Shanthi Gears Ltd. Opens Strong with 10.14% Gain, Outperforming Sector Trends

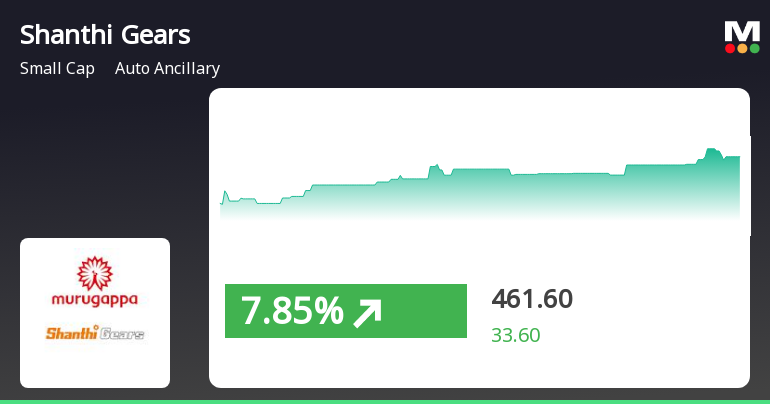

2025-03-18 09:50:03Shanthi Gears Ltd., a small-cap player in the auto ancillary industry, has shown significant activity today, opening with a notable gain of 10.14%. The stock has outperformed its sector by 0.62% and has been on an upward trend for the past three days, accumulating a total return of 3.65% during this period. Today, Shanthi Gears reached an intraday high of Rs 490, reflecting high volatility with an intraday fluctuation of 7.81%. In terms of performance metrics, the stock has delivered a 2.82% increase over the day, compared to the Sensex's 0.81% rise, and a robust 10.23% gain over the past month, while the Sensex has declined by 1.57%. From a technical perspective, Shanthi Gears is currently positioned higher than its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. The stock's beta of 1.35 indicates that it tends to exhibit greater volatility c...

Read MoreShanthi Gears Faces Mixed Technical Trends Amidst Market Volatility and Long-Term Resilience

2025-03-18 08:00:03Shanthi Gears, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 444.90, showing a slight increase from the previous close of 443.45. Over the past year, Shanthi Gears has experienced a decline of 8.14%, contrasting with a 2.10% gain in the Sensex, indicating a challenging performance relative to broader market trends. The technical summary reveals a mixed outlook, with the MACD indicating bearish trends on a weekly basis and mildly bearish on a monthly basis. The Bollinger Bands also reflect a mildly bearish stance, while the KST shows a mildly bullish trend on a weekly basis, suggesting some underlying strength. The stock's performance over various time frames highlights significant volatility, with a notable 539.22% return over the past five years, compared to a 142.55% return for the Se...

Read MoreShanthi Gears Faces Bearish Technical Trends Amid Market Volatility and Mixed Performance

2025-03-11 08:00:03Shanthi Gears, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 454.60, down from a previous close of 470.85, with a 52-week high of 703.55 and a low of 399.40. Today's trading saw a high of 475.05 and a low of 451.70, indicating some volatility. The technical summary for Shanthi Gears shows a bearish sentiment across various indicators. The MACD and Bollinger Bands reflect bearish trends on both weekly and monthly scales, while the moving averages also indicate a bearish stance. The KST aligns with this sentiment, showing bearish trends weekly and mildly bearish monthly. Notably, the On-Balance Volume (OBV) presents a mildly bullish outlook on a monthly basis, suggesting some underlying strength despite the overall bearish indicators. In terms of performance, Shanthi Gears has shown va...

Read MoreShanthi Gears Faces Bearish Technical Trends Amidst Mixed Market Sentiment

2025-03-10 08:00:03Shanthi Gears, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 470.85, showing a slight increase from the previous close of 462.80. Over the past year, Shanthi Gears has experienced a decline of 8.76%, contrasting with a modest gain of 0.29% in the Sensex during the same period. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also indicate a similar trend, highlighting the cautious market sentiment surrounding the stock. Notably, the On-Balance Volume (OBV) shows no significant trend on a weekly basis but leans mildly bullish on a monthly scale. When comparing returns, Shanthi Gears has outperformed the Sensex over the past three and five years, wi...

Read More

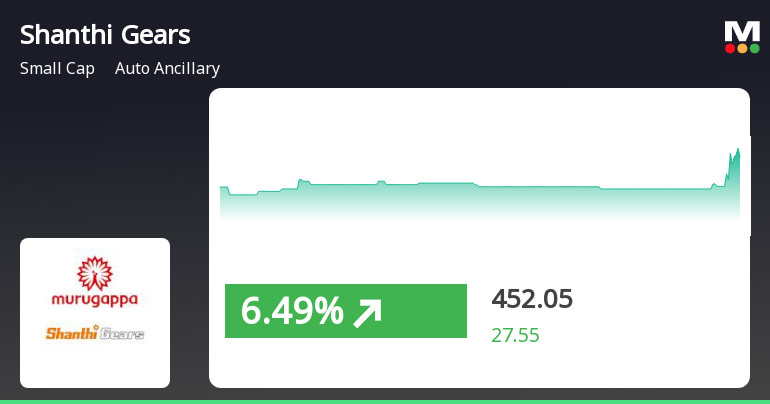

Shanthi Gears Shows Strong Short-Term Gains Amid Broader Small-Cap Market Rally

2025-03-06 13:00:15Shanthi Gears, a small-cap auto ancillary company, has experienced notable gains, outperforming its sector significantly. The stock has shown a consistent upward trend over three days, reaching an intraday high. Despite recent performance, it has faced a decline over the past year, contrasting with broader market trends.

Read More

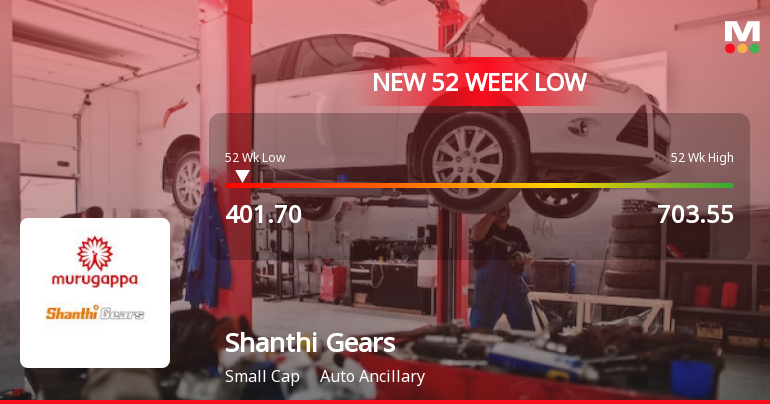

Shanthi Gears Faces Significant Volatility Amid Broader Auto Ancillary Sector Challenges

2025-03-03 11:35:12Shanthi Gears, a small-cap auto ancillary company, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has declined notably over the past year, contrasting with the broader market. Technical indicators suggest a bearish trend, reflecting ongoing challenges in a competitive environment.

Read More

Shanthi Gears Reports Record High Operating Profit and Sales for December Quarter

2025-01-30 18:15:24Shanthi Gears has announced its financial results for the quarter ending December 2024, showcasing record highs in operating profit, profit before tax, and net sales. The company also reported improved operating profit margins and earnings per share, despite facing challenges with a declining debtors turnover ratio.

Read More

Shanthi Gears Experiences Notable Intraday Gains Amid Broader Market Volatility

2025-01-30 14:30:19Shanthi Gears, a small-cap auto ancillary company, experienced significant trading activity on January 30, 2025, with a notable intraday high. Despite recent gains, the stock remains below key moving averages and has faced challenges over the past month, contrasting with broader market trends.

Read More

Shanthi Gears Faces Continued Decline Amid Broader Market Trends and Annual Challenges

2025-01-28 10:05:11Shanthi Gears, a small-cap auto ancillary company, is trading near its 52-week low after a four-day decline of 10.48%. Despite reaching an intraday high today, the stock remains below key moving averages and has experienced a 26.99% annual decline, contrasting with the Sensex's gains.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliance-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

Board Meeting Intimation for The Audited Financial Results For The Quarter And Year Ended 31St March 2025

08-Apr-2025 | Source : BSEShanthi Gears Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 24/04/2025 inter alia to consider and approve the audited financial results for the quarter and year ended 31st March 2025 and issue of dividend if any

Closure of Trading Window

24-Mar-2025 | Source : BSETrading Window Closure

Corporate Actions

No Upcoming Board Meetings

Shanthi Gears Ltd. has declared 300% dividend, ex-date: 07 Feb 25

No Splits history available

No Bonus history available

No Rights history available