Sheetal Cool Products Adjusts Valuation Amidst Competitive FMCG Landscape Dynamics

2025-04-01 08:00:43Sheetal Cool Products, a microcap player in the FMCG sector, has recently undergone a valuation adjustment. The company currently reports a price-to-earnings (PE) ratio of 17.22 and an EV to EBITDA ratio of 13.23, indicating its market positioning relative to its financial performance. The price-to-book value stands at 2.63, while the return on equity (ROE) is noted at 15.26%, reflecting its efficiency in generating profits from shareholders' equity. In comparison to its peers, Sheetal Cool's valuation metrics reveal a diverse landscape within the FMCG industry. For instance, Vadilal Enterprises shows a significantly higher PE ratio of 150.74, while Sarveshwar Foods maintains a PE of 27.65. Other competitors like Foods & Inns and Integrated Industries present attractive valuations with lower PE ratios, suggesting varying market perceptions and financial health across the sector. Despite recent fluctuation...

Read MoreSheetal Cool Products Adjusts Valuation Amid Competitive FMCG Landscape Dynamics

2025-03-24 08:01:01Sheetal Cool Products, a microcap player in the FMCG sector, has recently undergone a valuation adjustment. The company's current price stands at 340.00, reflecting a notable increase from the previous close of 311.70. Over the past year, the stock has experienced a decline of 4.83%, contrasting with a 5.87% gain in the Sensex. Key financial metrics for Sheetal Cool include a PE ratio of 18.83 and an EV to EBITDA ratio of 14.27, indicating its market positioning within the industry. The company's return on capital employed (ROCE) is reported at 11.77%, while the return on equity (ROE) stands at 15.26%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Sheetal Cool's valuation metrics reveal a diverse landscape. For instance, Vadilal Enterprises is positioned at a significantly higher valuation, while Sarveshwar Foods shares a similar val...

Read More

Sheetal Cool Products Faces Financial Challenges Amidst Market Evaluation Adjustments

2025-03-19 08:10:07Sheetal Cool Products, a microcap in the FMCG sector, has recently adjusted its evaluation amid financial challenges, including a decline in net sales and operating profit. Despite these setbacks, the company showcases strong management efficiency with a notable return on capital employed, while its valuation remains attractive compared to peers.

Read More

Sheetal Cool Products Faces Financial Challenges Amid Declining Sales and Profitability

2025-03-13 08:07:40Sheetal Cool Products, a microcap in the FMCG sector, has recently adjusted its evaluation amid challenging financial results for Q3 FY24-25. The company reported a decline in net sales and profit after tax, alongside a five-year trend of decreasing key metrics, despite maintaining a strong return on capital employed.

Read More

Sheetal Cool Products Faces Financial Challenges Amidst Market Evaluation Adjustments

2025-03-06 08:09:46Sheetal Cool Products, a microcap in the FMCG sector, has recently adjusted its evaluation amid ongoing financial challenges. The company reported a decline in net sales and operating profit for Q3 FY24-25, alongside a decrease in profit after tax. Despite these issues, it maintains strong management efficiency.

Read More

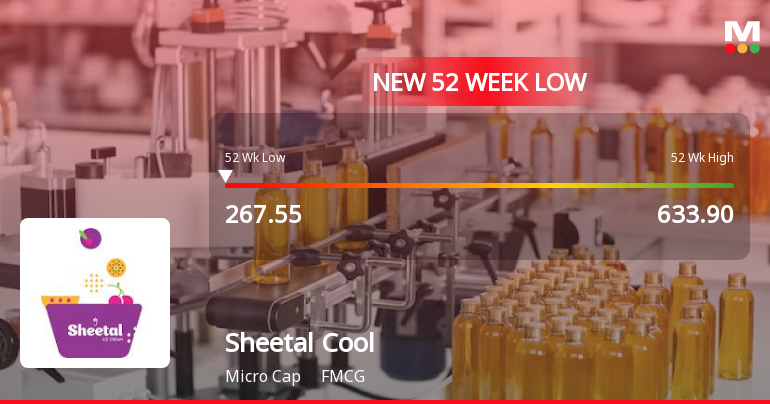

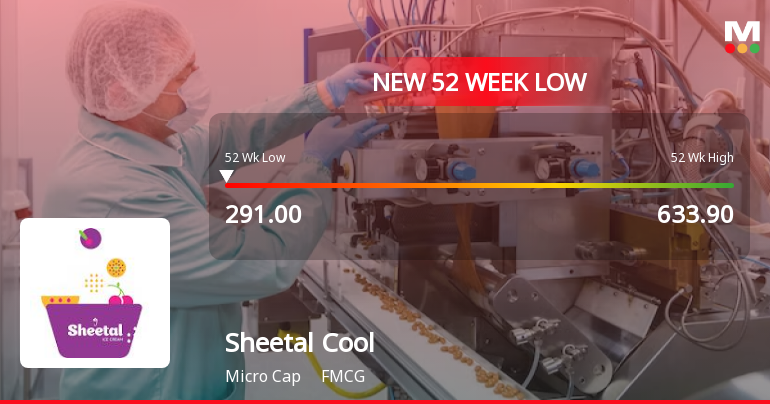

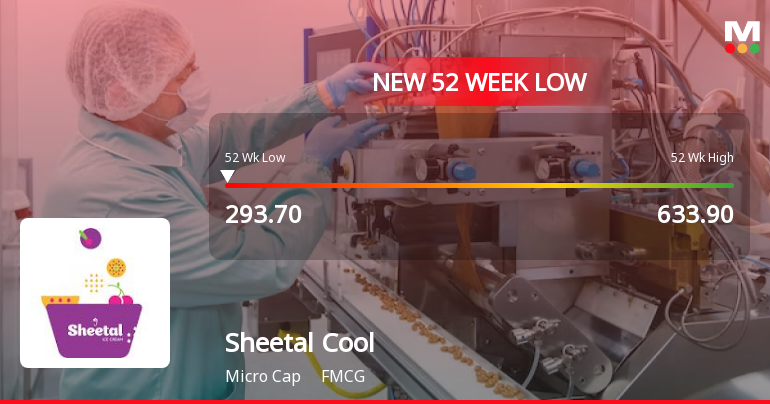

Sheetal Cool Products Faces Significant Volatility Amidst Ongoing Downward Trend

2025-02-18 15:05:26Sheetal Cool Products, a microcap in the FMCG sector, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has seen consecutive losses over the past week and is trading below multiple moving averages, indicating a continued downward trend in its performance.

Read More

Sheetal Cool Products Faces Persistent Stock Volatility Amidst Sector Underperformance

2025-02-17 14:10:53Sheetal Cool Products, a microcap in the FMCG sector, has faced notable stock volatility, hitting a new 52-week low and experiencing a 14.7% decline over six days. The stock's performance remains below key moving averages, with a year-over-year drop of 20.99%, contrasting with the Sensex's gains.

Read More

Sheetal Cool Products Faces Sustained Challenges Amid FMCG Sector Volatility

2025-02-14 09:36:56Sheetal Cool Products, a microcap in the FMCG sector, has hit a new 52-week low, continuing a downward trend with a notable decline over the past five days. The stock has underperformed its sector and recorded a year-long performance drop, contrasting with gains in the broader market.

Read More

Sheetal Cool Products Faces Continued Decline Amidst Broader FMCG Sector Trends

2025-02-13 15:05:24Sheetal Cool Products, a microcap in the FMCG sector, has hit a new 52-week low, continuing a downward trend with a 10.38% decline over four days. The stock is trading below key moving averages and has decreased 9.16% over the past year, contrasting with the Sensex's gains.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEAs Attached

Announcement under Regulation 30 (LODR)-Memorandum of Understanding /Agreements

03-Mar-2025 | Source : BSEAs attached.

Integrated Filing (Financial)

08-Feb-2025 | Source : BSEFor approval of Financial Statements for Quarter ended on 31st Decemeber 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available