also suggest a mildly bearish outlook, and the KST indicates a mildly bullish trend on a weekly basis but shifts to mildly bearish monthly. In terms of performance, Seshasayee Paper has shown varied returns compared to the Sensex. Over the past week, the stock returned -0.88%, while the Sensex returned...

Read MoreTechnical Indicators Signal Mixed Trends for Seshasayee Paper Amid Market Evaluation Revision

2025-03-06 08:00:53Seshasayee Paper & Boards, a small-cap player in the Paper & Paper Products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 293.80, showing a notable increase from the previous close of 277.55. Over the past year, the stock has experienced a decline of 15.47%, contrasting with a slight gain of 0.07% in the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also indicate a mildly bearish stance for both weekly and monthly assessments. Moving averages reflect a similar mildly bearish sentiment on a daily basis. Notably, the KST presents a mildly bullish trend weekly, but shifts to mildly bearish on a monthly basis. Despite the recent challenges, Seshasayee Paper has demonstrated resilience over longer...

Read More

Seshasayee Paper & Boards Faces Continued Decline Amid Market Challenges

2025-03-03 10:06:15Seshasayee Paper & Boards is facing notable challenges as it nears a 52-week low, with recent trading showing a decline over two consecutive days. The stock has underperformed its sector and is trading below key moving averages, reflecting a year-long performance drop compared to the broader market.

Read More

Seshasayee Paper & Boards Hits 52-Week Low Amid Broader Market Trends in October'23

2025-02-14 09:35:43Seshasayee Paper & Boards has reached a new 52-week low, reflecting a 10.47% decline over the past year, contrasting with the Sensex's 6.07% gain. The stock's performance shows mixed results against various moving averages, indicating a complex relationship with broader market trends.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

09-Apr-2025 | Source : BSEWe wish to inform you that CRISIL Ratings Limited vide its letter dated April 09 2025 has reaffirmed the Credit Rating for the credit facilities availed by the Company from Bankers as under. However the outlook has been revised from Stable to Negative.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEWe herewith enclose a certificate under Regulation 74(5) of SEBI (DP) Regulation 2018 ffor the quarter ended March 31 2025

Closure of Trading Window

28-Mar-2025 | Source : BSETrading Window for dealing in securities of the Company will remain closed for the Designated Persons with effect from 01.04.2025 (Tuesday) till 48 hours after the declaration of the Audited Financial Results of the Company for the quarter and year ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

Seshasayee Paper & Boards Ltd has declared 250% dividend, ex-date: 22 May 24

Seshasayee Paper & Boards Ltd has announced 2:10 stock split, ex-date: 19 Aug 19

No Bonus history available

No Rights history available