SG Finserve Adjusts Valuation Grade Amidst Competitive Financial Landscape Insights

2025-04-02 08:00:24SG Finserve, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 415.40, reflecting a slight increase from the previous close of 407.05. Over the past year, SG Finserve has experienced a stock return of -3.61%, contrasting with a 2.72% return from the Sensex. Key financial metrics for SG Finserve include a price-to-earnings (PE) ratio of 33.79 and an EV to EBITDA ratio of 18.85. The company's return on capital employed (ROCE) is reported at 18.98%, while the return on equity (ROE) is at 9.46%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, SG Finserve's valuation metrics reveal a diverse landscape. For instance, Indus Inf. Trust is positioned at a significantly higher PE ratio of 320.76, while MAS Fin. Ser. shows a more ...

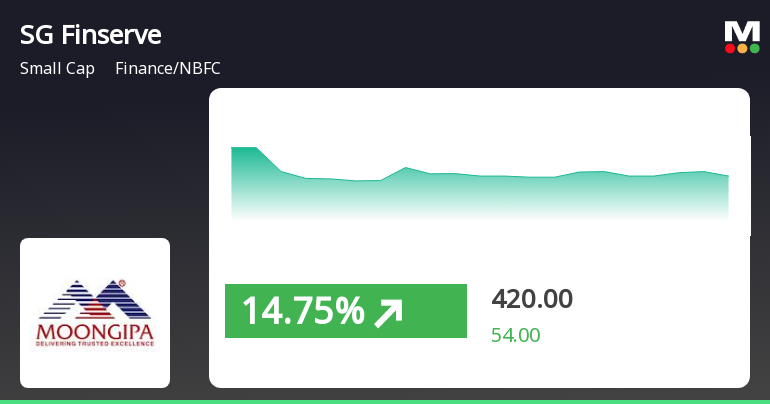

Read MoreSG Finserve Adjusts Valuation Amid Strong Stock Performance and Competitive Metrics

2025-03-26 08:00:08SG Finserve, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 411.55, reflecting a notable increase from the previous close of 366.00. Over the past week, SG Finserve has demonstrated a strong stock return of 31.7%, significantly outperforming the Sensex, which returned 3.61% in the same period. Key financial metrics for SG Finserve include a PE ratio of 33.48 and an EV to EBITDA ratio of 18.67, indicating its market positioning within the industry. The company's return on capital employed (ROCE) is reported at 18.98%, while the return on equity (ROE) stands at 9.46%. In comparison to its peers, SG Finserve's valuation metrics suggest a competitive stance, particularly when juxtaposed with companies like Indus Inf. Trust and Pilani Invest., which exhibit varying valuation profiles. This ...

Read More

SG Finserve's Strong Performance Highlights Positive Trends in Small-Cap Finance Sector

2025-03-25 09:30:17SG Finserve, a small-cap finance and NBFC company, has demonstrated significant activity, with a notable gain today and a cumulative return of 26.36% over three days. The stock is trading above multiple moving averages, indicating strong performance, while the broader market shows stability and growth.

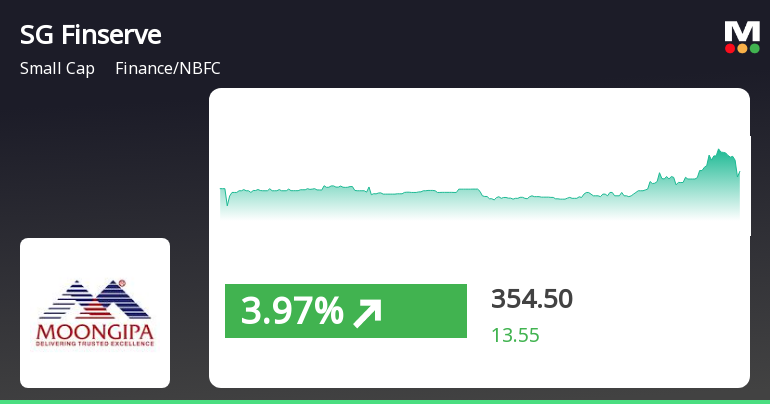

Read MoreSG Finserve Shows Strong Short-Term Gains Amid Mixed Technical Indicators

2025-03-25 08:00:50SG Finserve, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 366.00, showing a notable increase from its previous close of 340.95. Over the past week, SG Finserve has demonstrated a strong performance with a return of 16.45%, significantly outpacing the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the MACD suggests a bearish stance on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments. Bollinger Bands and moving averages also indicate a mildly bearish trend, aligning with the overall technical summary. Despite the recent fluctuations, SG Finserve's long-term performance remains noteworthy, particularly over three and five years, where it has achieved r...

Read More

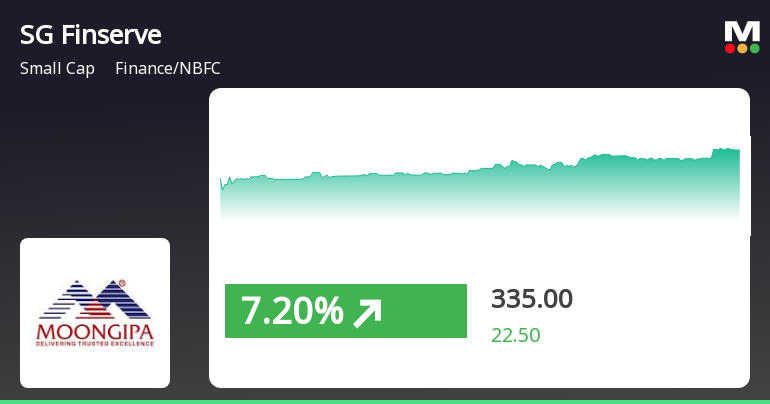

SG Finserve Outperforms Sector Amid Broader Market Gains and Mixed Long-Term Performance

2025-03-24 13:00:17SG Finserve, a small-cap finance and NBFC company, experienced significant trading activity, gaining 7.35% on March 24, 2025. The stock outperformed its sector and has shown consecutive gains over two days. However, its long-term performance reveals a decline of 14.24% over the past year, contrasting with broader market trends.

Read More

SG Finserve's Surge Signals Potential Shift Amid Broader Market Trends

2025-03-19 13:00:19SG Finserve experienced significant activity on March 19, 2025, reversing a two-day decline and outperforming its sector. The stock's current price is above its 5-day moving average but below longer-term averages. In the broader market, mid-cap stocks are performing well, while the Sensex shows mixed trends.

Read More

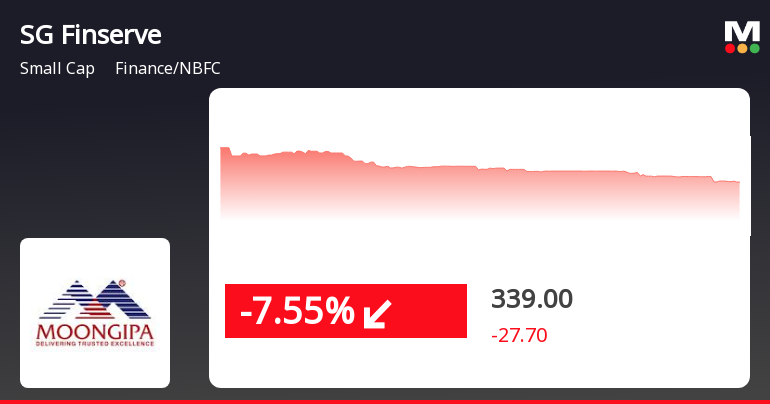

SG Finserve Faces Significant Challenges Amidst Market Volatility and Weak Fundamentals

2025-03-17 11:35:47SG Finserve, a small-cap finance/NBFC company, hit a new 52-week low today, reflecting significant volatility and underperformance compared to its sector. The stock has declined 24.71% over the past year, with recent quarterly net sales down 19% year-over-year, indicating ongoing challenges in the market.

Read More

SG Finserve Faces Continued Decline Amid Broader Market Trends and Small-Cap Resilience

2025-03-07 12:15:45SG Finserve, a small-cap finance and NBFC company, has seen its shares decline significantly, marking a continued downward trend over two days. The stock is trading below various moving averages, indicating a bearish outlook. In contrast, the broader market shows mixed performance, with small-cap stocks gaining.

Read More

SG Finserve Faces Significant Volatility Amidst Declining Investor Sentiment in Finance Sector

2025-03-03 11:35:23SG Finserve, a small-cap finance and NBFC company, has faced notable volatility, reaching a 52-week low. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges. Over the past year, it has declined significantly compared to the broader market.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

04-Apr-2025 | Source : BSEConfirmation of Credit Rating by ICRA Limited

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

01-Apr-2025 | Source : BSEAllotment ESOPs

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEDisclosure on Assets Under Management for FY2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available