Shankara Building Products Faces Technical Challenges Amidst Short-Term Resilience

2025-04-02 08:08:59Shankara Building Products, a small-cap player in the construction materials industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 584.00, showing a slight increase from the previous close of 569.00. Over the past year, the stock has experienced a decline of 11.01%, contrasting with a 2.72% gain in the Sensex, highlighting a notable underperformance relative to the broader market. In terms of technical indicators, the MACD and KST are both bearish on a weekly and monthly basis, suggesting a cautious outlook. The Bollinger Bands indicate a mildly bearish sentiment, while moving averages also reflect a similar trend. The Relative Strength Index (RSI) shows no significant signals, indicating a period of consolidation. Despite the recent challenges, Shankara Building Products has shown resilience in the short term, with a 1-week return...

Read MoreShankara Building Products Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-03-27 08:03:34Shankara Building Products, a small-cap player in the construction materials industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 578.95, slightly down from the previous close of 581.00. Over the past year, Shankara has faced challenges, with a return of -10.23%, contrasting with a 6.65% gain in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators, including MACD and Bollinger Bands, which suggest a cautious outlook. The moving averages also reflect a bearish trend, while the On-Balance Volume shows a bullish stance on a monthly basis, indicating mixed signals in trading activity. In terms of performance, Shankara's stock has shown volatility, with a 52-week high of 742.85 and a low of 444.40. Notably, the company has delivered a return of 149.17% over the past five year...

Read More

Shankara Building Products Faces Market Sentiment Shift Amid Profit Decline and Technical Adjustments

2025-03-26 08:11:12Shankara Building Products has recently experienced a score adjustment reflecting changes in its technical outlook. Despite maintaining a low Debt to EBITDA ratio and a favorable Return on Capital Employed, the company has faced profit declines and reduced institutional investor participation, indicating a complex market position.

Read MoreShankara Building Products Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-26 08:04:25Shankara Building Products, a small-cap player in the construction materials industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 581.00, slightly above its previous close of 578.00, with a notable 52-week high of 742.85 and a low of 444.40. Today's trading saw a high of 596.30 and a low of 565.10, indicating some volatility. The technical summary reveals a mixed outlook, with the MACD and KST indicators showing bearish trends on both weekly and monthly scales. The Bollinger Bands also reflect a bearish stance on the weekly chart, while the daily moving averages suggest a mildly bearish trend. Interestingly, the On-Balance Volume (OBV) indicates a bullish trend on a monthly basis, suggesting some underlying strength. In terms of performance, Shankara Building Products has shown varied returns compared to the Sensex. Over the past ...

Read More

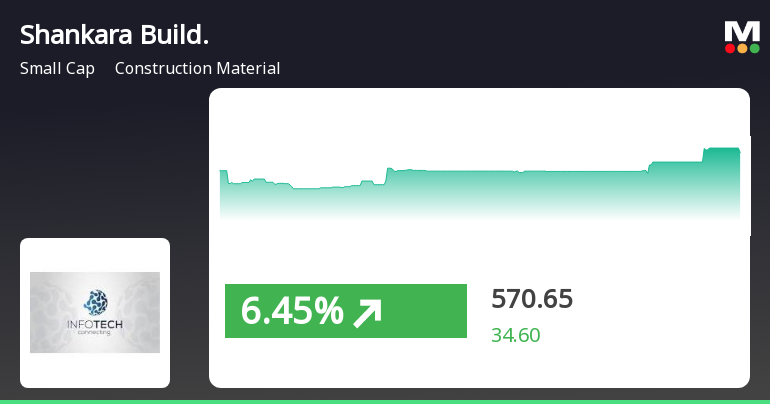

Shankara Building Products Outperforms Sector Amid Broader Market Recovery

2025-03-21 14:20:26Shankara Building Products experienced a significant rise on March 21, 2025, outperforming the construction material sector. The stock opened higher and reached an intraday peak, while the broader market, led by small-cap stocks, saw a notable recovery. The company's mixed performance reflects varying trends over different time frames.

Read More

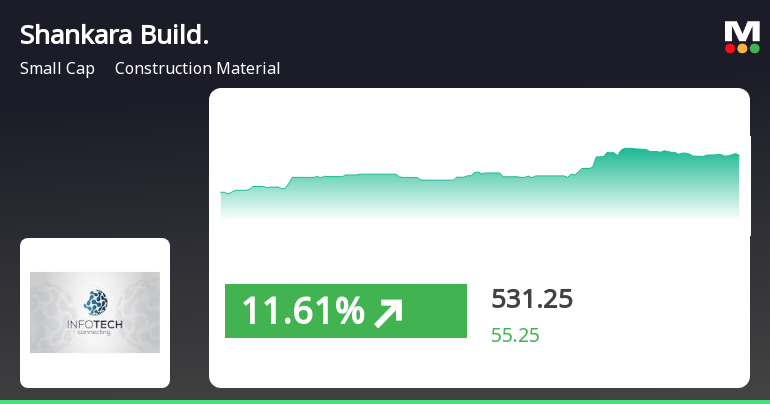

Shankara Building Products Shows Trend Reversal Amid Broader Market Gains

2025-03-18 11:05:24Shankara Building Products experienced a significant uptick on March 18, 2025, reversing a three-day decline. The stock outperformed the construction material sector, although it remains below key moving averages. Meanwhile, the broader market, led by small-cap stocks, continued its upward trend, with the Sensex rising notably.

Read MoreShankara Building Products Faces Persistent Stock Declines Amid Market Volatility

2025-03-03 10:28:49Shankara Building Products Ltd, a small-cap player in the construction materials industry, has experienced significant fluctuations in its stock performance recently. With a market capitalization of Rs 1,310.92 crore, the company currently holds a P/E ratio of 18.23, which stands in stark contrast to the industry average of 0. Over the past year, Shankara Building Products has seen a decline of 26.90%, while the benchmark Sensex has only dipped by 1.19%. In the short term, the stock has dropped 1.74% today, compared to a 0.37% decrease in the Sensex. The one-week performance shows a decline of 3.94%, and the month-to-date performance is down 13.06%, both underperforming the Sensex. Longer-term trends reveal a 21.68% decline year-to-date and a 23.07% drop over the past three years, contrasting sharply with the Sensex's 32.35% gain during the same period. Despite a positive 20.04% increase over the last fiv...

Read More

Shankara Building Products Faces Profit Decline Amidst Investor Caution and Receivables Challenges

2025-02-28 18:33:16Shankara Building Products has experienced a recent evaluation adjustment reflecting changes in its financial standing. The company reported flat quarterly performance with a decline in profit after tax and a low debtors turnover ratio. Institutional investor participation has also decreased, indicating a cautious approach towards the company.

Read More

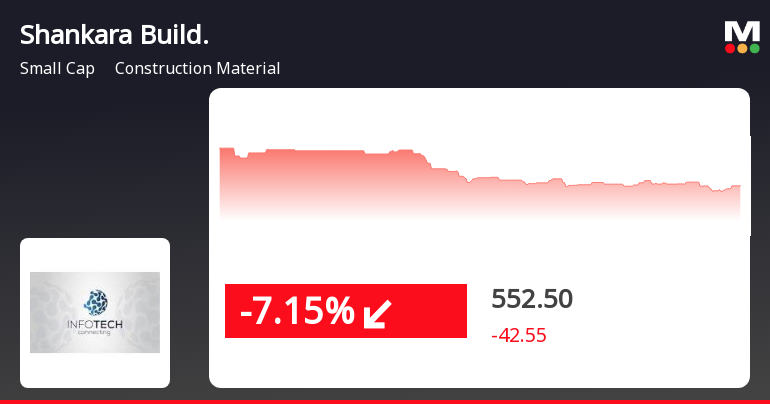

Shankara Building Products Faces Continued Decline Amid Broader Market Challenges

2025-02-14 13:35:33Shankara Building Products has faced notable volatility, experiencing a decline for four consecutive days, totaling a 13.51% drop. The stock opened positively but quickly reversed, trading below key moving averages. Over the past month, it has declined by 11.10%, significantly underperforming compared to the broader market.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

21-Mar-2025 | Source : BSENewspaper Advertisement of Completion of Dispatch of the Notice of Postal Ballot

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Mar-2025 | Source : BSEAttending Arihant Capital - Bharat Connect Conference : Rising star 2025

Corporate Actions

No Upcoming Board Meetings

Shankara Building Products Ltd has declared 30% dividend, ex-date: 13 Jun 24

No Splits history available

No Bonus history available

No Rights history available