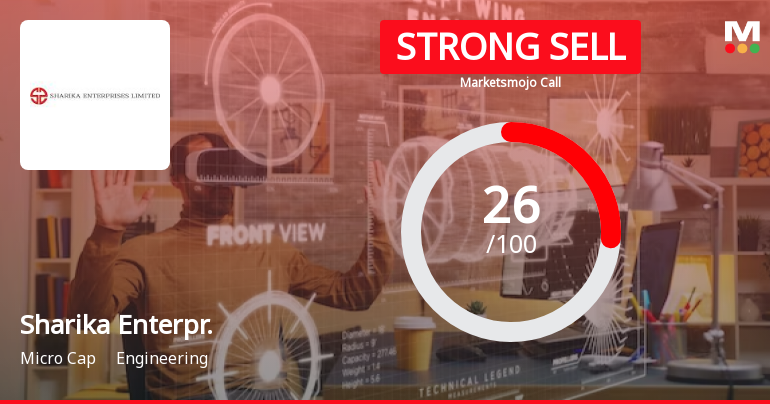

Sharika Enterprises Faces Mildly Bearish Outlook Amid Declining Sales and Profitability Concerns

2025-04-02 08:36:52Sharika Enterprises, a microcap engineering firm, has recently adjusted its evaluation, indicating a shift in technical trends. The company reported a net sales decline of 10.43% for the quarter and has faced challenges with a negative CAGR in operating profits over five years, alongside a high debt to EBITDA ratio.

Read More

Sharika Enterprises Faces Mixed Financial Indicators Amid Shift in Technical Trend

2025-03-26 08:11:17Sharika Enterprises, a microcap engineering firm, has recently adjusted its evaluation, indicating a shift in technical trends. Despite a significant annual return, the company faces challenges such as declining operating profits and a high Debt to EBITDA ratio, alongside low profitability metrics relative to shareholders.

Read MoreSharika Enterprises Ltd Experiences Strong Buying Activity Amid Significant Price Gains

2025-03-25 09:35:49Sharika Enterprises Ltd, a microcap player in the engineering sector, is witnessing significant buying activity, with the stock rising by 4.98% today, outperforming the Sensex, which gained only 0.42%. Over the past week, Sharika Enterprises has shown a robust performance with a 14.98% increase, compared to the Sensex's 3.99%. Notably, the stock has been on a consecutive gain streak for the last four days, accumulating a total return of 17.83% during this period. In terms of price summary, the stock opened with a gap up and reached an intraday high, reflecting strong buyer sentiment. While the stock has experienced a slight decline of 2.84% over the past month, its three-month performance stands at an impressive 16.78%, contrasting with the Sensex's marginal decline of 0.21%. Over the past year, Sharika Enterprises has surged by 130.72%, significantly outpacing the Sensex's 7.52% increase. The current buy...

Read MoreSharika Enterprises Ltd Sees Strong Buying Activity and Notable Price Gains

2025-03-24 09:36:04Sharika Enterprises Ltd, a microcap player in the engineering sector, is witnessing significant buying activity, with the stock rising by 4.96% today, outperforming the Sensex, which gained only 0.53%. Over the past week, Sharika Enterprises has shown a robust performance, increasing by 13.98%, compared to the Sensex's 4.23% rise. Notably, the stock has been on a consecutive gain streak for the last three days, accumulating a total return of 12.25% during this period. In terms of longer-term performance, Sharika Enterprises has delivered impressive returns, with a 119.78% increase over the past year, significantly outpacing the Sensex's 6.15% growth. However, the stock's performance over the last month shows a decline of 5.42%, contrasting with the Sensex's positive 3.84% return. Today's trading session opened with a gap up, and the stock reached an intraday high, reflecting strong buyer sentiment. The st...

Read MoreSharika Enterprises Ltd Sees Strong Buying Activity Amidst Notable Price Gains

2025-03-21 09:35:48Sharika Enterprises Ltd, a microcap player in the engineering sector, is witnessing significant buying activity, with the stock rising 5.22% today, notably outperforming the Sensex, which saw a mere 0.06% increase. Over the past week, Sharika Enterprises has gained 8.60%, compared to the Sensex's 3.47%. This marks a consecutive gain for the stock over the last two days, accumulating a total return of 6.94%. Despite a decline of 5.39% over the past month, the stock has shown resilience with a remarkable 101.81% increase over the past year, significantly outpacing the Sensex's 5.16% growth. Year-to-date, however, Sharika Enterprises is down 4.05%, while the Sensex has decreased by 2.24%. The stock opened with a gap up today, indicating strong buyer sentiment. It is currently trading above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. This ...

Read MoreSharika Enterprises Faces Intense Selling Pressure Amid Consecutive Losses and Market Challenges

2025-03-11 11:25:19Sharika Enterprises Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses over the past three days, with a total decline of 7.33%. Today alone, Sharika Enterprises saw a drop of 5.73%, markedly underperforming the Sensex, which fell by only 0.26%. In the past week, the stock has declined by 9.95%, while the Sensex has gained 1.28%. Over the last month, Sharika Enterprises has lost 15.84%, compared to a 3.11% decline in the Sensex. This trend is further highlighted by its year-to-date performance, where the stock is down 13.37%, against a 5.39% drop in the Sensex. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Contributing factors to this selling pressure may include broader market conditions and sector-specific challenges, particularly...

Read MoreSharika Enterprises Faces Intense Selling Pressure Amid Consecutive Losses and Declining Stock Performance

2025-03-03 10:24:37Sharika Enterprises Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses over the past three days, resulting in a cumulative decline of 15.96%. Today, the stock fell by 5.00%, underperforming the Sensex, which decreased by only 0.45%. Over the past week, Sharika Enterprises has seen a notable decline of 14.12%, compared to the Sensex's drop of 2.13%. The stock's performance over the past month is similarly concerning, with a decrease of 19.38% against the Sensex's decline of 5.60%. Despite a strong performance over the past year, where it gained 56.91%, the year-to-date performance shows a decline of 8.56%, while the Sensex has fallen by 6.75%. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Potential contributing factors to this sell...

Read More

Sharika Enterprises Faces Financial Challenges Amidst Stock Resilience and High Valuation Concerns

2025-02-27 18:57:11Sharika Enterprises, a microcap engineering firm, has recently adjusted its evaluation amid flat financial performance for Q3 FY24-25, reporting net sales of Rs 21.90 crore. The company faces challenges with a declining operating profit CAGR and high debt-to-EBITDA ratio, despite a notable stock performance over the past year.

Read MoreSharika Enterprises Adjusts Valuation Grade Amid Competitive Financial Landscape

2025-02-25 10:23:44Sharika Enterprises, a microcap player in the engineering sector, has recently undergone a valuation adjustment, reflecting shifts in its financial metrics. The company currently exhibits a price-to-earnings (P/E) ratio of 37.17 and an enterprise value to EBITDA ratio of 24.99. These figures indicate a premium valuation compared to its peers, which include companies like Axtel Industries and Permanent Magnet, both of which also show elevated P/E ratios. In terms of performance, Sharika Enterprises has demonstrated notable returns over various periods. Over the past year, the company has achieved an impressive return of 85.08%, significantly outpacing the Sensex, which recorded a modest 2.06% return in the same timeframe. However, its three-year performance shows a decline of 6.6%, contrasting with the Sensex's growth of 33.64%. The company's return on capital employed (ROCE) stands at 3.79%, while its ret...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

01-Apr-2025 | Source : BSEIntimation regarding appointment of Secretarial Auditor by the Board of Directors of the Company for the FY 2024-25

Closure of Trading Window

28-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

19-Mar-2025 | Source : BSEPlease find enclosed the outcome of postal ballot.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Sharika Enterprises Ltd has announced 5:10 stock split, ex-date: 17 Aug 21

Sharika Enterprises Ltd has announced 1:1 bonus issue, ex-date: 08 Jul 21

No Rights history available