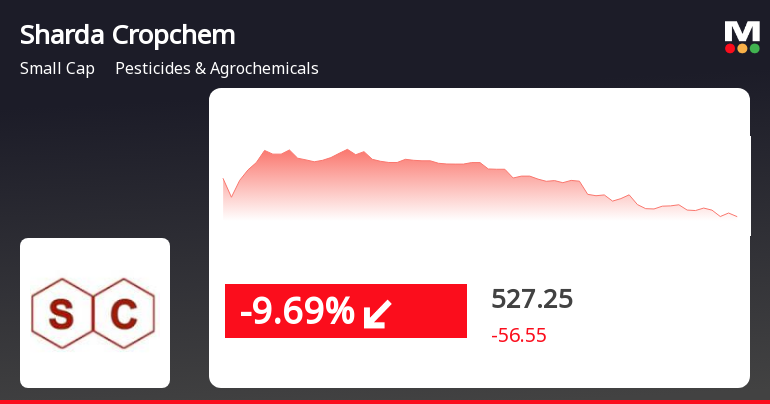

Sharda Cropchem Faces Continued Decline Amidst Agrochemical Sector Volatility

2025-04-03 09:50:21Sharda Cropchem, a midcap agrochemical company, has seen its shares decline for two consecutive days, reflecting a broader volatility in the sector. Currently trading below key moving averages, the stock has experienced an 8.40% drop over the past week, despite a notable annual gain.

Read MoreSharda Cropchem Adjusts Valuation Grade Amid Competitive Agrochemical Market Dynamics

2025-04-01 08:00:29Sharda Cropchem, a midcap player in the Pesticides and Agrochemicals sector, has recently undergone a valuation adjustment reflecting its financial metrics and market positioning. The company currently exhibits a price-to-earnings (PE) ratio of 21.08 and a price-to-book value of 2.24, indicating a solid valuation relative to its assets. Additionally, its enterprise value to EBITDA stands at 8.56, while the enterprise value to sales is recorded at 1.21, showcasing efficient operational performance. The company's return on capital employed (ROCE) is at 13.49%, and return on equity (ROE) is 9.49%, both of which are critical indicators of profitability and operational efficiency. Sharda Cropchem's dividend yield is 1.05%, providing a modest return to shareholders. In comparison to its peers, Sharda Cropchem's valuation metrics appear favorable. BASF India and Dhanuka Agritech are positioned differently within...

Read More

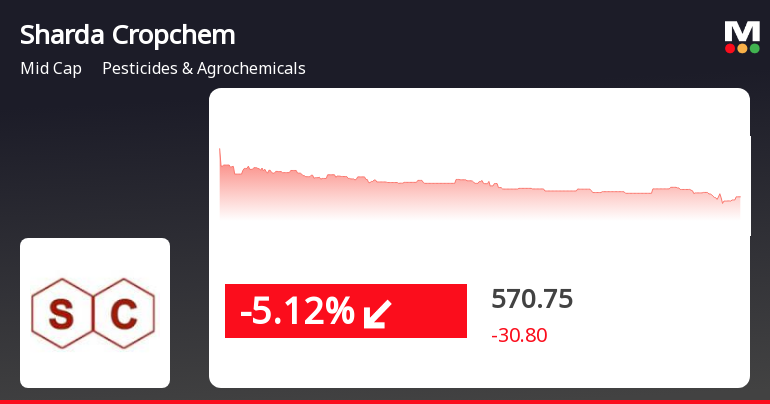

Sharda Cropchem Faces Decline Amid Broader Market Downturn and Mixed Momentum Signals

2025-03-28 15:35:22Sharda Cropchem, a midcap agrochemical company, saw a significant decline on March 28, 2025, underperforming its sector amid broader market trends. The stock's recent performance shows mixed momentum, with notable fluctuations over various time frames, including a substantial long-term increase over five years.

Read More

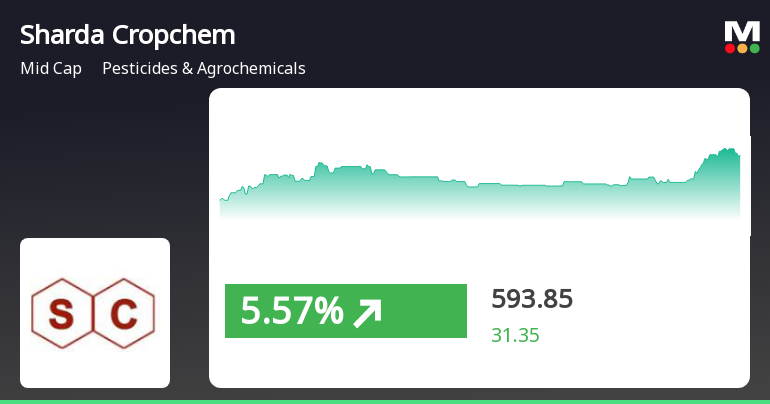

Sharda Cropchem Shows Trend Reversal Amidst Mixed Performance Metrics in Agrochemicals Sector

2025-03-27 14:35:23Sharda Cropchem, a midcap in the Pesticides & Agrochemicals sector, has reversed a three-day decline, gaining 6.12% on March 27, 2025. The stock has shown strong performance over the past month and year, significantly outperforming the Sensex, despite recent challenges in the three-month period.

Read MoreSharda Cropchem's Mixed Technical Indicators Reflect Market Resilience and Caution

2025-03-25 08:04:31Sharda Cropchem, a midcap player in the Pesticides and Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 583.00, slightly down from the previous close of 586.00. Over the past year, Sharda Cropchem has shown a notable return of 76.19%, significantly outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics indicate a bullish outlook. The daily moving averages reflect a mildly bearish trend, and the KST shows a bearish signal on a weekly basis but a bullish one monthly. The overall technical summary presents a mixed picture, with some indicators signaling caution while others suggest potential strength. Sharda Cropchem's performance over various time frames highlights its...

Read MoreSharda Cropchem Adjusts Valuation Grade Amid Strong Market Performance and Competitive Metrics

2025-03-25 08:00:44Sharda Cropchem, a midcap player in the Pesticides & Agrochemicals sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company's current price stands at 583.00, with a 52-week high of 886.35 and a low of 318.00. Key financial indicators include a PE ratio of 21.53 and an EV to EBITDA ratio of 8.77, which position Sharda Cropchem favorably compared to its peers. The company also boasts a PEG ratio of 0.12 and a dividend yield of 1.03%. Return on Capital Employed (ROCE) is reported at 13.49%, while Return on Equity (ROE) is at 9.49%. In terms of performance, Sharda Cropchem has shown notable returns over various periods, including a 76.19% increase over the past year, significantly outperforming the Sensex, which returned 7.07% in the same timeframe. Over five years, the company has delivered a remarkable 443.59% return, compared to the Sensex's ...

Read MoreSharda Cropchem Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:01:55Sharda Cropchem, a midcap player in the Pesticides and Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 586.00, showing a notable increase from the previous close of 562.90. Over the past year, Sharda Cropchem has demonstrated a strong performance with a return of 75.90%, significantly outpacing the Sensex, which recorded a return of 5.87% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while being bullish monthly. The Relative Strength Index (RSI) presents no clear signals, and Bollinger Bands reflect a mildly bearish trend weekly but bullish monthly. Additionally, the On-Balance Volume (OBV) suggests a bullish sentiment in both weekly and monthly assessments. In terms of stock performance, Sharda Cropchem has shown resilience, particul...

Read More

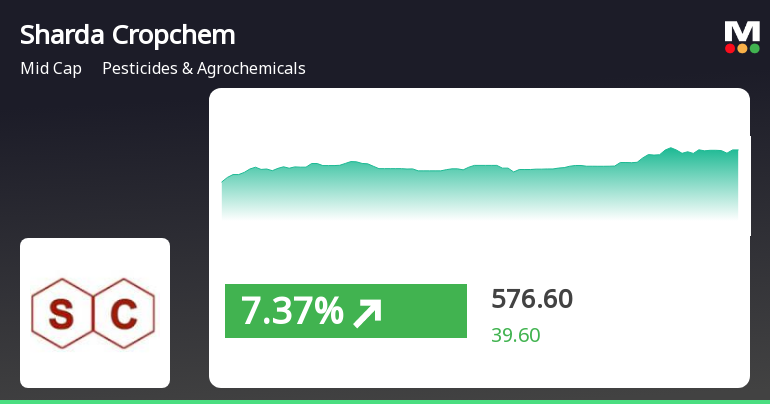

Sharda Cropchem Shows Resilience Amid Fluctuating Market Conditions

2025-03-20 10:45:49Sharda Cropchem has demonstrated notable performance in the Pesticides & Agrochemicals sector, achieving consecutive gains over two days. The stock's price is currently above its short-term moving averages, while the broader market, represented by the Sensex, shows mixed trends, indicating a complex market environment.

Read MoreSharda Cropchem Adjusts Valuation Grade Amid Mixed Performance and Competitive Positioning

2025-03-19 08:00:43Sharda Cropchem, a small-cap player in the Pesticides & Agrochemicals sector, has recently undergone a valuation adjustment. The company's financial metrics reflect a PE ratio of 19.48 and an EV to EBITDA ratio of 7.84, indicating a competitive position within its industry. The PEG ratio stands at a notably low 0.11, suggesting potential for growth relative to its earnings. In terms of returns, Sharda Cropchem has experienced a mixed performance. Over the past year, the stock has returned 57.63%, significantly outperforming the Sensex, which recorded a 3.51% return. However, the year-to-date performance shows a decline of 33.44%, contrasting with the Sensex's slight drop of 3.63%. When compared to its peers, Sharda Cropchem's valuation metrics appear favorable. For instance, while Laxmi Organic and Rallis India also show attractive valuations, Bharat Rasayan and Bhagiradha Chemicals are positioned at hig...

Read MoreSubmission Of Statement Of Grievance Redressal Mechanism Under Reg. 13(3) Of The SEBI LODR Regulation 2015

09-Apr-2025 | Source : BSESubmission of Statement of Grievance Redressal Mechanism under Reg. 13(3) of the SEBI LODR Regulation 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Reg.74(5) of SEBI (DP) Regulation 2018.

Compliance Certificate For Period Ended 31St March 2025

03-Apr-2025 | Source : BSESubmission of Compliance Certificate under Regulation 7(3) of SEBI LODR Regulation 2015.

Corporate Actions

No Upcoming Board Meetings

Sharda Cropchem Ltd has declared 30% dividend, ex-date: 06 Feb 25

No Splits history available

No Bonus history available

No Rights history available